2025 Week 36 - with 5

5 years and more

I missed week 26 and now it is coming to week 39 - another check point for the year. At this current phase of the market, I am more keen to sell than buy. The rotation at the bottom of my portfolio continues.

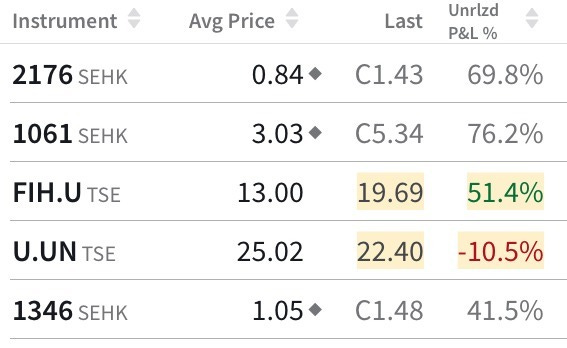

These are the few core holdings which sat right at the top of my portfolio holdings and has not moved for a while.

*Average price shown on my IB screen is wrong. Most of the stocks above have been transferred in from another broker and IB has shown the price on the date that the stock has been transferred in. For the more correct average price, please refer to the articles.

CCID Consulting Company Limited (2176.HK)

2176.HK which was profiled on 2025 Week 5 - SOE continued to execute on many level. As the Chinese government designated consulting firm, 2176.HK could do no wrong for now.

My guess is that the growth in the second half will accelerate but Jam_invest in his latest post think otherwise. While I have gotten more comfortable in the company, I am not sure of the expectation baked into the share price.

I have been selling since Week 26.

If you are keen to read about my initial thought process on 2176.HK, then click the article below.

Essex Bio-Technology Ltd (1061.HK)

1061.HK was first mentioned on 10th April 2023. It has been > 2 years. Their main drugs Basic fibroblast growth factor (bFGF) continues to have patent protection till 2030. The approval of new drugs like HANBEITAI (bevacizumab injection) should drive the next phase of growth. The rest of the drugs in the pipeline like SKQ-1 are just options for future growth.

Two years ago, I bought it as a value stock to ride the Covid recovery and two years later I am holding it because growth seems more certain now. I try to be patient when growth comes about.

If you are keen to read about my initial thought process on 1061.HK, click the article below.

Fairfax India Holdings Corp (FIH)

FIH is an even longer hold for than 1061.HK. I first wrote about the company on 18th Sep 2020. It has been 5 years! FIH thesis rest on 3 assumptions.

management of Fairfax being competent,

management being equitable,

and the growth of India.

In that article, I wrote that I intend to hold this position for the long term (5 - 10 years). I am half way there now. Maybe teleportation will become remotely real before I even considering selling the company.

If you are keen to read about my initial thought process on FIH, click the article below.

Sprott Physical Uranium Trust (U.UN)

U.UN is not even known as Sprott Physical Uranium Trust when I first bought it. I first wrote about the company on 23rd October 2020. The continued bet has to be that Uranium will spike one day in the future? I am still looking forward to that day.

This continues to be in my portfolio as a hedge as well as an option.

If you are keen to read about my initial thought process on U.UN, click the article below.

Lever Style Corp (1346.HK)

1346.HK was introduced as a portfolio holding on the 20th February 2025. Every conference call involve analysts asking the most basic questions to understand their business model. This fundamental lack of understanding of the business have created a perpetual discount on this disruptive company to their industry. I believe the analysts and investors are getting their head wrapped around their business model.

This is my disruptive play on a traditional industry and it looks like it will be in the portfolio for quite a bit of time.

If you are keen to read about my initial thought process on 1346.HK, click the article below.

This also marked my 5 years on writing on Substack. What started as a thing to kill time during the pandemic has become a personal struggle. Struggling to keep creating-writing and the getting the habit going.

The best thing that has happened to me since writing on Substack is to know Chan Teik from nextinsight.net and got introduced to his investor-badminton friends. They are such a lovable bunch that I am constantly reminding myself that I need to make an effort to maintain-improve this precious friendships brought along by Covid.

The exhilaration felt on the ups and the excruciating pain felt on the downs in the market is something every investor needs to deal with. As an investor, there is a need for an independence of mind which meant that you operate alone most of the time.

For once this solitary journey does not feel as lonely.

I have not done much work on building ideas on CCID’s growth prospects. When I originally bought it, I did not need to.

I was, however, anticipating a continued shift towards more recurring and higher margin (Data) revenues.

In the interim results Data revenue declined. Moreover the leading indicator “contract liabilties” came in weakish. That’s opposite from what I was anticipating.