2025 Week 8 - Expectations and Performance

When performance >< = expectation...

My Performance < My Expectation:

Recently, I have managed to transfer most of my HK portfolio to Interactive Brokers and that means that for the first time, I can present you some form of “audited” returns for my stock portfolio returns.

With a late rally in 2024, my HK dominated portfolio managed to eek out a small return for the year. Going forward, I guess I will just do a regular cut and paste of this chart to be accountable to myself and whoever who is reading out there.

Our Stock Picks Performance > Our Expectation:

Previously, I talked about how CT from NextInsight asked 11 private Singaporean investors (including me) to share their stock picks for 2024. The goal in mind is to select stocks that will finish the year 2024 with the highest percentage returns. The top 2 winners got invited to an atas1 meal.

We had so much fun that HP and I decided to host the next round of contest (Jan - Mar 2025) with the reward of going to an even more atas restaurant. This time, the stock pick is supposed to consist of 1-3 stock with the highest weighted returns by the end March 2025.

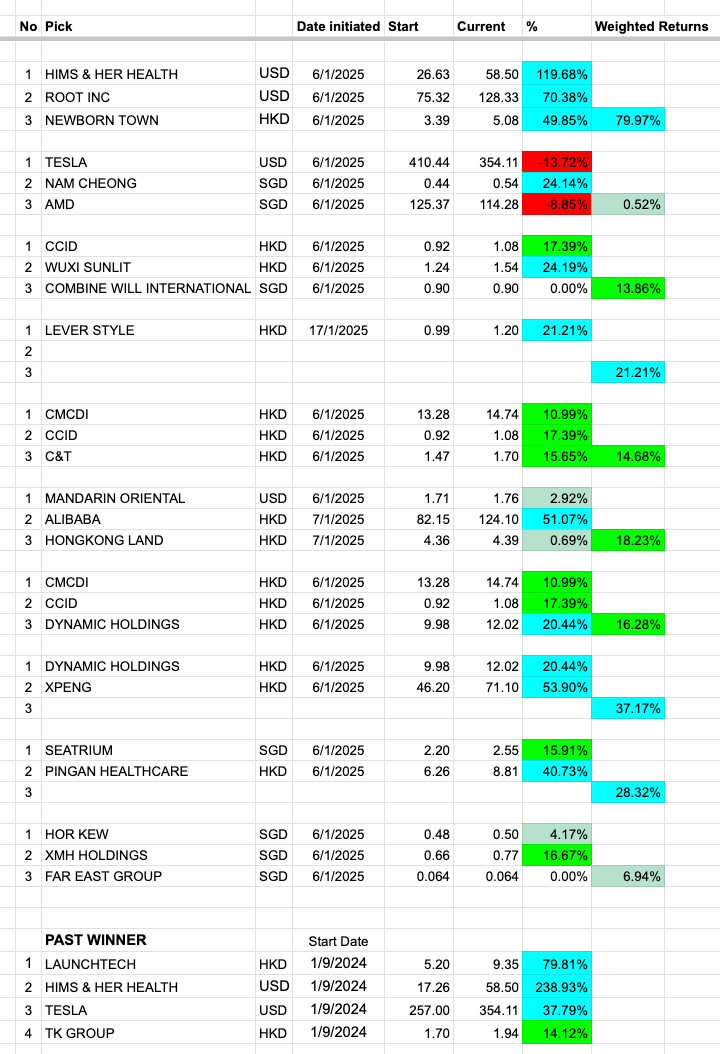

The list of stocks and their performance till 19th February are as below.

Those that are highlighted in bright green are > 10% and those that are highlighted in turquoise are > 20%.

It has been a really good year for most investors. It is not even the end of February and some of us are really hitting the ball out of the park with 28% - 79% weighted returns!

While everyone is celebrating the revival of the Chinese technology stocks like Alibaba, the real returns are still in the US stock market. If you have bought HIMS in September 2024 you would have been up a cool 238.93% in less than 6 months!

I am pretty sure that there is some form of bubble in the US stock market but I have been wrong for almost 2 years now. Maybe the bubble only exists in my mind.

Due to some personal circumstances, my portfolio pick came in late and only consist of only 1 stock which happens to be…

Lever Style Corporation which I covered on 2024 Week 45.

Lever Style - Operation Performance > Stock Price Expectation:

Lever Style Corporation, an investment holding company, engages in the design, production, and trading of garments. Its products include seamless-bonded, activewear, performance wear and outwear, sweaters, denim, bottoms, soft wovens, shirts, cut-and-sewn knit, fashion outwear, leather, and tailoring products for men, women, and kids. The company operates in Mainland China, Hong Kong, Macau, Taiwan, the United States, Europe, Oceania, and internationally. Lever Style Corporation was founded in 1956 and is based in Kwun Tong, Hong Kong.

-Tikr.com

I happened to learn about Lever Style when I visited HK with Swen Lorenz - Undervalued Shares and Michael Fritzell - Asian Century Stocks last April 2024. The takeaway seems to be that most people are not comfortable with its business model.

Stanley Szeto, Chairman of Lever Style like to say that they are the Uber2 of apparels manufacturing. But any mention of any businesses describing themselves as any “innovative” business model usually comes with a large warning signs3.

If we are to understand Lever Style’s market positioning, I believe that Lever Style’s business model is the riding of the trend of “fast” fashion.

Unlike Li & Fung, who ride the trend of low cost textile manufacturing (low mix high volume) in China, Lever Style is riding the trend of fast fashion (high mix low volume). It means that fashion brands need to be much in tune with their supply chains - which meant dealing with lots of small orders and through many small factories.

This also mean that fashion brands either

beef up their design, purchasing and operation department to deal with multiple factories working on multiple designs with ever shortening timeline

work with someone like Lever Style to navigate these challenges

Coupled with the threat of a Trump’s tariff on almost every country in the world, wouldn’t most fashion brands take up Lever Style’s services than create a department who may or may not navigate the complexities of dealing with multiple factories, multiple designs, multiple tariffs while mulling how to get a quicker design and production period?

Lever Style announced their 2024 2Q results on 5th August 2024 with a drop in revenue and net profit for FY2024 due to some bad debt provision. I got into a conference call with the management and managed to clear most of my concerns in regards to their business and their bad debt situation.

The management started buying at HKD 0.78 and I also joined in the party and have continued to average up since.

On 15th January 2025, Lever Style issued a profit alert sending the share price significantly higher than before.

The latest profit alert highlights the attractiveness of Lever Style’s business model.

Lever Style high mix low volume business model is the trend forward and it has allowed them to win new customers and grow organically with their existing customers.

With Trump screaming “Tariffs!”, I expect the trend for brands to continue building redundancies and resilience into their supply chain.

Lever Style is going to be more needed than before.

I have been buying since 25th September 2024 and the average price paid is HKD 0.92.

Do your own research and I may buy and sell the above-mentioned stocks at any time.

singlish usage of atas is commonly used to describe something that is high class and of good taste.

which i think does a huge disservice to explain Lever Style’s business model

remember the times when every startup wanted to be the Groupon or Amazon or Uber of something.