2025 Week 5 - SOE

there are the regular SOEs while this is one of the exceptional ones

Last year, CT from NextInsight decided to ask 11 private Singaporean investors (including me) to share their stock picks. The goal in mind is to select stocks that will finish the year with the highest percentage returns1.

This cumulated into a series of article.

6th October 2024 - The bull looks strong. Here are 28 stock picks of 11 private investors

2nd December 2024 - 28 Stock Picks of Private Investors: 3 Skyrocket with 87%, 34%, and 31% Gains

1st January 2024 - 28 Stocks, 11 Investors: Massive Gains for Who at Year-End Finish Line?

Among these stock pick there is one company which 8 out of the 11 investors (including me) owns. Most of us believe that it should be another solid performer for us for 2025.

The bad new is that the stock has gone from HKD0.57 to end 2024 at HKD0.97.

The good news is that the company’s story remained untold and stock price cheap despite the rise in valuation.

If you have been patient to cross-reference the information provided till thus far, you will know that the company I am talking about is…

CCID Consulting Company Limited (2176.HK)

CCID Consulting Company Limited, together with its subsidiaries, provides consulting services in the People’s Republic of China. The company operates through three segments: Decision-Making Consulting Services, Data Platform Services, and Science and Technology Innovation Platform Services. The Decision-Making Consulting Services segment provides specific decision-making consulting services, such as regional strategy, park consulting, industrial planning, executive research and feasibility study, investment and financing, and digitalization transformation. The Data Platform Services segment offers industry data and digital technology-driven data analytics and decision-making services. The Science and Technology Innovation Platform Services segment provides comprehensive services, including science and technology innovation center operation, and brand conferences and exhibitions. CCID Consulting Company Limited was founded in 2000 and is based in Beijing, the People’s Republic of China.

- Tikr

Synopsis:

2176, unlike other SOE listed on the HKSE is owned by the China's Ministry of Industry and Information Technology. Being a leading consulting firm with proprietary data in China meant that they could be the Gartner of China.

2176 should report a double digit increase in earnings with earnings to at least RMB 80 - 90m. With a market cap of HKD 693m, the PE is around 7x - 8x. With the emphasis on shareholder returns by the Chinese government, I will expect that most of earnings to be distributed as dividends which meant that the conservative final dividend yield should be around 10% on current share price. Strong growth in revenue and net profit coupled with a ROE of > 20% meant that this stock will be rerated strongly when the next result is out on the end of March 2025.

Background:

The problem I have with China SOE is that every other week, there are some SOE selling/buying their subsidiaries to one another. Some SOE became stronger while other became weaker as a result of these “gerrymandering”. I have been on the short end of the stick before and I am glad that I am on the other side now.

We first got to know of the 2176 when they started this process in their 2022 4Q - 20th April 2023.

The accounts then were messy and hard to decipher. While we still do not know much about the CCID Supervision (which is being sold off), there are positives coming out from their core Consulting and Data Platform services divisions.

2176 also declared an interim dividend of HKD 0.046 when the stock is trading at HKD 0.36 on the 23rd August 2023. Using the share price of HKD 0.415 reached on the next day of 24th August 2023, 2176 still sport a 11.08% at half time.

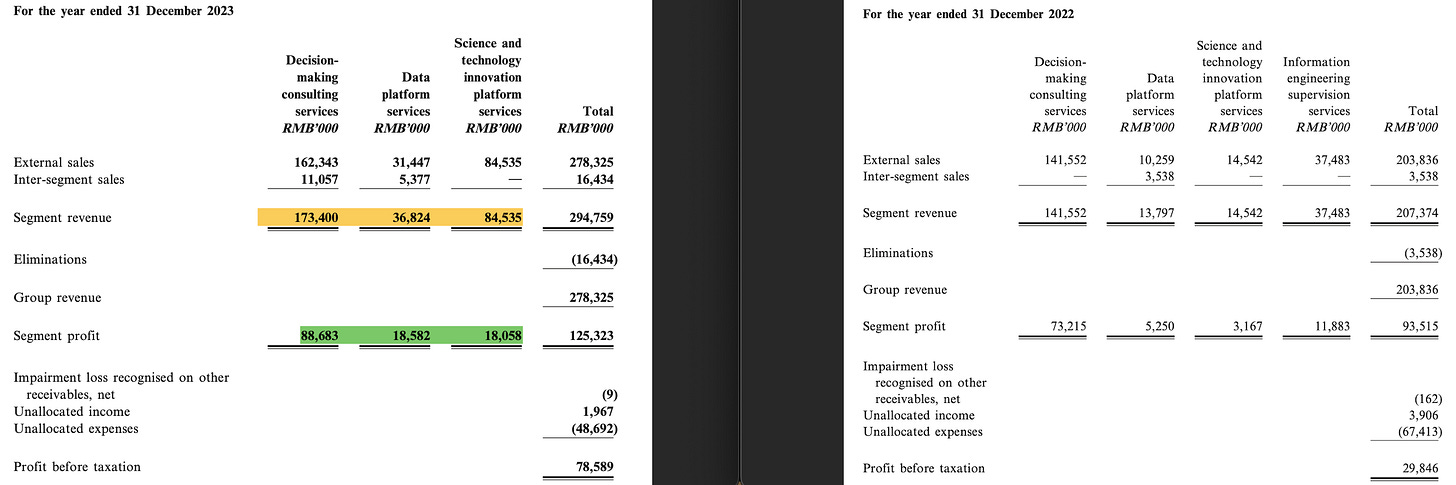

On 28th March 2024, 2176 released their 2023 full year results where net profit more than doubled.

The platform services division (which included the acquired CCID exhibition) turns out to be highly profitable.

Coupled with another RMB 0.0764 (HKD 0.084) of dividends, 2176 paid out HKD 0.1246 for the whole year.

At that point, the share price has almost doubled to HKD0.67, sporting a market cap of HKD 469m, a single digit PE with a dividend yield of around 8.3% .

For 2024 2Q which was released on 23rd August 2024, the bottomline grew by another 35%. Surprisingly, 2176 did not declare any dividend. By this time, the share price has gone up to HKD0.84.

Future:

So what can we expect for the 2024 4Q results? For one, we know that the contract liabilities which is a good indicator for future revenue has gone up by 48%.

On the segmental analysis, the growth driver seems to be coming from their data platform and innovation platform services.

If you have been trying to log on to CCID official website, then you would have realise that it is unavailable in the anywhere in the world except China and HK. But if you have consistently tried to access CCID website since last year, you would have noticed that CCID website is briefly available towards the end of 2024.

On the now unavailable website, 2176 stated that they have 15 innovation centres around China which is an increase from 9 in 2023. Using some of the alternative data we have gathered, the consulting services also recorded a stronger 2H which indicated a strong revenue increase for the full year.

Valuation and Risk:

2176 should do much better in FY2024 than FY2023. A simple extrapolation from 2024 1H would indicate that net profit would grow by at least 15%. Since 2H is usually stronger than the 1H, we would expect higher growth. Reasonable future PE is around 7-8x.

Using last year as a reference, we could expect 2176 to pay out most of their earnings sporting a 10% dividend yield. Results should be out by the end of March 2025 and waiting 2 months for the stock to pop seems reasonable.

The usual risk of buying a Chinese SOE meant the taking on of China risk such as the invasion of Taiwan or the change in dividend policies.

At HKD 1.00, it also at the highest price it has been since its listing.

Expectation has somewhat been baked in but my guess is that there is still plenty of gas to go even higher when the results are released at the end of March.

I have been buying since August 2023 and the average price paid is HKD0.52 (without accounting for dividends received).

Do your own research and I may buy and sell the above-mentioned stocks at any time.

The result is so inspiring that we are on our next round of contest. I will be releasing some of the CNY stock picks for 2025 1Q where winners would be announced in April 2025.