Bausch Health Companies (BHC) - the reincarnation of the infamous Valeant Pharmaceutical1 has been guiding towards the separation of Bausch + Lomb Company (Bausch + Lomb).

Usually this would not have not been a news but...

If you look at the Bausch + Lomb market cap, it is currently trading at USD 5.6b.

Since BHC owns around 88.7% of Bausch + Lomb, you would expect that some of that Bausch + Lomb valuation (USD4.84b2) to account in BHC valuation?

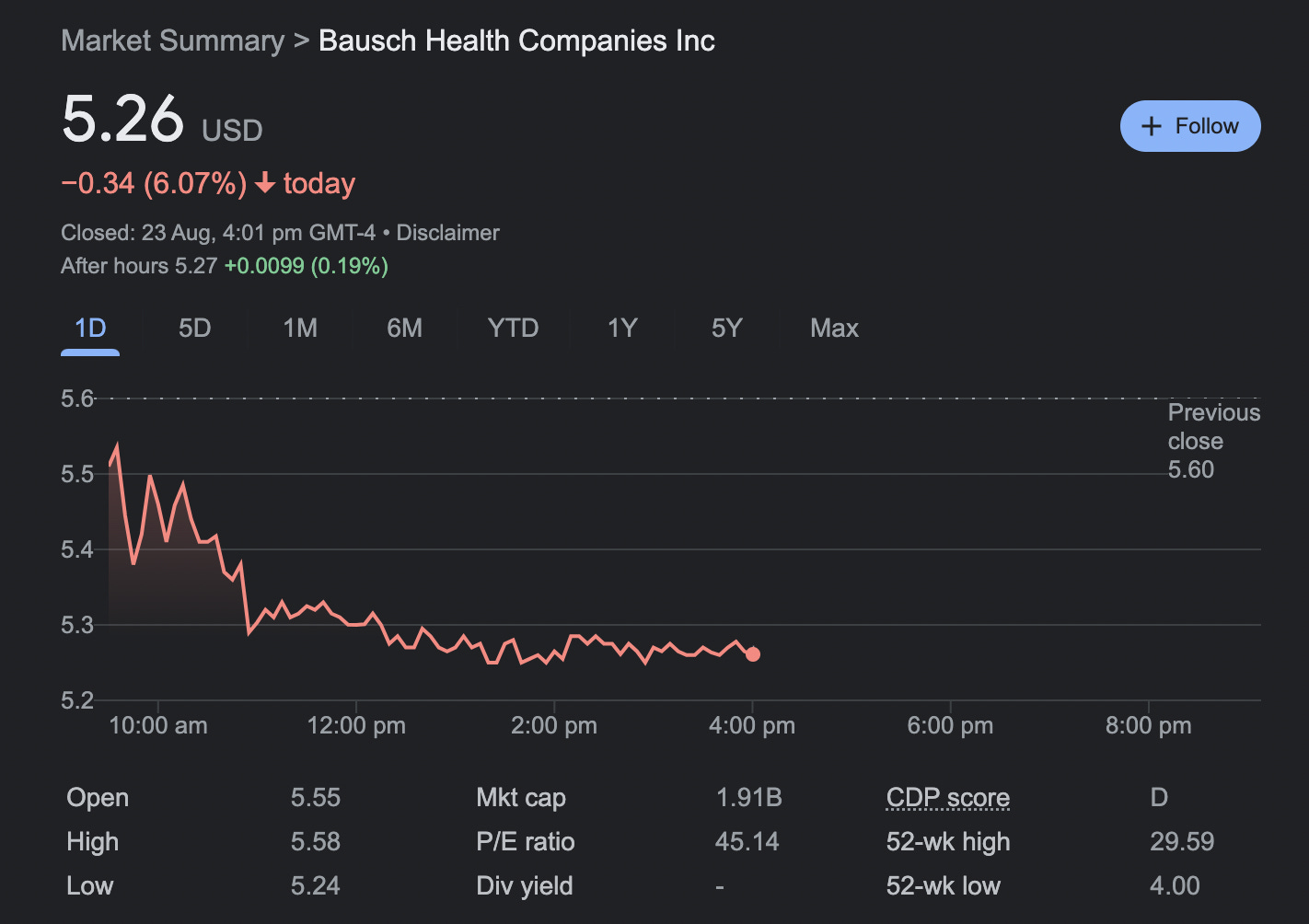

BHC is trading at USD 1.91b at this moment. So you could be paying USD 1.91b for BHC and getting B&L for USD 5.46b?

Since the announcement below, the share price has decreased by another 6%.

So what account for this disparity of valuation and what is the catch?

The thing to understand is to read the announcement again carefully.

"The separation of Bausch + Lomb is contingent on the expiry of customary lockups related to the initial public offering of Bausch + Lomb, the achievement of targeted debt leverage ratios and the receipt of applicable shareholder and other necessary approvals."

If the debt leverage ratio at Bausch Health Companies do not come down, the separation or value realisation will not happen at all!

Since BHC is currently sitting on USD 21b worth of debt, BHC can ONLY transfer 38.6% of the issued and outstanding shares of Bausch + Lomb Corporation to an existing wholly-owned unrestricted subsidiary of BHC and has to retain 50.1% of Bausch + Lomb under their wholly-owned restricted subsidiary of BHC.

Since the 38.6% of Bausch + Lomb is within an unrestricted subsidiary of BHC, it means that this unrestricted subsidiary could be sold for USD 2.1b.

It seems that market is right to punish BHC with a 6.07% drop today?

Market has finally realise that BHC is only worth as much as the their 38.6% stake (USD 2.1b) in Bausch + Lomb and that even the sale of 38.6% of Bausch + Lomb will most likely not be enough to save BHC.

88.7% * 5.46 = 4.84