2025 Week 38 - Everything is relative

Especially sentiment

On my recent trip to China, I had the chance to meet some exceptionally sharp local investors. From our conversations, it was clear they’ve been raking in significant gains in the Chinese and Hong Kong markets. That’s the edge that intelligence and localisation provide—you develop a deep feel for market sentiment, which allows you to spot and exploit inefficiencies others might miss.

One particularly interesting stock-picking concept I picked up from them was strikingly simple: track Eyeballs and Buying Interest.

Low Eyeball Low Buying Interest: the neglected child

As value investors, we often get a thrill1 from uncovering stocks with low eyeballs and little buying interest. These are the classic “unknown and undervalued” plays—companies overlooked by the market, with limited demand and/or supply. Because they’re under the radar, liquidity tends to be thin. And while some may indeed be hidden gems waiting to be discovered, there’s always the risk that they’re simply neglected names—and could remain neglected for a very long time2.

Low Eyeball High Buying Interest: the high potential kid

These are the kinds of companies often circulating on financial blogs—well-known names among investors who see themselves as more “professional.” Everyone believes the stock is undervalued, and everyone wants a piece of it. But with buying interest already strong, chances are it’s not truly undervalued—it’s simply under-followed. The real question is: when will the story break into the mainstream? Once someone influential highlights the stock, fresh eyeballs flood in, often driving the price into a parabolic rise. That’s when it transforms into…

High Eyeball High Buying Interest: the popular kid

These are the companies you hear aunties, uncles, and friends chatting about—the household names everyone already knows and that are typically fully valued. Their stock prices rise and fall in lockstep with the broader market, simply because they are the market. Which brings us to…

High Eyeball Low Buying Interest: once popular kid

This is perhaps the most interesting segment. These are the companies that aunties, uncles, and friends used to talk about, but no longer do. Once seen as cool and exciting, they’ve since fallen out of favour—so much so that many investors don’t even want to see them in their portfolios. The stock still has high visibility, since everyone knows it, but buying interest has all but disappeared. Any serious attempt to accumulate shares is usually met with an equal wave of selling pressure.

Once Popular Kid - Once upon a time in Stock Connect

On other stock exchanges, you occasionally see a once-popular stock dropped from an index. The price reaction is usually swift, adjusting quickly to the new demand-and-supply dynamics.

In Hong Kong, however, the story plays out differently. Removal from the Stock Connect doesn’t just change liquidity—it cuts off mainland investors entirely. They can no longer buy, only sell. And since most are retail investors, the company drifts to the back of their minds. When opportunities to sell arise, many make them simply to ease the pain. This is the hallmark of the Once Popular Kid—and the story of one such fallen favourite.

YUHUA EDUCATION HKG:6169 - One such Once popular kid

With potential policy shifts on the horizon, the education sector appears ready to emerge from its doldrums. After scanning the landscape, I narrowed my focus to a few select education names.

I first wrote about Yuhua Education on Substack on May 8, 2025. For a full breakdown of Yuhua’s convertible bond saga, please refer to the footnote3.

China YuHua Education Corporation Limited, together with its subsidiaries, provides education services in the People’s Republic of China

and Thailand. It is involved in the provision of private formal education from high school to university education services. The company also operates higher vocational colleges.In addition, it is involved in the property management business; and provision of research projects and training programs services. The company was founded in 2001 and is headquartered in Zhengzhou, the People’s Republic of China.-tikr

I prefer Yuhua over other dividend-paying education companies because:

Its universities generally enjoy a solid reputation.

The balance sheet is now the cleanest in the sector following the bond default saga.

The company has strictly complied with government policy by not drawing cash from its schools—hence, no dividends.

At the AGM, I picked up a few additional insights:

The company has already laid out plans for the eventual conversion.

However, the exact timeline for this conversion remains uncertain.

I left with a measure of confidence that, given time, the pieces will fall into place. On top of that, I learned they’ve already registered a name for the Changsha school—a small but reassuring sign of progress.

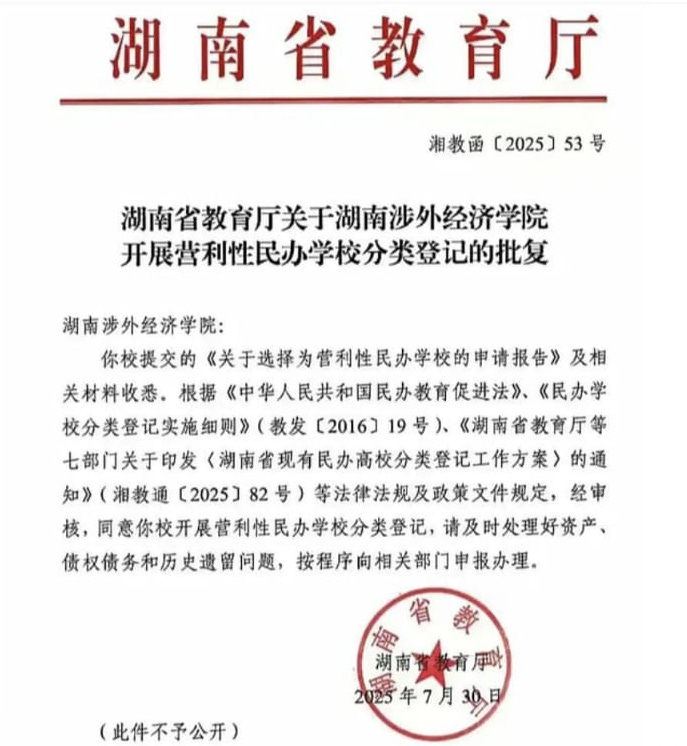

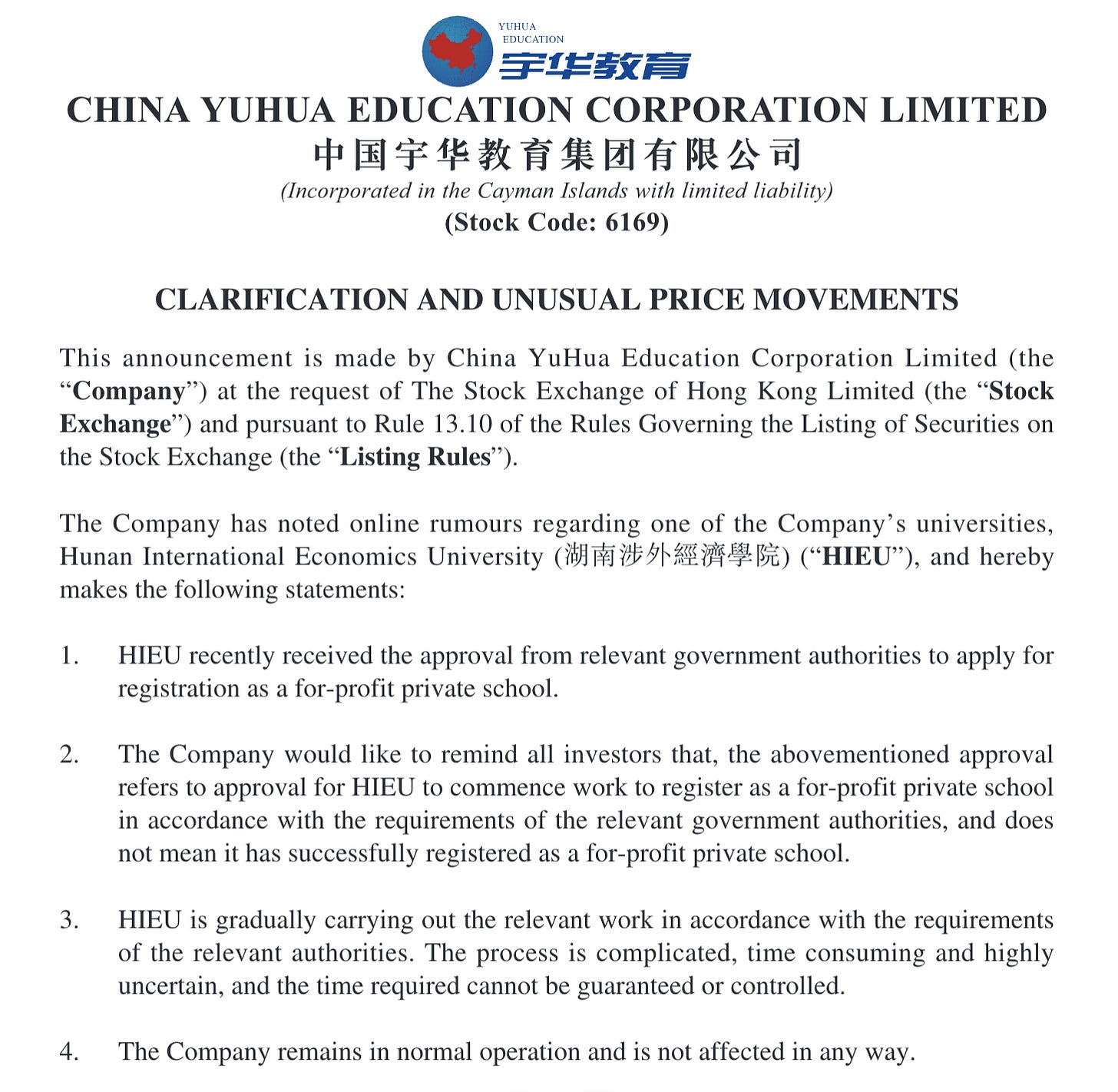

Last Friday (12 September), news surfaced on social media that Hunan had approved Yuhua’s application for conversion as of 30 July 2025.

The price then rallied from 50 to 74 cents.

But there are still much uncertainties.

I’m still betting that Yuhua will pull through on their conversion.

I’ve been accumulating shares since 6 May 2025, with an average entry price of HKD 0.425.

Do your own research and I may buy and sell the above-mentioned stocks at any time.

value investor often like to talk about companies that no one has heard of before.

that sounds like all the deep value stocks we are used to like or maybe still like

Timeline of Yuhua Education’s Convertible Bond Issuance and Subsequent Events - compiled by ChatGPT (any error is ChatGPT error)

2019: Convertible Bond Issuance and Terms

27 Dec 2019 – Issuance of HK$2.088 Billion Convertible Bond: China Yuhua Education completed the issue of 5-year convertible bonds on 27 Dec 2019, raising HK$2.088 billion. The bonds carry a 0.90% annual coupon, paid semi-annually on 27 June and 27 December. Maturity was set for 27 Dec 2024, at which time the principal would be redeemable at 100% of face value. The initial conversion price was HK$7.1303 per share (about a 34% premium over the then-share price). The bonds were listed on HKEX (debt stock code 40109) and were issued under a general mandate, concurrently with the repurchase of the company’s earlier 3.0% convertible bonds due 2020.

2021: Regulatory Headwinds and Share Price Decline

2021 – Education Policy Impact: In mid-2021, China’s regulatory crackdown on private education (the “double reduction” policy) severely impacted investor sentiment. Yuhua’s share price fell well below the conversion price, making bond conversion unattractive (the stock traded in the HK$0.5–1 range vs. a ~HK$6+ conversion price). While no default occurred at this time (interest payments at 0.9% were maintained), the collapsing share price and sector outlook were early signs of potential stress in refinancing the bond.

2022: Bond Repurchase and Early Warning Signs

25 Oct 2022 – Partial Bond Buyback: Anticipating difficulty with the upcoming bond obligations, Yuhua repurchased HK$614 million of the bond’s principal on 25 Oct 2022 from certain holders at a steep discount. The buyback was done at ~70% of face value (HK$428.1 million paid for HK$614m principal), generating a gain of ~HK$186 million. This reduced the outstanding bond principal to HK$1.474 billion.

30 Nov 2022 – Results Delayed, Liquidity Warning: Yuhua announced a delay in releasing its annual results for year ended 31 Aug 2022. The auditor was unwilling to sign off without clarity on whether the company had sufficient offshore funds to fully redeem the bonds due December 2022. In this announcement, Yuhua disclosed it was actively discussing solutions with bondholders and aimed to publish the results by 27 Dec 2022. Trading in Yuhua’s shares was halted by the Hong Kong Stock Exchange around this time due to the results delay and the looming debt issue (as per HKEX rules).

27 Dec 2022 – Bondholder Put and Default Event: Per the bond terms, 27 Dec 2022 was an early redemption (put) date at the 3-year mark. All remaining bondholders exercised their right to demand redemption of the HK$1.474 billion outstanding principal (plus accrued interest) on that date. Yuhua was unable to meet this payment in full: although the Group had over HK$4.3 billion in cash, most of it was trapped in mainland China and not transferable offshore in time. Consequently, Yuhua failed to pay the HK$1.474 billion principal + HK$6.6 million interest due on 27 Dec 2022, constituting an event of default. On 28 Dec 2022, the company publicly announced the default and that it was in urgent discussions with an ad-hoc group of bondholders to restructure the debt. (Notably, Yuhua’s shares remained suspended pending a resolution of this default and publication of the overdue financial results.)

2023: Standstill Agreement and Partial Restructuring

Jan 2023 – Standstill & Restructuring Plan (Phase 1): Yuhua quickly negotiated a standstill arrangement with major bondholders to avert enforcement of the default. On 12 Jan 2023, the company issued a consent solicitation to bondholders, proposing an Extraordinary Resolution to amend the bond terms and waive the default. The key terms (approved by the requisite bondholder majority on 18 Jan 2023 and effective 19 Jan) were:

(a) Partial Redemption: Yuhua would mandatorily redeem HK$500 million of principal (about one-third of the outstanding bonds) for cash, on a pro-rata basis, by 30 Jan 2023.

(b) Extension of Maturity: The remaining HK$974 million principal would be retained by bondholders, with the final maturity still 27 Dec 2024 (i.e. no date change) but now reclassified as a non-current liability until one year before maturity. The 0.90% coupon and semiannual interest schedule remained unchanged.

(c) Conversion Price Reset: The conversion price was slashed from HK$6.68 to HK$1.65 per share, a dramatic reduction intended to improve the chances that bondholders could eventually convert to equity (and thus ease repayment pressure). A new clause allowed mandatory conversion of the remaining bonds if Yuhua’s average share price exceeded 130% of HK$1.65 for 20 out of 30 trading days any time after 1 Mar 2023. This provided a potential equity exit for bondholders if the stock rebounded sufficiently.

(d) Waiver of Default: Bondholders agreed to waive and forbear enforcement of the Dec 2022 default (and any default interest or penalties) upon these new terms taking effect.30 Jan 2023 – Cash Payment Executed: Yuhua fulfilled the agreed partial redemption, paying HK$500 million (plus accrued interest) to bondholders on 30 Jan 2023. This reduced the outstanding bond principal to HK$974 million, now due in Dec 2024. Following this successful interim restructuring, the company’s immediate default crisis was resolved. Yuhua’s auditors were able to finalize the delayed FY2022 financial statements, and the annual results were announced on 27 Feb 2023. Trading in Yuhua’s stock then resumed in late Feb 2023, with the share price jumping over 20% on the news of the results and the bond deal. This marked a temporary stabilization: throughout 2023, Yuhua remained listed and in compliance, and continued servicing the 0.9% coupon on the HK$974 million bonds. However, the company still needed a plan to address the bulk of the bond by the end of 2024.

2024: Preparations for Maturity and Second Default

20 Sep 2024 – Additional Bond Buyback: As the Dec 2024 maturity neared, Yuhua opportunistically repurchased a small additional portion of the bonds. On 20 Sep 2024, the company bought back HK$60.13 million in principal from bondholders for just HK$32.47 million in cash (about 54% of par). This transaction realized a gain of ~HK$18.7 million and trimmed the outstanding bond principal to approximately HK$913.87 million.

27 Oct 2024 – Warning of Possible Default: In its 2024 interim report (for the year ended 31 Aug 2024), Yuhua likely signaled going-concern uncertainties related to the looming bond repayment. Management discussions noted efforts to raise funds or dispose assets to repay or restructure the bonds. (For instance, Yuhua agreed in late 2024 to sell its Thailand subsidiary for HK$240 million, explicitly to “facilitate the repayment” of the bonds due 2024.

29 Nov 2024 – Trading Suspension and Results Delay: With the bond’s maturity only weeks away, Yuhua again postponed its annual results (FY2024) and its board meeting. On 29 Nov 2024 the company announced it was unable to finalize accounts because negotiations with bondholders over the Dec 2024 maturity were still in progress. To avoid publishing potentially misleading financials, the audit was put on hold. As a result, the Hong Kong Stock Exchange suspended trading in Yuhua’s shares (and its listed debt) from 2 Dec 2024 pending resolution. This was a strong signal that Yuhua might default absent a last-minute deal.

27 Dec 2024 – Maturity Date and Standstill Agreement: The bond matured on 27 Dec 2024 with HK$913.9 million principal outstanding. Yuhua did not repay this principal on the due date. Instead, the company announced that on 27 Dec it had entered into a Standstill Agreement with an ad-hoc group of bondholders representing >75% of the bonds. Under this in-principle deal – documented in a term sheet – bondholders agreed not to take enforcement action and to support a comprehensive restructuring, allowing Yuhua to avoid an immediate liquidation. Key points of the proposed plan (subject to formal bondholder and regulatory approval) included:

Yuhua would place HK$430 million in escrow as a cash reserve toward partial bond repayment. (This amount roughly corresponded to the remaining cash Yuhua could muster, including proceeds from the asset disposal and internal resources.)

Bondholders would formally waive the default and extend the bond’s final maturity beyond 27 Dec. In fact, the maturity was to be pushed out until the 10th business day after resumption of trading in Yuhua’s shares, at which point the remaining debt would be mandatorily settled. This clever mechanism tied the bond resolution to the share’s relisting timeline.

The debt would be restructured into equity: on the effective date, Yuhua planned to redeem HK$430 million in cash (using the escrow funds) and convert the remaining principal (roughly HK$484 million) into new ordinary shares of the company. Based on the term sheet, about 660 million new shares would be issued to bondholders for the residual debt, massively diluting the existing equity. (The implied conversion price for this final swap was much lower than previous terms, reflecting the stock’s depressed value – essentially a debt-equity swap at the distressed price).

As a consent fee for bondholders, Yuhua agreed to issue warrants to them (with no public listing of the warrants). The initial exercise price of the warrants was set at HK$0.50 per share, with each warrant entitling the holder to purchase 1 new share. The aggregate number of warrants was to be equivalent to a fee of HK$70.5 million in value, allocated pro rata to bondholders. These unlisted warrants essentially provided upside participation if the company’s stock price recovered, as an incentive for bondholders to accept the restructuring terms.

Interest and Disclosure: Notably, Yuhua kept current on interest up to maturity – the company paid the final semi-annual coupon in June 2024, and even paid HK$4.2 million of accrued interest on 27 Dec 2024 into the escrow for bondholders. Yuhua disclosed the standstill and proposed restructuring in announcements to the stock exchange on 27 Dec and 31 Dec 2024. By 31 Dec 2024, HKEX formally withdrew the listing of the 0.90% 2024 Bonds (stock code 40109), since they were no longer to remain as a tradable instrument.

2025: Final Restructuring and Trading Resumption

10 Feb 2025 – Bondholder Approval of Restructuring: By early 2025, Yuhua moved to implement the term sheet via a bondholders’ meeting. On 10 Feb 2025, 100% of the bondholders (not just the ad-hoc group) passed an Extraordinary Resolution sanctioning the final restructuring transactions. The approved plan mirrored the term sheet: (1) waiver of all default consequences; (2) redeem HK$430 million in cash on the 5th business day after the resolution; (3) convert all remaining bonds to equity on the new extended maturity date (aligned with share relisting); and (4) issue the agreed warrants as a consent fee. The HK$430 million cash redemption was completed in mid-Feb 2025, drawing down the escrow funds. This left no cash-paying debt; only the conversion of the last ~HK$484 million into shares remained.

Feb–Apr 2025 – Financial Results and Regulatory Clearance: With the bond deal in place, Yuhua’s auditors finalized the FY2024 accounts. The company published its FY2024 annual results on 27 Feb 2025, clearing one key hurdle for resumption. Yuhua also returned to a normal reporting timetable, releasing interim results for the half-year ended Feb 2025 on 30 Apr 2025 – which showed a strong rebound in profitability (boosted by the removal of debt and one-time gains). During this period, Yuhua worked with regulators and the stock exchange to satisfy all resumption conditions (including demonstrating sufficient operations and financial stability post-restructuring). The Hong Kong Stock Exchange had set resumption guidance requiring quarterly updates until trading restart, and the company made requisite disclosures (e.g. updates on the warrant issuance timing in mid-2025).

July 2025 – Share Relisting with New Equity and Warrants: By mid-2025, trading in Yuhua’s shares was allowed to resume on HKEX, after the exchange was satisfied that the firm had addressed its defaults and met disclosure obligations. The stock relisted (ending roughly a 7-month suspension since Dec 2024). Around this time, Yuhua executed the debt-to-equity swap: approximately 660 million new shares were issued to the former bondholders, converting the remaining HK$484 million debt into equity. This dramatically altered the equity structure – bondholders became major shareholders, while the founding Li family’s stake was significantly diluted. Additionally, Yuhua issued the agreed warrants to the consenting bondholders as the negotiated fee for the deal. The warrants were unlisted, with an exercise price of HK$0.50 and a term allowing future subscription of an equivalent number of shares. (Bondholders could choose to exercise or, if the warrant issuance was delayed beyond the long-stop date, opt to receive a cash fee instead.) No listing of the warrants was sought, per the company’s disclosure.