2024 Week 28

Capita Plc, Beijing Capital Jiaye, Jinmao Property Services, Yuexiu Services, Jinke Smart Services Group, Yincheng Life Services, Pernod Ricard

There is always something to sell within the Capita Portfolio of companies - Capita Plc

Capita Plc is a stock that I have covered at every price from its previous height of GBX 29.32 to its depth of GBX 12.50 and back to its current height of GBX 21.35. And through this period, they have been streamlining their business by selling their subsidiaries.

The last I wrote about Capita is on the 7th April which happens to be a low at GBX12.50 when Capita is valued at £211m. The valuation stayed pretty much at between £200m-£220m for 4 months.

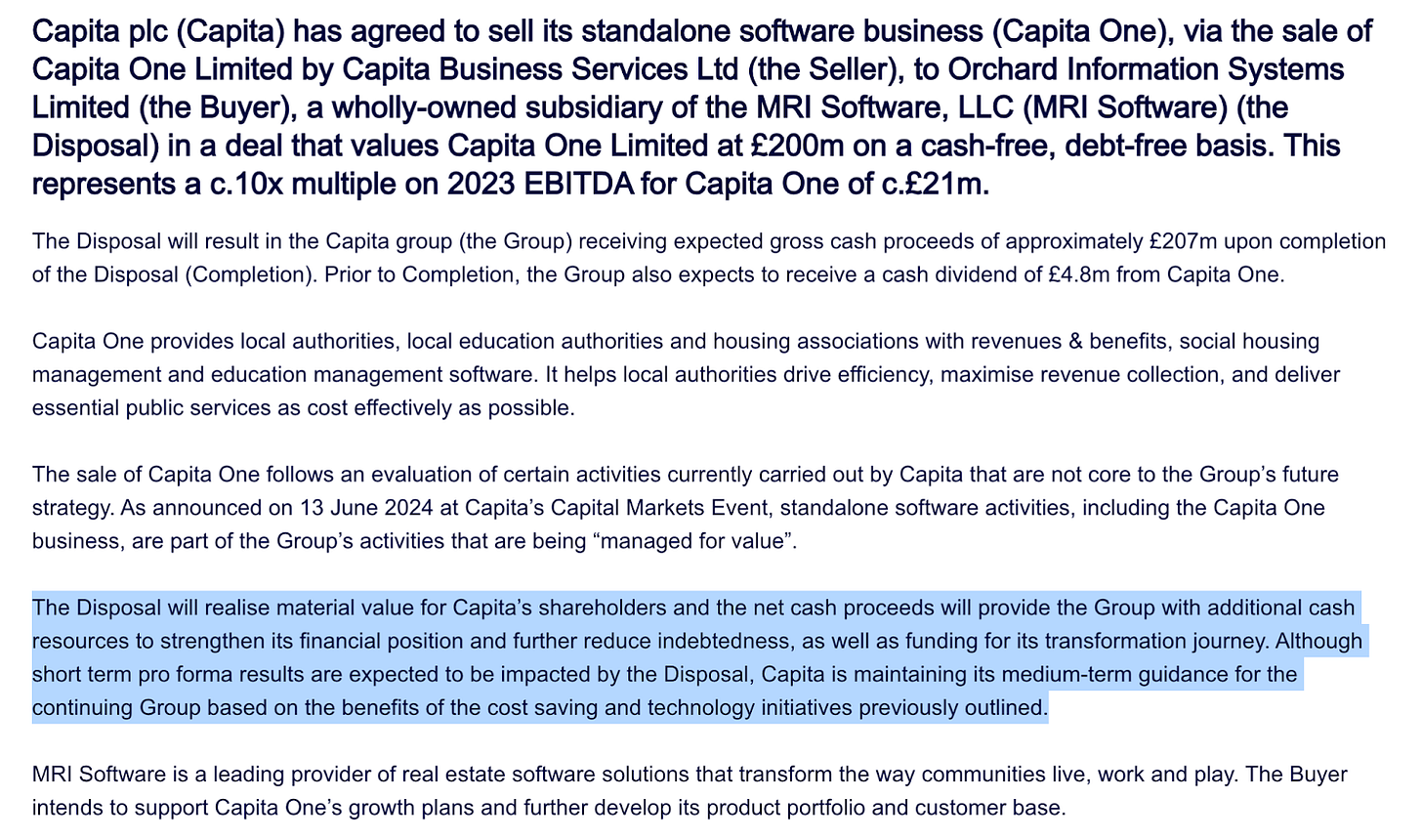

Just as the market is coming to a conclusion that Capita is “screwed” as they have seemingly sold everything of value off, the new CEO - Adolfo Hernandez pop the following news.

Capita One which is deemed as “non-core” is another one piece that is going out of the Capita portfolio at a price tag of £207m. The total assets of Capita One as at 31 December 2023 were £67m and the revenue and profit before tax for the year then ended were £55m and £19m respectively.

“As I outlined recently at our Capital Markets Event, Capita’s strategy is to become a more focused company, prioritising businesses where we can deliver material opportunities in the future, with greater simplification and cost reduction.”

-Adolfo Hernandez Capita CEO

Now, the market decided that Capita is worth £357m. If we net off the incoming £207m, the rest of Capita will be valued at £150m. This leftover business is supposed to have more material opportunities and comes with ample chances of cost reduction.

Just like the Chinese market, I think that the UK market is equally hated.

But like any turnaround, the turnaround effort may just not happen…

Looking among the wreckage - Beijing Capital Jiaye, Jinmao Property Services, Yuexiu Services, Jinke Smart Services Group, Yincheng Life Services

The Chinese property management sector is so wrecked that there is bound to be some opportunity within that sector?

My initial preference is to limit my search close to Beijing. The thesis is that there would be less hanky-panky in the accounts from a Beijing based company.

I quickly narrowed down to Beijing Capital Jiaye (Jiaye), Jinmao Property Services (Jinmao) - Tied to Sinochem through Jinmao Property. Since they are all based in Beijing and have some ties to some State Owned Enterprise, would their financials be better?

A cursory look would have indicated a big fat no. Receivables looks unreasonably high and long and seem likely to be written off.

Coupled with much love for SOE linked companies, their valuation have become unpalatable.

Maybe the companies who are doing share buybacks are better?

Yuexiu Services (Yuexiu) and Jinke Smart Services Group (Jinke) have been buying back stock regularly for quite some time now.

Yuexiu Services which is owned by Yuexiu Property is primarily controlled by Guanzhou Yuexiu Holdings which is an investment corporation owned by the Guanzhou Government. All these look good except that it is newly listed and is sporting a valuation far in excess of Jinmao and Jiaye.

As for Jinke, I continue to wonder why they are buying back their stock. It may be a diamond in the rough but getting there will be too rough for my liking. RMB 2,372m of receivables on RMB4,979m of revenue. They have tons of cash at RMB 2,905m but sport a market capitalisation of HKD 3,860m.

Another company that caught my eye through my random screening on HKEX announcement is Yincheng Life Services (Yincheng). Yincheng is the only company whose financials look relatively “clean”.

Yincheng even paid a special dividend of 12.4 cents when the stock price was trading at HKD 1.8.

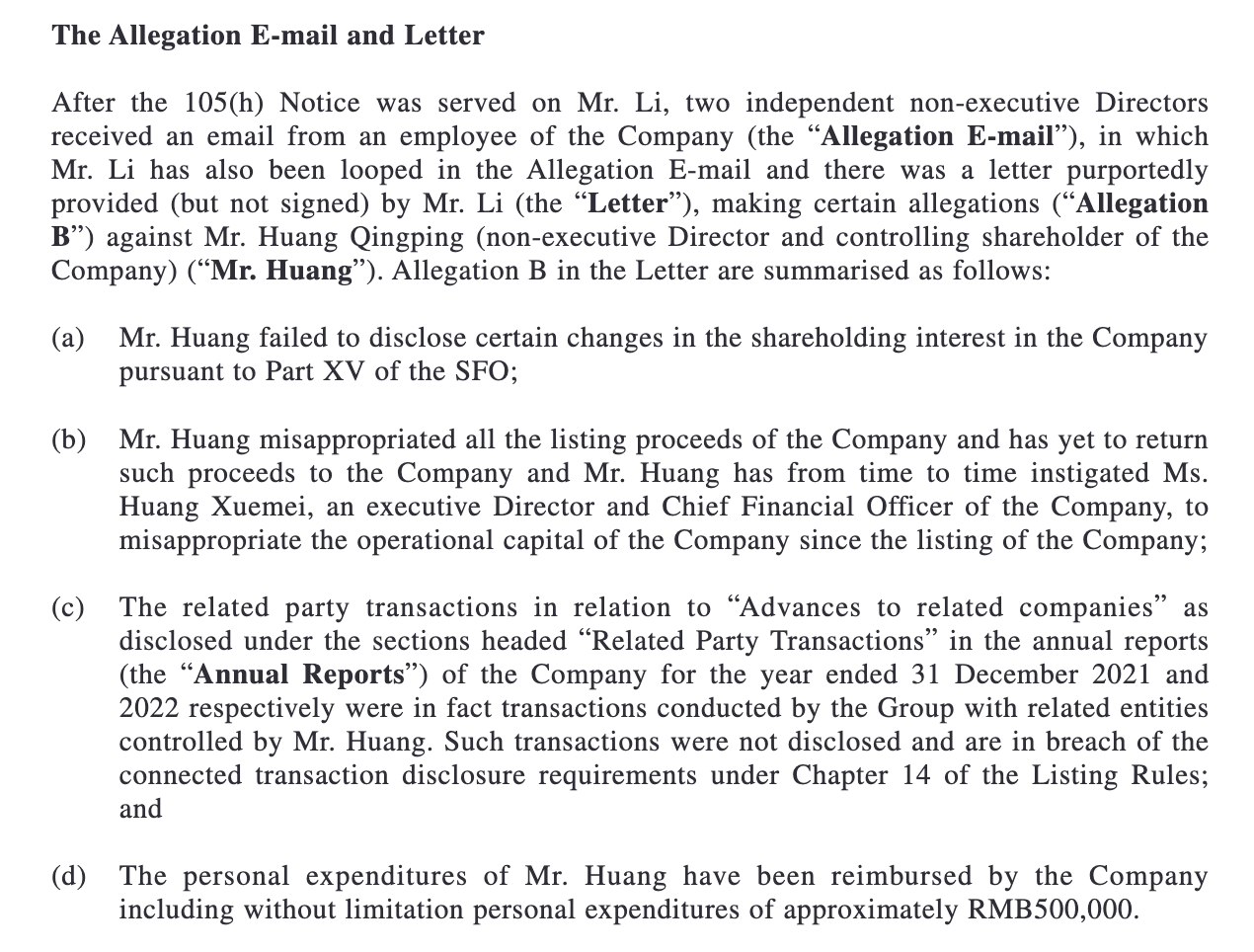

But alas, on 11th June, Yincheng released this information about their executive director.

The executive director was removed and then further allegations were made against the non-executive director and controlling shareholder.

This is how the stock looks since the announcement. This could be the cheapest of the lot but I do not think I have the stomach for it.

I even pulled out my old list of Property Management Companies to have a look and nothing passed my simple filter. My old time favourite (before the Property sector bust) - First Services Holding is on the non-tradable list on Saxo joining may other dubious companies.

There is seldom just one cockroach in the kitchen.

-Warren Buffett

I looked through the wreckage and only found cockroaches.

Handicapping the ratings - Pernod Ricard

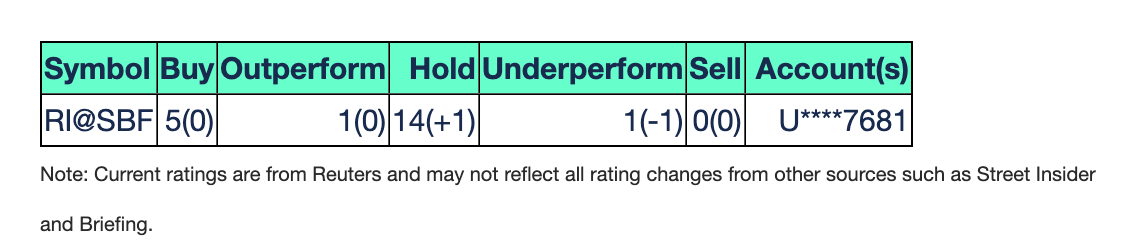

Following on my post last week, an update on Pernod Ricard came in. There is a single change from Underperform to Hold.

I do not know how ratings have changed for the sell side.

In the past, a Underperform is a Hold, a Hold is a Sell and a Outperform is a buy and a Buy is issued by the “consensus” analyst who dare not say anything else but Buy.

Any analyst who issues a Sell call is the one with the balls of steel or an idiot.

The consensus looks like a sell (or Hold to the analyst) to me. For any investor with a > 1-2 year horizon, that should be positive cos there are ample brokers to shift from hold to outperform.