2022 Special #7: Activation Group

When the pandemic fades away in China, will luxury buying and marketing be back?

The beauty of this industry is that it is highly predictable in a “non-covid” environment.

All brands require some form of “physical” marketing effort and the opening of the economy would likely spell a continued forecastable economics for this industry.

Instead of going for the juggernaut in the industry which will be more of a broad recovery play, investing in the smaller player operating in the luxury industry should provide better returns?

In addition, the recent lockdown in Shanghai has created a buying opportunity. The business will report losses for the 1st half of FY2022. With lockdown in China easing, the chance of having a normalised operation for the rest of the year seems to be in place.

The story is easily understood and the catalyst are in sync where

China Covid policy is bound to loosen

luxury players would be keen to reach out to Chinese consumers

net margin will continue to stay elevated due to operating leverage

This following company is place in the Special Strategy.

Arbitrage-Assumption:

Pandemic is ending even for China and spending on marketing for luxury goods will hold up

Weighting:

Betting - Equal Weighted

Possible Catalyst:

Resumption of luxury marketing in China

Potential Risk:

Customer concentration risk

Holding Period:

2 years for revenue and margin to return to normalcy

Introduction:

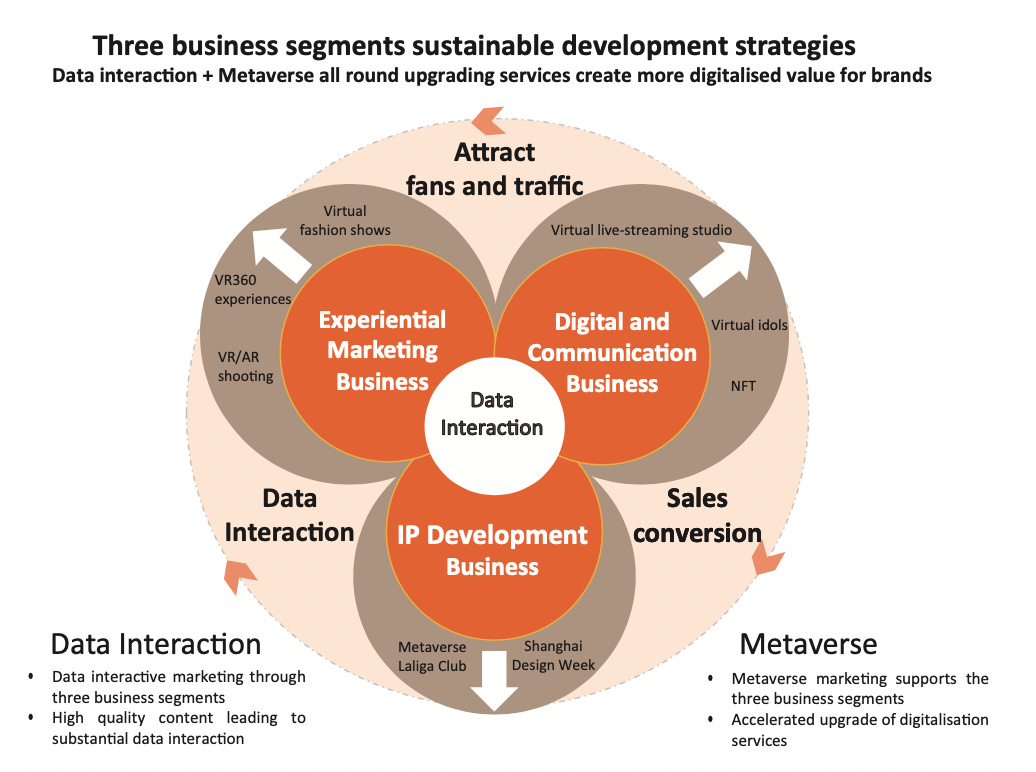

Activation Gp (AG) operates as an integrated marketing solutions provider in China offering integrated marketing solutions, including experiential marketing, digital and brand communication, and public relations services.

AG also has a IP development arm but that has been relatively small and unsuccessful.

Their main customers are the international premium and luxury brands in the fashion industry as well as the automobile industry.

Since they are catering to the luxury brands, that meant that AG will record lower revenue in the first half of their financial year and experience higher revenue due to the launch of the promotion campaign in the second half of the year.

The good news about focusing on luxury brandname is that

focusing allows AG to gain the requisite experience and manpower to deal with luxury brands.

luxury brands usually do not “trade down” as experience is key to their brand.

The theory is that if AG continue to stick to the luxury space, they could effectively garner better gross margin and improve their stickiness to their core customers by offering a differentiated experience for their customers.

The downside may be the continued slowdown in the luxury market in China but the Chinese consumers should continue their luxury spending for many more years to come (if we use Japanese consumers as a reference point).

Better Capital Allocation?

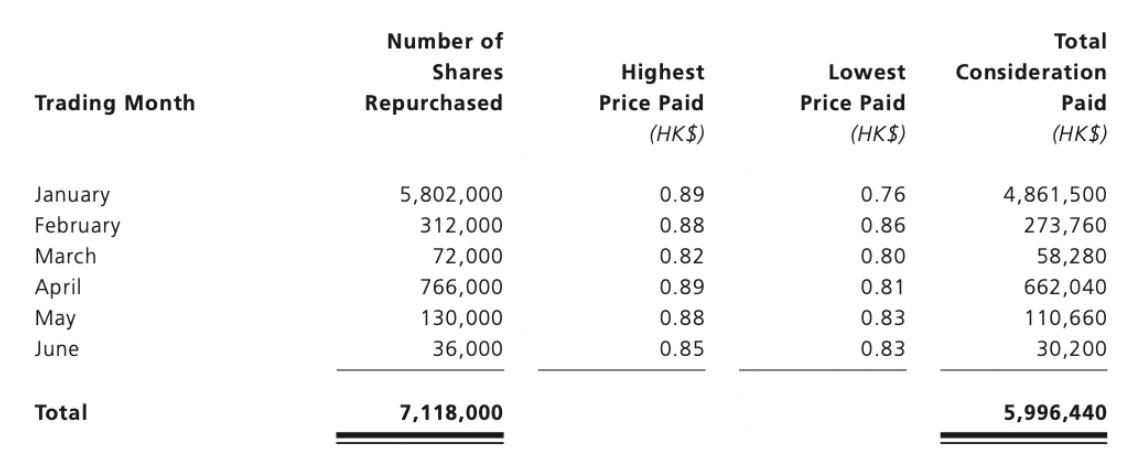

AG is my radar as they have always been a constant purchaser of their own shares.

Since they had also issued out 7m shares, this is pretty much negated as a factor.

AG decision to pay out a special interim dividend of HKD 0.0693 + a final dividend of HKD 0.02 for FY 2021 meant that the company is paying out 63.78% of their FY2021 earnings.

The bet here is that such capital allocation policy will continue because…

Alignment with shareholders:

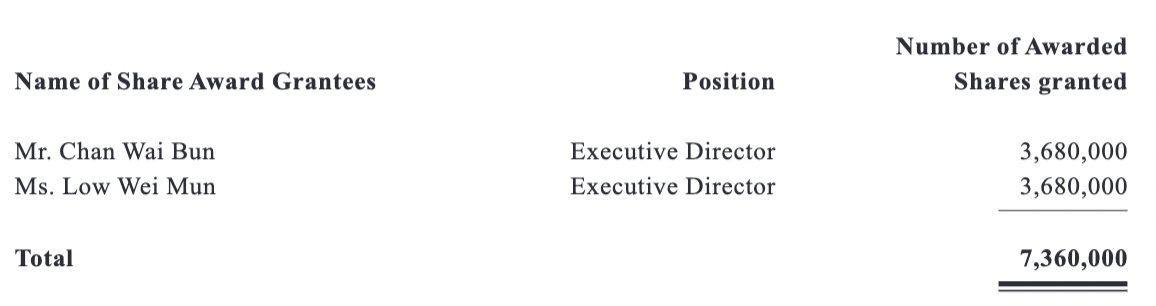

Other than the share grant that Mr Chan and Ms Low is getting…

The operators (Mr Chan and Ms Low) had been granted shares in AG through a dividend in specie from ACT Partners through Brightly Sky. Since this grant came from a trustee set up to reward1 management, it did not cost anything to shareholders.

Margin Improvement:

All these would have meant nothing if the operating metric and the operating environment are going to continue to worsen

The main assumption I am resting on is that Chinese consumers are absolutely critical to the luxury brands.

That means that even if there is a slowdown in luxury spending in China, the brands could not afford to let their brand presence slip in China.

If we can take any reference from the opening in the rest of the world, there would be a pent up of demand from China and brands would be hoping to capitalise on it by cementing their place in the Chinese consumer minds.

The latest FY2021 numbers also highlight the operating leverage AG is having. The belief is that this trend of higher revenue and higher profit before tax would continue.

Except for a very inopportune IPO (listing right before Covid), there is really no serious red flags within its prospectus

Other risks:

Customer Risk: A worry is the customer concentration risk. A single customer A2 constitute 25.9% of their FY2021 revenue.

Since receivables looks similar to yesteryears, there is no worries on that. The question is if this top customer would be continuing their purchase in FY 2022.

Investment Risk: The other worry has been the utter inability to invest in their peripheral businesses. Their ability to incinerate small amount of cash to try to broaden their business lines3 could either be seen as adventurous or a total folly.

On a side note, their recent part purchase of Shanghai Design Week seems pretty astute.

Trading Risk:

Overall, I am comfortable with the business risk I am onboarding here.

The first half of FY2022 should be bad and I am betting that the second half to do much better.

Trading volume for this company is really thin and there is a fund4 who is the bag holder of AG. If they start selling, the share price could potentially crash.

I had bought a small initial stake and would be averaging down when the bad first half of FY2022 comes along.

This dividend in specie came from the trust setup by the management - ACT Holdings is held under a trust for the benefit of the executive Directors, senior management and other key personnel of the Group pursuant to awards to be granted by the Company at the discretion of the Board from time to time.

Supposedly LVHM Group

Their investment in Fosun Fashion Group (Caymen) Limited could be seen as their recent folly.

RAYS Capital Partners Limited has just bought another large block of shares off market in AG at HKD1.05.