2021 Quicktake #4: Organon and Co

Spinoff on a low valuation

Joel Greenblatt gave the idea that we should scour the world for spinoff as they are incredible opportunities. But the space got incredibly crowded since he launched his book.

Spinoff is no longer cheap and shareholders are less willing to sell indiscriminately as of in the past.

The opportunity gap seems to be gone for a long while until recently… With everyone focused on the compounders, Spinoff which looks, feel and smell like a value stock is now once again left in the dust collecting cobwebs.

Increasingly, we are seeing more demergers/spinoffs in the works and we think that it may just be an increasingly interesting space for the next few years.

Organon and Co (OGN) is a global healthcare company formed through a spinoff from Merck. Merck is spinning off OGN as Merck wants higher growth and OGN’s portfolio is just not sexy.

OGN has 60 medicines and products across its three core franchises:

Women’s Health: Anchored by NEXPLANON (etonogestrel implant), a long-acting reversible contraception, along with its contraceptive and fertility businesses and boosted by its recently announced proposed acquisition of Alydia Health, a medical device company focused on preventing maternal morbidity and mortality caused by postpartum hemorrhage (PPH) or abnormal postpartum uterine bleeding.

Biosimilars: A key growth pillar with products available in various parts of the world including RENFLEXIS (infliximab-abda) and BRENZYS (etanercept) in immunology and ONTRUZANT (trastuzumab-dttb) in oncology. Organon’s expertise is in the commercialization of these products, bringing them to more people around the world.

Established Brands: 49 well-known products in the respiratory, cardiovascular, dermatology and non-opioid pain areas.

OGN aims to be a global women’s health company with a focus on reproductive health, health issues that are unique to women, as well as conditions that disproportionately affect women.

“At Organon, we are here for her health. Our vision is to create a better and healthier every day for every woman around the world. There is no other healthcare company with our global footprint dedicated to putting women at the center that will focus on identifying medicines and solutions that they so urgently need.”

-Kevin Ali, Chief Executive Officer, Organon.

With that aim, the representation of women on the Board of OGN is 70%. The aim is clear, be a global women’s health company!

The above all sounds good except that Women’s health is a small portion (26.5%) of OGN!

So the story is not really true. Let’s dig a little deeper on what must happen to the company for it to be a truly global women’s health company.

Step 1: Sell?

First, it may want to get rid of its smallest division - biosimilars1.

For biosimilars segment, Merck entered into an agreement with Samsung Bioepis Co., Ltd. (Bioepis) to develop and commercialise multiple pre-specified biosimilar candidates in 2013. Under the agreement, Bioepis is responsible for preclinical and clinical development, process development and manufacturing, clinical trials and registration of product candidates, and OGN has an exclusive license for worldwide commercialisation with certain geographic exceptions specified on a product-by-product basis.

OGN’s access rights to each product under the agreement last for 10 years from each product’s launch date on a market-by-market basis. Gross profits are shared equally in all markets with the exception of Brazil where gross profits are shared 65% to Bioepis and 35% to OGN.

Looking at the above, the transaction is heavily skewed in favour of OGN. The agreement is structured as Bioepis is most likely hoping to tap on Merck’s sales channel. With OGN taking over the contract, Samsung would be itching to control their own products which they had invested heavily. The biosimilar division will fetch a very good price due to the agreement structure and its growth potential.

Even if the biosimilars division is not sold, the division is in its early stage of growth. In total, 60 biosimilars have been approved in the EU and 29 approved in the U.S., representing a market of about $17 billion. OGN had indicated that 54 major biologics with an aggregate market value of $220 billion will lose patent protection over the next decade, which could allow biosimilars market to nearly double in size.

Step 2: Juice

Second, it will continue to juice its established brands (EB).

OGN has 49 products in its EB portfolio.

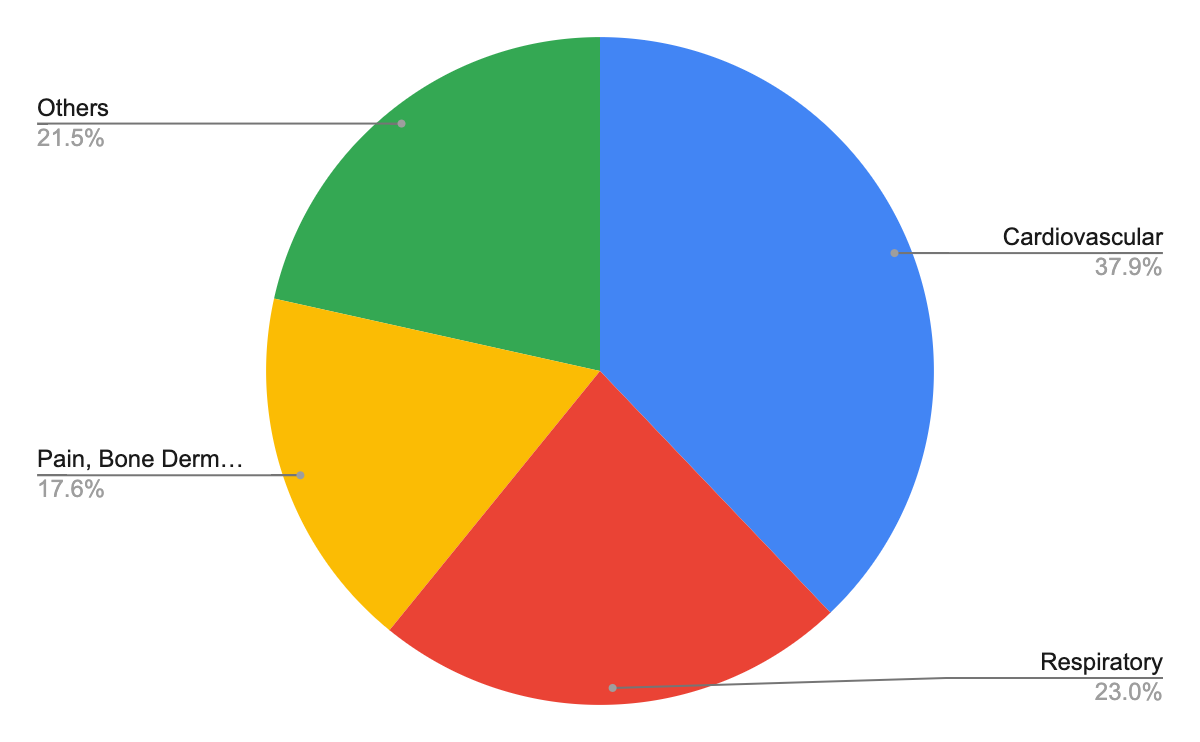

The largest category is cardiovascular, followed by respiratory, non-opioid pain, bone, dermatology and others.

The idea here is that they will maximise cash flow by investing judiciously in market-specific opportunities, life cycle management, and digital marketing.

Step 3: Acquisition

With the possible sale for their biosimilars and then the continued cashflow from EB, OGN is well position to acquire and grow their Women’s health division.

This is a multi-year transformation and as per all M&A exercise, the management could overpay or even buy a dud product and the end result could be disastrous.

We are not sure if we will wait till then but…

Back to Step 1: Valuation

If the biosimilars division is put up for sale, the share price for OGN will pop.

In addition, the market seems to be valuing OGN with the likes of Teva, Endo and Viatris.

Teva and Endo are subjected to enormous legal liabilities2 and high leverage.

Viatris which came from a combination of Mylan and Pfizer’s Upjohn generic business suffer from high leverage3.

Merck seem to want to position OGN for growth when they structured the spinoff (with minimal debt and multiple cashflow options).

OGN is valued at around 5-6x PE at an ROE of around 30% coupled with an ability to drive growth through acquisition using cash either from the sales of their biosimilars division or the cashflow from their EB.

As usual, a DCF is not required for OGN looks like a steal right now.

If you would like to follow us on real time on what we are thinking of and news article we are reading on.please join us at our telegram channel - https://t.me/weightedresearch

or follow me on Twitter - https://twitter.com/OngWeeHiang

Subscribe to our newsletter if you want to receive timely information on our positions!

If you have any comments, just hit the comment button below.

Biosimilars are similar to chemical generics except that biologic molecules can never be exactly the same, thus they are called biosimilars. The manufacturing and regulatory process is more complex than chemical drugs, which meant lesser competition and better pricing.

Viatris took on new debt of $24.5bn, of which $12bn was used as a cash closing payment from Upjohn to Pfizer.