2021 Quicktake #3: Kaspi.kz

The fastest growing bank who operates more like Alibaba

Sometimes when you search all over the world for interesting businesses, you will come across something so amazing that you will want to take a second take. Usually when people think about FinTech, they will think of China or the U.S.

Would anyone think of Kazakhstan?

If you are to look back at how Alibaba started, you would could just imagine why it is so natural to move into the financial service - Alipay as it is a natural extension to their core business of e-commerce.

If you have asked me if a bank would move into the tech service of providing e-commerce, the closest I can think of are the neo-banks. But even then, they are just working on payment and financial services and not creating a whole eco-system of e-commerce, travel, and a super app to cover every aspect of a consumer life.

It take a form of serendipity and that is how one of the most interesting company is born in Kazakhstan.

Instead of looking at its future, let’s start with it history and somehow we have a feeling that the company has a long runway ahead as it has a talented management team with a wind behind its back.

History of Kaspiyskiy:

It was in 1991 when the Soviet Union collapse and Kazakh consumers were in dire straits economically. An entrepreneur named Vyacheslav Kim (Kim) founded Planeta Elektroniki, a computer, electronics, and household appliances retail chain in Almaty at the age of 23.

In 2002, Kim and his partner bought a recently privatised bank, Kaspiyskiy. It was not the wisest of choice and by 2005 they are looking for a financial partner to help them to manage the bank.

Through a mutual friend, Kim knew Mikhail Lomtadze (Misha) from Baring Vostok (a private equity firm from the ashes of Baring Bank). Misha brought the deal of injecting capital into Kaspiyskiy back to Baring Vostok, and Baring Vostok bought a stake in Kaspiyskiy.

The bank was promptly renamed Kaspi Bank (Kaspi) with an aim for an IPO in 2-3 years but the Great Financial Crisis of 2008 hit and throw their plans into disarray.

Misha decided to clean up the bank by focusing on retail banking. Misha dissolved the whole leadership team of the bank and brought in a bunch of young executives who are willing to act like entrepreneurs.

Kaspi’s product portfolio was cut to one deposit product and two consumer loan products. Also in 2008, it launched a mass-market credit card business and acquired over one million customers in four years1

While Kaspi grew to be highly profitable in 2012, they had fallen into the trap of every bank. Their customers hated them. Using the feedback from the net promoter score (NPS), Kaspi shut down its credit card program in 2012 and launch an online product for bill payment. Kaspi’s online payment system became an overnight success as it is free of charge and is built around daily consumers payment needs with high frequency of contact with end-users.

Crisis and Opportunity:

In 2014, Kazakhstan’s Central Bank devalued the Tenge, the local currency by 25%2. An anonymous WhatsApp highlighting that the some of the banks would collapse cause a run on the bank3. Instead of limiting withdrawal, Kaspi loaded its branches with cash and reassured the public that their money is safe.

Kaspi’s online marketplace and online consumer finance was launched in that same year allowing instalment payments to be made for their marketplace customers. The marketplace worked so well that Kaspi draw a seller fee of 6% for each transaction as retailers are accessing their 5 million customers.

Kaspi.kz - the mobile app was launched in 2017 and within 12 months, half of the transactions were done through mobile.

With the availability of data on their customers, Kaspi is able to assess loans within 10 seconds of application and dispense the loan in 15 minutes while decreasing the level of delinquency of the loan.

In 2016, Kim gave Misha a 9.9% stake in Kaspi.

In October 2018, a failure occured on the superapp. Rumours flies saying that Misha had run away with Kaspi’s money. To avoid a bank run, Misha made a quick video holding the day paper stating that he is still in Kazakhstan (looking like a notice from Harry Potter). That worked and no one came and withdrew any money.

Controversy:

In 2018, Kim spend $390m buying stock from one of the shareholders on the Kazakh stock exchange. The stake was transferred to Misha (at the time were worth an estimated $500 million) in exchange for a “certain non-cash consideration” in December 2018 “pursuant to a long-standing arrangement encompassing their various business interests.”

The person who cash out right before the IPO is Kairat Satybaldy (Satybaldy), the nephew of Kazakhstan’s former longtime president Nursultan Nazarbayev and is a member of the country’s business and political elite.

The question is why cash out before IPO?

The problem is that if Satybaldy name had been on the IPO document, no reputable financial institution would be interested in the listing. Satybaldy is too politically exposed to be a controlling shareholder in one of the biggest banks in Kazakhstan.

How did Kim manage to find $390m to purchase the stake for Misha?

If this is all true, the transaction between Kim and Misha is one the most interesting and long dated (2007 -2020) shareholder agreement all funded on the basis of trust.

Other than an investment from Baring Vostok in 2006, Kaspi never took any external capital or pre-IPO funding till their plans for IPO on the London Stock Exchange (LSE).

Growth:

On November 2018, Kaspi dropped the word Bank from its name and renamed the company as Kaspi.kz.

Kaspi proceeded with their IPO on the LSE in the midst of the pandemic and the share price had been on a tear since.

By the time of their IPO, Kaspi.kz superapp had become the leading mobile app in the country with 7.8 million MAU.

Kaspi.kz superapp has also starting to exhibit the superapp of the world and even surpassing some of them.

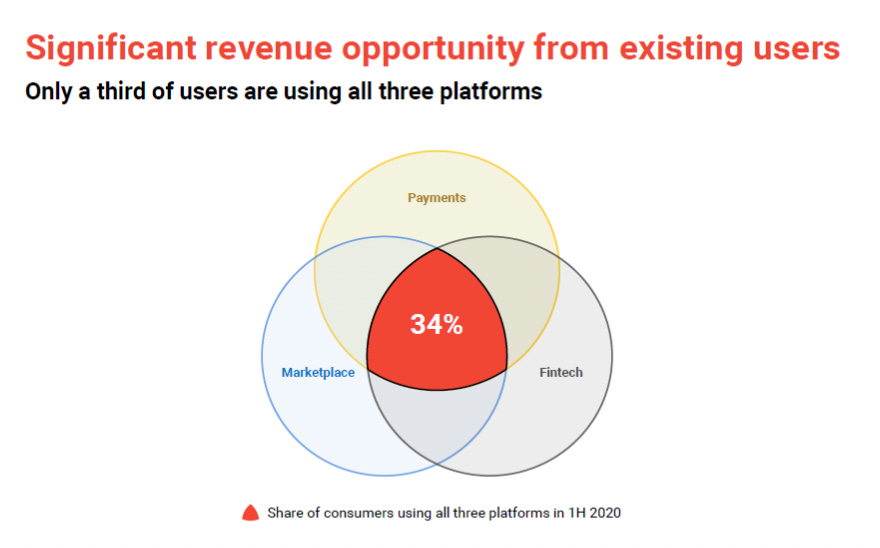

Kaspi continue to drive its growth from its ecosystem of 1. Payment, 2. Marketplace and 3. Fintech.

Their NPS remain high and customer retention had continued at above 90%. They continue to onboard more merchants onto their marketplace, which allow them to continue to provide credit to their customers which got their initial flywheel going.

And the best thing of all, within Kazakhstan, they still have a long way to deepen their marketshare.

Looking at their 20211Q results, the pandemic had really propelled their business to cement them at the top of the food chain.

Valuation:

With a guidance like the below, selling at 20x PE for FY2021 guided earnings, with an ROE of 50%, and projected earning growth of 100% this year, Kaspi.kz may just be the most exciting bank you have never heard of.

If you would like to follow us on real time on what we are thinking of and news article we are reading on.please join us at our telegram channel - https://t.me/weightedresearch

or follow me on Twitter - https://twitter.com/OngWeeHiang

Subscribe to our newsletter if you want to receive timely information on our positions!

If you have any comments, just hit the comment button below.