2021 Quicktake #2: Maker Dao

Move to the dark side, own a truly "Blockchain" bank

We have started to move into understanding the uses of the blockchain and the digital businesses who are utilising them.

Take note that we are not talking about the currency here - Bitcoin or Ethereum.

The main thing is that we are trying to understand the business of blockchain and not in the speculation of the currency.

Similar to the stock market, we are interested in the business and not the foreign currency they are base on (thou, the Asian financial crisis do tell us that foreign currency exposure do matter as much).

The concept of Decentralised Finance (DeFi) has been very interesting to us. Like everything thing crypto related, the concept may sound alien but the fundamental are very much the same. Let’s go to Wikipedia for some definition of DeFi.

Decentralised finance is a blockchain-based form of finance that does not rely on central financial intermediaries such as brokerages, exchanges, or banks to offer traditional financial instruments, and instead utilises smart contracts on blockchains, the most common being Ethereum. DeFi platforms allow people to lend or borrow funds from others, speculate on price movements on a range of assets using derivatives, trade cryptocurrencies, insure against risks, and earn interest in savings-like accounts. DeFi uses a layered architecture and highly composable building blocks.

-Wikipedia on DeFi

So technically, instead of using some intermediary, you set up a bunch of codes build upon a blockchain and then allow one to lend or borrow funds (that is way simplifying everything but that about the gist of it all) and a business is born!

The supposedly beauty of it all is that it requires minimal human intervention (but increasingly the organisation is realising that someone need to keep the “business” running).

If this goes the way DeFi wants it to be, it spells a huge opportunity to serve the people who are actively involve in the blockchain economy which is just getting larger every day.

Unlike the neobanks where almost everyone is unprofitable, some of these DeFi structures are turning highly profitable!

But with headlines like this, we sense that there may be pocket of opportunity in the DeFi space.

If your idea is to learn more about DeFi, then this may be the start for you. The financial structure is really intriguing and in the midst it may also be a small money making opportunity.

The “digital currency” we are talking about is Maker DAO.

Maker (MKR)

This is currently a USD 2b organisation with a daily liquidity of USD 100m.

What is interesting is that MKR is a DAO - Decentralised Autonomous Organisation – which means it delegates governance decisions to its community.

MKR’s performance dashboard is live for everyone to see. The discussions among its users are fully searchable online and its profits are filed monthly within days of the month end.

MKR net interest income is USD 166,612 in 2019 and swiftly grew to a net interest income of USD 36m for the year till 31st May 2021!

While the explosive growth came from the increased use of Crypto, let just focus on the operating expense segment.

MKR spend a total of USD 800,000 to facilitate a business of USD 36m!

Just imagine how many people or how much expenses would be required if you are building a banking operation which yield USD 36m a year!

Operating on the equity of around USD 40m, they have a business platform which facilitated USD 2b worth of loan!

This is basically Ant Financial on steroids!

MKR is able to provide a platform to loan money to anyone as long as they can put up adequate collateral in digital currency.

If the pledged collateral are insufficient to maintain your loan value, a liquidation event will occur as per what a bank would do if you took up a loan.

If you are still interested in this idea, let’s go down to the risk segment.

Risk 1:

All these are on the premise that the digital assets are stable and we know that they are not. If MKR is unable to release the value of collateral quickly enough in a falling market, then it suffer a mark to market losses. This happened in March 2020, when MKR took a hit of $5.8 million as the price of Ethereum fell by 45%.

Risk 2:

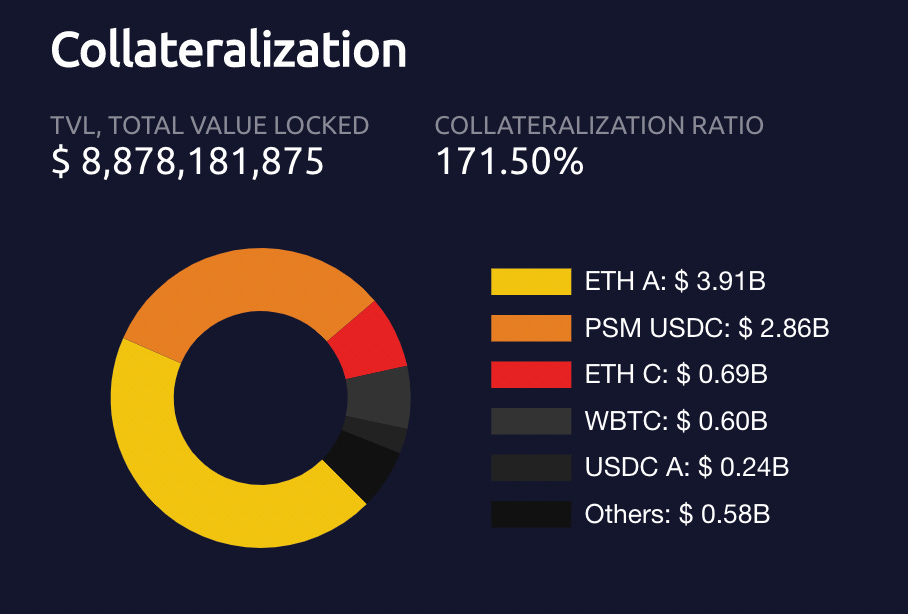

MKR’s USD2.2 b of liquidity consists mainly of USDC stablecoins which are backed by US Dollars held by the Centre consortium. It’s the closest thing you can get to a real dollar in the crypto world but it may still turn out to be not so real!

Risk 3:

What they are doing is really similar to free banking model practiced in Scotland1. That means that they are issuing currency (Dai). Regulator may see them to be a banking operation and deem them as too risky?

Risk 4:

MKR is not a legal entity despite making some serious money. Someday, someone will decide that something needs to be done to this “illegal” operation and we do not know when!

If you still can get pass all the above, let’s dwell into the history of MKR.

History:

https://www.netinterest.co/ did an excellent job in describing the history and we decided we should not to re-write his excellent explanation below.

The story will have to start 6 years ago when Rune Christensen became heavily involved in Bitcoin in 2011. Over time, he grew disillusioned with Bitcoin because of its volatility and turned his attention towards stablecoins instead. Unlike free floating currencies such as Bitcoin, stablecoins are pegged to other assets like the US Dollar.

In 2015, Christensen spent six months spinning up a dollar-pegged stablecoin on the Ethereum platform. He called it the eDollar and posted his design on Reddit. Two years later, Christensen formalised his eDollar into a form of money called Dai. The bank he devised to create his money is called Maker DAO, and it works like this:

An investor comes into Maker DAO for a loan. He (yep, usually he) has some collateral he’s happy to keep locked in a vault. Right now, that collateral is usually a crypto asset like Ethereum. For every $100 worth of crypto assets, Maker is typically prepared to lend $66 – the gap adding a buffer of protection against a possible fall in the value of the collateral. Maker accepts the collateral and advances a loan, which it does by issuing its Dai money.

Of course, if Maker locked up valuable crypto assets and simply issued lemons, nobody would be interested. Its money has to have some value, so it pegs it to the dollar, albeit differently from the way Scottish banks peg their money to the pound. In Maker’s case, borrowers pay a fee – which Maker calls its Stability Fee – over the duration of their loan. That fee can be flexed by Maker to influence the supply of Dai. At higher stability fee rates, fewer people want to borrow and so the supply of Dai is managed down; conversely, at lower stability fee rates, the supply of Dai can be managed up. Demand for Dai can similarly be managed via a Dai Savings Rate which Maker pays to holders of Dai – equivalent to interest on a bank deposit. By using these rates to influence both supply and demand, Maker can therefore maintain the value of its Dai close to its target level of US$1.00.

Simplified Form:

If you are lost from the explanation above, let me try to do it in a paragraph.

MKR provides a platform where they create a form of stablecoins known as Dai which is backed by the other USD backed stablecoin allowing a borrower to borrow DAI up to 66% on the collaterals (mostly Ethereum) they put up and allowing borrowers to use Dai in whatever way they wish (mostly to speculate) and MKR manage the “peg” to USD stablecoin through the use of stability fee and interest rate to crimp or increase demand for Dai keeping the value of Dai stable.

If it is still confusing to you, please read it again…

So how does MKR make money?

MKR makes money from

the collection of the stability fee from its core lending business,

the trading business (where it exchanges Dai for other USD backed stablecoins)

and from liquidating loan collateral (which can also generate losses).

Investment Thesis:

So what happened to the profit that they make?

The profit that MKR made through their operation is used to

🥁

🥁

🥁

🥁

🥁

🥁

🥁

🥁

decrease the number of MKR in issuance!

That is so elegant!

Effectively, owners of MKR owns the profit from MKR. Since MKR is not a legal entity and is in no position to distribute their profit, they had instituted a “buyback” policy by destroying the number of MKR in issuance!

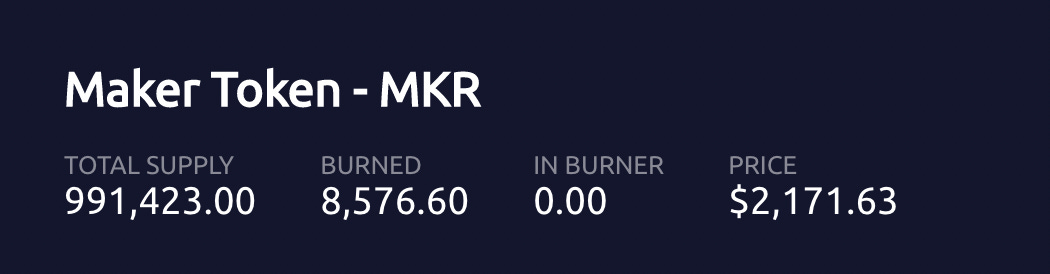

There is 1,000,000 supply of MKR at the start and 8576.60 of MKR had been burned so far.

As long as MKR continue to make profit, the owners of MKR continue to own a larger piece of the future profit!2

Selling at 22.14x earnings, with ROE > 100%, current annual profit of USD 88m, with a growth of > 100% from last year, a falling crypto currency situation (more profit from liquidation), falling MKR price among the rout in Cryptoland, a growing reputation as one of the few truly decentralised organisation around, we think MKR may just be one of the most interesting business on Cryptoland!

One last caveat: Cryptoland is where reflexivity3 flex its muscle. When the crowd starts to lose faith in all of Cryptoland which lead to lower prices, DeFi will needs to sell the collaterals held, which causes lower prices leading to more faith lost and finally the collapse of the market.

Like what Albus Dumbledore said to Harry Potter.

“Fawkes is a phoenix, Harry. Phoenixes burst into flame when it is time for them to die and are reborn from the ashes.”

Just that we do not know if the reborn is the same phoenix as the one that died….

If you would like to follow us on real time on what we are thinking of and news article we are reading on.please join us at our telegram channel - https://t.me/weightedresearch

or follow me on Twitter - https://twitter.com/OngWeeHiang

Subscribe to our newsletter if you want to receive timely information on our positions!

If you have any comments, just hit the comment button below.

Free banking model had been practiced in Scotland between 1716 and 1845 The banks were largely unregulated, allowed to issue money according to the market forces of supply and demand. The legacy of Scottish free banking survives in the form of private banknotes the three Scottish banks issue in their own name.

If DAO could control the time they burned the MKR, they could get better value for money as their highest profit usually occurs when the MKR price is the highest.

Reflexivity in economics is the theory that a feedback loop exists in which investors' perceptions affect economic fundamentals, which in turn changes investor perception.