We Bother to read the Press!

“It’s in the price if it’s in the press so why bother?"

“It’s in the price if it’s in the press so why bother?"

This is Jake van der Kamp’s argument at an event in Hong Kong

“It's a bell curve and the peak of that bell curve will coincide with the correct answer. What an individual doesn't know, the community does. That’s the way it is in the market.”

- Jake van der Kamp

Oh Screw it! Who uses a Bell Curve argument in this era and time? We thought that the argument is for the 80s.

Anyway, do read my dear friend Gabriel Tan rebuttal.

Gabriel's argument is base on his profession as an investor relation professional that effective financial communication help support business objectives and educates the market to ensure sustainable increase in value or defends it against downward pressure due to irrational factors which we have no reason to argue against.

In a recent podcast done by Bill Ackman, he reveals that he still read the newspaper for ideas. We do as well. Just one thing more, while the news is often reflected in the price, the price often reflect a biased view which an enterprising investor would be able to take advantage of.

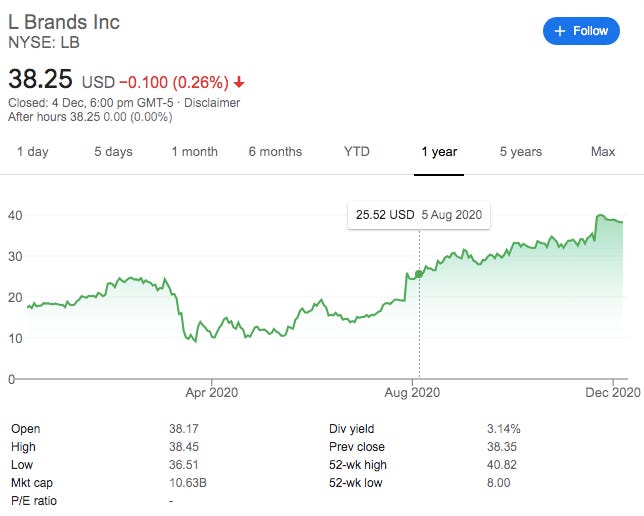

The most recent investment which we had made out of reading the Wall Street Journal is L Brands. In April 2020, with news of Sycamore Partners pulling out of the deal to buy Victoria Secret, the market is all doom and gloom for L Brands.

By May 2020, long time Chairman and CEO Les Wexner had stepped down. While everyone is talking about Victoria Secret, they had forgotten that L Brands owns one of the most attractive business asset during a pandemic - Bath & Body Works.

Bath & Body Works sells affordable liquid soaps, moisturising creams, candles, and home fragrances. From 2014 to 2019, it grew at a 9% compounded annual growth rate while maintaining an industry-leading operating margin of 23%. In May, you could have bought L Brands for USD 4b while the whole Bath & Body Works could be worth USD 8 - 12 b.

L Brands had since doubled since April/May low and the fear of the narrative of that non-purchase by Sycamore had been relegated to footnote which no one would remember now.

Anyway, this is an one off case and you should not take it too seriously.

While everyone ditch the newspaper, we continue to consume them.

As full time investors, we take our newspaper reading seriously. We usually cover business news in Singapore, Malaysia, Indonesia, Philippines, Thailand, Korea, Hong Kong, Japan and China in the morning before moving to news in Europe and the Western Hemisphere in the afternoon and evening.

While most of the new would be totally useless except for some coffee table talk, 1 or 2 ideas may just become our L Brands of tomorrow.

If you wish to receive more regular updates on what we are working on, do join our telegram channel.

If you have any comments, just hit the comment button below.