NetDragon Websoft

When the East meet the West and Gaming meet Education

We took Darroy in as an intern during the pandemic. The main reason was to get the Darroy to write some introductory articles for us. After knowing that he is into gaming, we started to get him to educate us on the history of gaming from arcade to console, from PC to mobile.

We understood the addressable market for each segment and why they are complimentary and then we ran through all the listed gaming companies such as Activision Blizzard, Capcom, Nexon, Nintendo, Keywords Studio, Square Enix and Take Two. We become better acquainted with gaming as an industry but could not find an edge for an investment.

During the same time, we also invested some time in a EdTech startup tackling the international school education market in South-East Asia. We started to understand that schools are difficult customer to acquire. We are close to doing a deal with one of the major international school but alas it is a herculean effort.

The reason why we are putting you through our stories is that sometimes knowledge needs to catch up as mentioned in the our article on patience. If we had not unknowingly got Darroy in as an intern to teach us on gaming or dabbled in a EdTech startup, we would not have given much thoughts to the business we are talking about next.

It takes some imagination to visualise how lousy or how wonderful the business could become but overall we believe that the valuation is pretty attractive now.

We are looking at companies with low or no expectation baked into their share price. The following company has that quality and the company we are going to talk about is Netdragon Websoft (ND).

Now, the share price is back at its 2013 level and we think it is at an interesting level to revisit the ND story.

GAMING: ND is a company that had build games in the MMORPG space. Their IP had been long running and most of the gamers who had played their game on PC had become young adults. Their games are pay to win games and people who play are ready to fork out cash to play and win.

EDUCATION: They developed a suite of education products such as 101. We struggled to understand the positioning of the myriad of products under 101 and often came away with a feeling that there multiple education product/websites that are defunct but remain online.

But at the same time, their acquired subsidiaries which include

Cherrypicks (Acquired in 2014)

Chivox (Acquired in 2015)

Edmodo (Acquired in 2018)

Promethean (Acquired in 2015)

seem to be doing fine.

This is an unusual way for us to write an article but we are going to “chronicle our thoughts” on the company from 2013 till now.

At the start of the mobile revolution after the launch of iPhone on Jan 9, 2006, and the public beta of Android version 1.0 launched for developers on Nov. 5, 2007 came the launch of 91 Assistant (91助手) by ND in 2008.

91 Assistant quickly became one of the most popular smart phone management tools for smart phones users in China and its HiMarket (安卓市場) appstore became the most active third party download platform for Android users in China in terms of user base and total downloads.

2013:

In October 2013, ND completed the sale of 91 Wireless Websoft Limited and its subsidiaries to Baidu (Hong Kong) Limited, a wholly-owned subsidiary of Baidu, Inc., for USD1.9 billion, making it the largest online M&A deal in China at that point of time.

That also woke up the share price and for a brief moment, ND is the toast of the investing community.

In 2013 annual report, there is only a small mention on moving into the online education sector.

By riding on the fast development trend of mobile Internet and developing businesses via unique learning methods brought by smart mobile equipment, strengthening the resources for the “Online Education Cloud Platform” (「在線教育雲平台」) which forms the foundation of the project, and fully utilizing the cooperation between Foxteq Holdings Inc., an indirect wholly-owned subsidiary of Hon Hai Precision Industry Co., Ltd. and Vision Knight Capital (China) Fund I, L.P., online education products endorsed by users will be launched continuously.

-Liu Dejian Chairman (Annual Report 2013)

Our notes in 2014:

In 2014, revenue from the gaming operation continue to rise as users continue to increase, but normalised earnings had started to decrease due to the increasing selling and marketing expenses (106m to 152m) and development costs (162m to 249m). On a normalised basis, earnings would have decreased from 158m to slightly less than 100m.

We are struggling to understand the surge in development costs and wondered if the company the company had re-attributed some administrative cost to development cost. In short, we are skeptical of the company’s account.

The Company’s vision in the education space is to develop a game-changing online and mobile education ecosystem that will empower students and learners to learn not just more effectively and efficiently, but with more fun and motivation compared to the conventional way of education. The Group intends to achieve this vision by leveraging its proven world-class mobile internet and gaming expertise, large-scale technology resources and team infrastructure that was built out of scaling several successful businesses over the many years since its inception.

-Liu Dejian Chairman (Annual Report 2014)

On hindsight, we should have seen that that they are heavily investing and developing their new strategic business – online and mobile education.

Our notes in 2015:

ND acquired Promethean and delisted it from the UK market. This is also the year when we really questioned if the company is a fraud.

Revenue growth continued at a fast pace but expenses ballooned even faster. Thou there are more mention on the education business but we always thought of it as a side project till Promethean came along.

Now we are expecting a hardware business to thrive? We are at a loss on how to evaluate the company. Should we just value just the gaming segment and ignore a potential huge burn rate in the online/hardware education business?

The Company’s online education subsidiary acquired a Series A equity fundraising round of USD52.5 million, at a valuation of USD477.5 million. The Company continued to optimize and improve our educational products. During the year, the Company commenced its go-to-market roll-out and successfully won several tenders, with the Company’s sales contracts covering 5,000 classrooms in 400 schools across 14 provinces (or direct-controlled municipalities).

-Liu Dejian Chairman (Annual Report 2015)

On hindsight, we should have just valued the gaming business and ignore the education business. Or we could use the implied valuation in the education business Series A funding as a valuation.

Our notes in 2016:

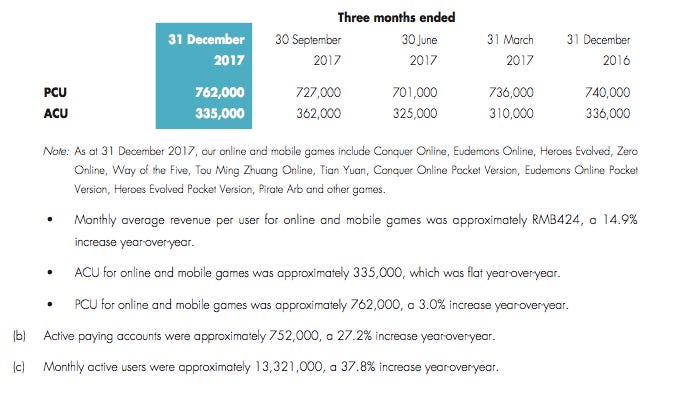

For gaming, ND has always presented Average Concurrent Users (ACU) and Peak Concurrent Users (PCU) as a way to measure their user retention and user growth. This is the year that the users growth in PCU had flatlined.

Instead they talked about how the monthly revenue per use had increased. We started to wonder if all the numbers is true or how much more can the revenue per user increase to?

Furthermore, we have also noticed encouraging signs in the spending power of our active quality users. In 2016, we spent more time studying our current user base, focusing on the user experience of our most active and valuable customers. As a result, our ARPU reached RMB369 in the last quarter of 2016, a 28.6% increase compared with 2015.

-Liu Dejian Chairman (Annual Report 2016)

The slowdown in growth in the gaming business got us worried. By squeezing more cash out of each player, are they are making the game a bad experience for players in general?

The education sector also registered more losses. Now we are worried on both the gaming and the education sector which make this company even harder to evaluate.

Our notes in 2017:

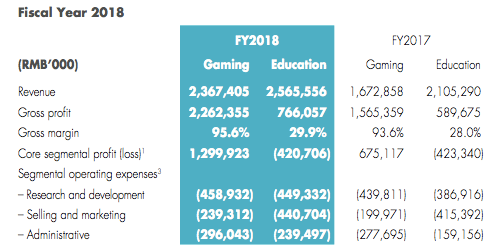

The superior gaming business had overcome the perpetual money losing online education business. Maybe the PCU and ACU is not the main metric to look out for?

The better metric is more regular metric such as monthly active users and paying accounts. The monthly average user paid more as well showing how strong the gaming franchise is.

R&D, SG&A cost for education started to moderate for education. This seems like a trend that could continue. Rising revenue and contained cost seems like a winning recipe.

There is some talk on new games and new game-play feature which is something that has been lacking in previous years.

Looking forward, the Company will continue to maximize our IP values by introducing new games and new game-play features. After launching several new games in 2017, we expect to launch multiple new games in 2018, with a focus on mobile games.

-Liu Dejian Chairman (Annual Report 2017)

Our notes in 2018:

Acquired Edmodo. At least this is a company that we know well as we were once a user.

During the year, we took another major step forward for our education business by acquiring Edmodo, one of the largest education communities globally with over 100 million users to date. The acquisition enables us to offer a complete product portfolio that covers pre-class, in-class and after-class learning environments, anywhere and at any time.

-Liu Dejian Chairman (Annual Report 2018)

Promethean strengthen its market leadership in K-12 interactive displays and reported a net profit of RMB151.5 million. This is a markedly improved result albeit boosted by the Moscow’s tender shipment.

The company turned highly profitable, leaving us ruing on our lost chances in acquiring a good company. Maybe we should have recognised and valued the good part and ignore the bad one?

As for gaming, PCU and ACU disappeared as a metric. The only metric left is the average revenue per user (ARPU) which increased to a 64.8% to RMB 665. Never have we seen revenue increase at such a rapid pace with minimal expense increases. Gaming is a phenomenal business.

But at the same time, we hated it when format changes, it usually tell us that management has something to hide. At least tell us why you remove the PCU and ACU reporting!

Our notes in 2019:

Finally, we can see how the online education onboarding works. Promethean opens the door for either 101 Education or Edmodo to move in to sell a SAAS product. If the monetisation is successful, the education business get transformed overnight into a high revenue growth segment.

On the other hand, our online learning community platform Edmodo has seen unprecedented increase in users since the outbreak of the coronavirus, on top of becoming Egypt’s designated national K-12 online learning platform in March 2020. Edmodo was also recently selected as a UNESCO-recommended distance learning platform, due to its wide reach, strong user base and evidence of positive impact on learning.

-Liu Dejian Chairman (Annual Report 2019)

We guess investors continued to be spooked by Education’s lower revenue and higher losses. With the pandemic, we are changing our mind on the education business. The demand for online education is being pull forward. Education ministry and schools need to change and adapt and they will only choose the best hardware and software combination.

The 101 Education/Edmodo/Promethean combination seems like a good combination to sell to the educators/schools/district/ministry. There is hardly any competitors who can execute on this breath and scale.

The business should scale well and revenue growth seems assured with one time sales paid by the upgrading of hardware and a continual sale through SAAS. Selling and Marketing cost should moderate in the near future helping the business to turn profitable.

Our notes in 20202Q:

The share price retreated as the company release their 20202Q result. The main reason is that the growth investor is disappointed with the growth of the revenue.

Gaming had grown strongly in the past. So there is good likelihood that that will continue. Their legacy IP is showing some age but players on the game seems to playing the game to reminisce on their childhood. It has always been a pay to play and win game and everyone who plays recognise that they need to spend some cash. We guess since the players are older now, the propensity to pay has to be higher.

Growth in R&D, SG&A expenses are all moderating. We think this is good sign to see.

Education is poise for a good jump in revenue on the second part of the year.

Conclusion:

As you can see we are very conflicted on the company. Every year, there seems to be something bugging us.

In the initial years, we struggled to understand the ballooning admin, SG&A cost. Then we worried about Promethean - the hardware business which is low margin and possibly low growth but dominant.

It is only when they acquired Edmodo that we had a change in heart on the education business. Then we worried about their legacy gaming franchise and wondered if they could extend their longevity by squeezing more dollar out of every player.

But there is a few things working in favour other than the low valuation.

Capacity to Invest and Suffer:

ND’s management had shown an enormous capacity to suffer through investing in the future. They had basically took their USD 1.9b in receipt from the sale of 91 to invest in the future of online education. In return, they had string together a number of assets right before online education took off.

The ability to bet heavily on one’s judgement show us the Chairman foresight and his ability to pounce on opportunity.

In addition, the gaming business continue to throw off large amount of earnings and cashflow.

On a betting basis, if education investment turn out to be a dud, the ND becomes a pure gaming company which should accord it a higher valuation multiple. If education turns out to be good, then a conglomerate discount continues to exist albeit at a higher valuation.

Either way, we think that the current valuation did not factor in any possibility of failure or success on the education business.

Exponential growth in Education:

The software portion of the education business had grown exponentially in the past 6 months. Even if you do not give the management credit for purchasing Edmodo, the onset of the pandemic had brought forward the on boarding of students onto online platform by at least 5 years.

The ability to build a business selling a SAAS education platform to the State/National, School District level is a moat that is hard to penetrate. Once running, there would be huge inertia for the customer to not want to change.

Willingness to sell a business:

The management in the past had sold 91 Wireless Websoft Limited and its subsidiaries to Baidu (Hong Kong) Limited. That sale had been a masterstroke as ND sold a business at its peak. We will expect them to be as comfortable to part with the education business.

Valuation:

On 13 February 2020, ND had entered to place 33,000,000 shares at HK$23.70. We are getting it at HKD17.60 now.

Using the latest VC round of USD 1.35b for the valuation of the education segment versus the current valuation of ND at USD 1.28b, we could see how undervalued they are.

It would be easy to list the education business. If they are to sell to a SPAC right now, our guess is that the valuation would be easily more than USD 2b.

With gaming poised to earn RMB 2,000m (HKD 2,314) in 2020. ND is selling at 4.5x PE on gaming earnings. Give the PE any multiples reasonable multiple and ND would still look like a steal.

Disclosure: At the time of publishing Wee Hiang has a position in the above company. Holdings are subject to change at any time. This report, and disclosure, should not be considered to be a recommendation.