Perturbation Theory

When one overriding factor determines the path...

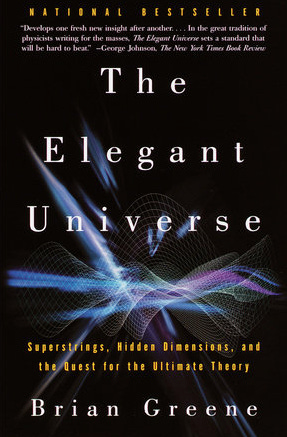

The reading of physics related book has always been to fulfil a childhood fascination of being a theoretical physicist. With lesser time on hand, reading physics had become a hobbyist activity reserve for the holiday breaks.

Physics is elegant as you do not depend on when or where you use them in the universe. This basically means that the fixed set of physical principles leads to the belief that the same physics law do hold true everywhere. This is known as symmetries of nature

One overarching lesson we have learned during the past hundred years is that the known law of physics are associated with the principle of symmetry. Special Relativity is based on the symmetry between all constant velocity vantage points. The gravitational force, as embodied in the general relativity, is based on the extension of the principle of relativity to embrace all possible vantage points regardless of the complexity of their states of motion.

-Brian Greene

Symmetries of Finance?

Physicist who first encountered economics/finance/investment always assume that symmetry of nature applies to economics/finance/investment which alas is not true.

There is no fixed set of principles in the financial market. Different market is make up of different

accounting standards

financial structures

market participants

political environment

thus leading to drastically different result. While we continue to read Warren Buffett’s work, we somehow believe that it is all different when you invest across jurisdiction.

Instead of using symmetries of nature, we believe another physics concept would have been a more useful mental tool for investors.

When there is too much variable:

Physics theories/experiment are usually beautiful and unlike finance theories/practise which are messy. But sometimes, physics could also be messy (like string theory) when there is a lot of unknown and where mathematics are difficult.

One of the core tenet of String theory is that it exposes supersymmetry as a possible candidate for undiscovered particle physics, and if confirmed correct could resolve various areas where current theories are believed to be incomplete

To better analyse string theory (when there is no available experiment to do), physicist need to use approximation to try to give a rough answer to a question and then systematically improving this approximation by paying closer attention to the fine details initially ignored.

This is known as the Perturbation Theory

Perturbation Theory:

To explain the theory, lets use our sun and earth as an example. According to Newton and Einstein, everything exert a gravitational influence on everything else. Since that is the case, we are quickly lead down a path in which we need to account for everything in the universe to understand gravity to determine the motion of earth. Nevertheless, we can predict the motion of the earth through the solar system with great accuracy by using the perturbative approach.

We only need to care about one variable which is the sun!

As the sun is the largest mass in comparison to that of every other member of our solar system coupled with its proximity to earth, we can get a ballpark estimate of the motion of earth by considering the sun’s gravitational effect. We can then further refine the calculation by including the rest of the gravitational influences like the moon.

A perturbative approach only works if there is a dominant physical influence that admits a simple theoretical description. If there is three heavenly participants (2 suns and a planet), the equation become so complicated that any ballpark figure derived would be significantly off the mark.

The theory has been an essential part in many scientific research and is also something that we had been doing in everyday life. Since this is a finance/investment newsletter, let us move on to how we use perturbation theory in finance.

Perturbation theory in investment:

If we are to broadly apply perturbation process to investment we would have understood that most opportunities are too hard with too many variables, making valuation impossible to do.

For us, the narrative and the true state of an investment in a business is very simple. If there is no single dominant physical influence that admits a simple theoretical description of an investment in a company we would say SKIP!

As Peter Lynch says “Never invest in any idea you can't illustrate with a crayon.”*

If you wish to receive more regular updates on what we are working on, do join our telegram channel.

If you have any comments, just hit the comment button below.

Do subscribe if you are keen to see our investment thesis and portfolio.

*Weighted Research says “Never invest in any idea you can’t articulate within a readable email length.”