Industry Update: Leisure will be back

So what are the assets to own?

First let differentiate between two type of travel; business travel and then travelling for leisure or just leisure as a whole.

We are unsure how business travel will fare. We are reticent on the idea of business travel for we realise we can do a lot through online and Zoom will do just fine for us here. But we are sure that business travel will bounce back, just slower. Seeing a person face to face and being able to close that deal much faster makes a lot of difference.

During the pandemic, we had even sold off our long term holding in Pico Far East - they primarily do event management around Asia. We still love the company, its organisational culture but the industry is just so tough now. We cannot forecast how business travel and convention will look like in 3 years time.

As for spending on leisure, even for a person like me who is not keen on having any leisure, I do reminisce the oversea travel spend with my extended family. Maybe leisure is something that modern human really needs after all.

We are pretty sure spending on leisure is going to rebound and we wonder what is the best way to position for the rebound.

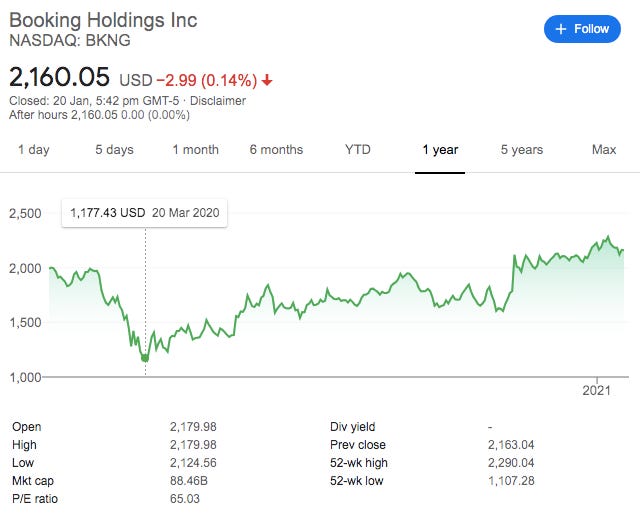

The usual online travel booking companies are at their high and do not look like the best assets to own.

Lets define leisure.

Instead of defining it narrowly such as travel assets (like airports, airlines and hotels), we are talking about a range of activities. This could be going to casinos, cruise, live attractions, movies, shopping strips, tourist attractions. We had put in our buy price for a few public listed companies and we are just hoping that it will hit the buy price we like.

We like “pure” tourist assets which could not be easily or economically replicated. We are also drawn to assets which should facilitate the start of travel or is itself a travel destination. Even within the domestic leisure space, we think that domestic spending on leisure will rebound once vaccine is widely applied.

Instead of going big on one company, our thoughts here is to go into a variety of asset play in case some asset class turn out to be duds.

We also like companies which has assets which will perform well during the pandemic and also have the optionality of doing even better when the leisure market recovers!

These bunch of companies will be placed in the leisure statistical portfolio.

We are not too concern on if there is going to be a rebound in leisure spending. The question is not when but by how much.

If the rebound in spending on leisure is significant, we believe most companies will be moving much higher from this point.

If the rebound in spending is small, then the low share price would had been baked into most of these situation. We are trying to look 2 years out. In 2023, we believe humans would be out finding leisure instead of cooping in at home.

If leisure continues to stagnate, then we guess that their line of business which is pandemic proof should hold their value and the optionality we had bought would decay away…

Time Horizon:

This is a part of the effort to build investment with different horizon. As the bull market continues, we need to shift assets into assets with different thesis maturity allowing us to successfully navigate this bull market and the subsequent bear market.

The idea is that we will be vesting into companies with a 2 year horizon effort and possibly 5 - 10 years horizon.

Leisure is going to be bigger in 10 years time than now, and we can be sure we will still be vested in some of these names many years later.

If you would like to follow us on real time on what we are thinking of and news article we are reading on.please join us @ telegram - https://t.me/weightedresearch.

If you would like to re-read some of our investment reflections, then do follow us on Facebook at https://www.facebook.com/weightedresearch.

Subscribe to our newsletter if you want to receive timely information on our positions.

If you have any comments, just hit the comment button below.