Danone SA

Investment Ideas from the Press #4

This series of companies from the press is inspired by Gabriel’s article on Linkedin.

We did an article on IBM and Intel, then an article on Regis before moving to the below. Hope you are enjoying our articles on the search for investment ideas in the press.

Yakult is a drink that most Asian are all exposed to. We are used to seeing the Yakult ladies selling the drinks house to house.

When we saw the news that Danone is selling their stake in Yakult Honsha (Yakult), we thought that there would be some interesting movement and opportunity in looking at Yakult. As with most companies in Japan, there is nothing interesting happening except that business will continue as usual…

Share price had retreated slightly but there is really no catalyst for us to buy Yakult now.

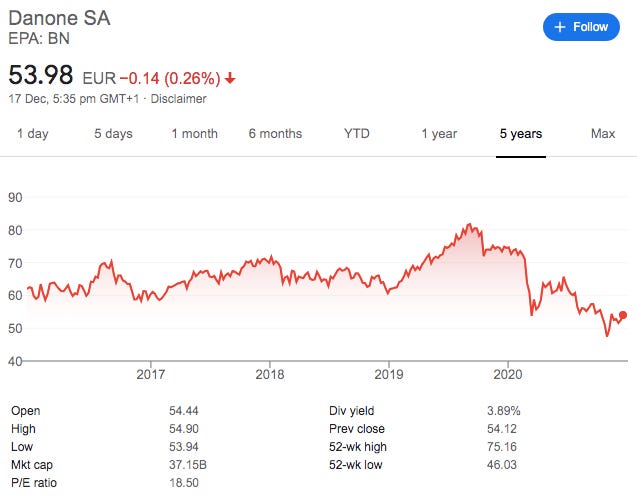

Instead, we had notice that Danone is also at it multi-year low. That pique our interest and that is what we are covering today.

Danone share price started to retreat right after it is deleted from the STOXX Global 200. Selling pressure is always a good start.

In October, right after the announcement of their divestment in Yakult, the selling actually intensify dropping to a year low of EUR 46.

We are interested in Danone as it is a company as they could be seen at the same light as Nestle and Unilever. When WSJ started to highlight the dismal return on Danone, we knew that this is something we are keen to look into.

With all eyes on Danone, CEO Emmanuel Faber had talked about diversifying away from their dairy business, a strategic review of all their brands and changing of management structure. Faber had been CEO for six years and little had happened, so what makes us think that this will be it?

Looking at Nestle playbook (2016 - 2018):

In 2016, Nestle came under pressure from Dan Loeb. The strategy proposed is simple.

Be Sharper in Articulating Strategy

Be Bolder in Re-shaping the Portfolio

Be Faster in Overhauling the Organization

The response had been rapid

restructure their operation to reduce HQ staff

ditch their underperforming business

sold its Gerber Life Insurance unit to Western & Southern Financial Group for $1.55 billion in cash

sold off its skin care division for 10b

redirect investment into areas such as personalised vitamin startup Persona that delivers straight to customers’ doors

acquired Canadian vitamin maker Atrium Innovations Inc. for $2.3 billion

paid USD 7.2b to sell Starbuck coffee exclusively

We had no doubt that the response had helped Nestle respond during the pandemic and the restructuring had helped its share price.

50% over 5 years is not exactly fantastic returns but this is Nestle we are talking about here… Very little risk for a decent return.

The good thing about large conglomerate business in the consumer space is that the ills are always almost the same

HQ had swelled too huge and bureaucracy had set in

too many SKUs

investment in non-core sector is weighing down returns

too slow in making investment in fast growing areas

and the way to remedy this is usually a rapid slimming exercise.

Danone Playbook 2020:

No Dan Loeb is needed here. The catalyst is the underperformance during the pandemic when they should be performing!

The good news is that Danone is working on the exact playbook.

restructure to reduce 1500 -2000 HQ staffs

decentralised and shift power back to country head

20% SKU reduction

sold Yakult Honsha share

full strategic review of its portfolio of brands, starting with Vega

shift the group’s portfolio into fast-growing areas such as

probiotics,

plant-based

and genetically modified-free products

The plan had been put in place and we will await for more divestment and more investment.

Unlike Kraft Heinz which is in the wrong category of “desired” food and is focus on cost cutting, Danone has always been positioned in the “healthier” category and should be able to divest and invest in growth area as well as Nestle did.

If you wish to receive more regular updates on what we are working on, do join our telegram channel.

Subscribe to our newsletter if you find this information useful.

If you have any comments, just hit the comment button below.