Regis Corporation

Investment Ideas from the Press #3

This series of companies from the press is inspired by Gabriel’s article on Linkedin.

We did an article on IBM and Intel before moving to the below. Hope you are enjoying our article on the search for investment ideas in the press.

We are always scanning for changes in CEO.

Some executive are trained to grow/ market a company and some are trained to cut cost. For the company today, the new CEO will be tasked to cut cost while continuing with the strategy the previous CEO had put in place. The new CEO came from 3G Capital group of companies.

3G Capital’s is best known for its Zero-based budgeting. While the strategy had been lambasted since 3G acquisition of Kraft Heinz, we believe that it is relevant here. We believed that the demand of the services will remain constant and may even benefit from the pandemic. To understand more about 3G strategy do read the book below.

The company we will be talking about would be Regis Corporation (Regis).

Regis franchises and owns hairstyling and hair care salons with 6,923 locations worldwide. The salons operate primarily under the trade names of SmartStyle, Supercuts, Cost Cutters, First Choice Haircutters and Roosters and they generally serve the value category within the industry. Each of the Company's salon concepts generally offer similar salon products and services.

The major services supplied by the salons are haircutting and styling (including shampooing and conditioning), hair colouring and other services. Salons also sell a variety of hair care and other beauty products. Regis earns revenue for services and products sold at the company-owned salons, product sold to franchisees, and earn royalty revenue based on service and product sales at our franchise locations.

The company share price had recovered strongly from its March, September, November 2020 low.

Regis current share price is back to where it is in the 1990s. Nothing fundamentally had change for its business. They are in the business of provision of hair salon services in North America. With or without the pandemic, people need to cut hair.

They had expanded rapidly through salon acquisition from 1994 - 2004 and is now paying the price of needing to slim down.

Business Model Hypothesis:

The business model of Regis is base on the premise that with financial strength, successful salon operations and national recognition, Regis would be attractive tenant to landlords. Since the service business requires a good frontage, by being bigger in size, their stores would then be conveniently located, highly visible sites in high traffic locations which allow customers adequate parking and quick and easy store access. Similar to retail, Regis believe that site location helps drive business.

This particular thesis help drive their business decision since.

Roll-up Strategy (1994 - 2004):

The business strategy seems like a roll-up strategy. They went about acquiring salon companies. Roll-up strategies could work wonderfully if you are able to squeeze cost and improve the operation.

In 2000, Regis added 68 salons operating under the Supercuts name through its merger with Supercuts UK. While in 2002, Regis added 523 salons with its acquisition of the French franchise company Groupe Gerard Glemain, along with nearly 1,200 franchised salons with its acquisition of the European franchisor Jean Louis David.

During 2003, the Company added nearly 1,000 salons acquiring 328 domestic BoRics salons, 25 Vidal Sassoon salons and 286 salons, including 196 franchised salons, from Opal Concepts.

In 2004, Regis expanded into the beauty career school business with the acquisition of six Blaine Beauty Career Schools. combining with the four beauty career schools in conjunction with the Vidal Sassoon acquisition.

There is nothing wrong with a roll-up strategy if not for the fact that Regis had taken on too much too fast.

Franchise Buyback + Rapid Acquisition (2003 - 2007):

In 2003, the share price had propelled to above USD 30+, making executive whose pay are tied to share performance to behave as required.

To keep the music going and having every investor at the dance floor, the management need to come up with new ways of acquisition. Buying new salon brands is too unwieldy and uncertain and they must supplement it with something else to boost margins.

In 2003 the management hit on a better model, out of the 555 acquired company-owned salons, they also acquired 97 franchise salon buybacks. During 2004, Regis up the game by acquiring 405 company- owned salons, including 206 franchise buybacks. In 2005, Regis acquired 451 salons including 139 franchise salon buybacks.

From 1994 to 2007, Regis acquired 7,926 locations, expanding in both North America and internationally. Revenue increase 50% from 2003 - 2007 correspondingly with debts doubling during the same period. Company salon accounts for 68% of the total store count at end 2007.

While it all looks amazing from a financial point of view, franchise buyback with continued rapid acquisition is a terrible idea!

By acquiring franchise salon which is highly profitable, Regis is converting a successful franchise owner into a rich employee thereby reducing their motivation and entrepreneurial spirit.

The unravelling period (2007 - 2017):

By 2007, the empire had become too wieldy to be managed effectively. After years of rapid feasting and indigestion, it is time to slim down.

To avoid having too large a financial hit, the company executives found a way to sell down part of their wholly owned companies in exchange for equities.

In 2007, Regis contributed 51 of its wholly-owned accredited cosmetology schools to EEG in exchange for a 49.0 percent equity interest in EEG. The investment is accounted for under the equity method. Regis recorded an impairment charge related to this transaction of $23.0 million.

In 2008, the Company merged its continental European franchise salon operations with the operations of the Franck Provost Salon Group in exchange for a 30.0 percent equity interest in the newly formed Provalliance entity.

These transactions help the management to look slightly smarter, but they are nevertheless just financial engineering and the chickens are bound to come home to roost.

From a high of 11,881 stores in 2007, the number of stores continue to decrease to 9,288 in 2016. With growth gone with the wind, the company shares retracted by half to USD 20.

New CEO, Back to Franchising (2017 - 2020):

In 2017, Hugh Sawyer joined Regis as CEO and started to embark on a full franchise strategy. Sawyer immediately announced plans to expand the franchise side of their business, through organic growth and by selling certain company-owned salons to franchisees over time.

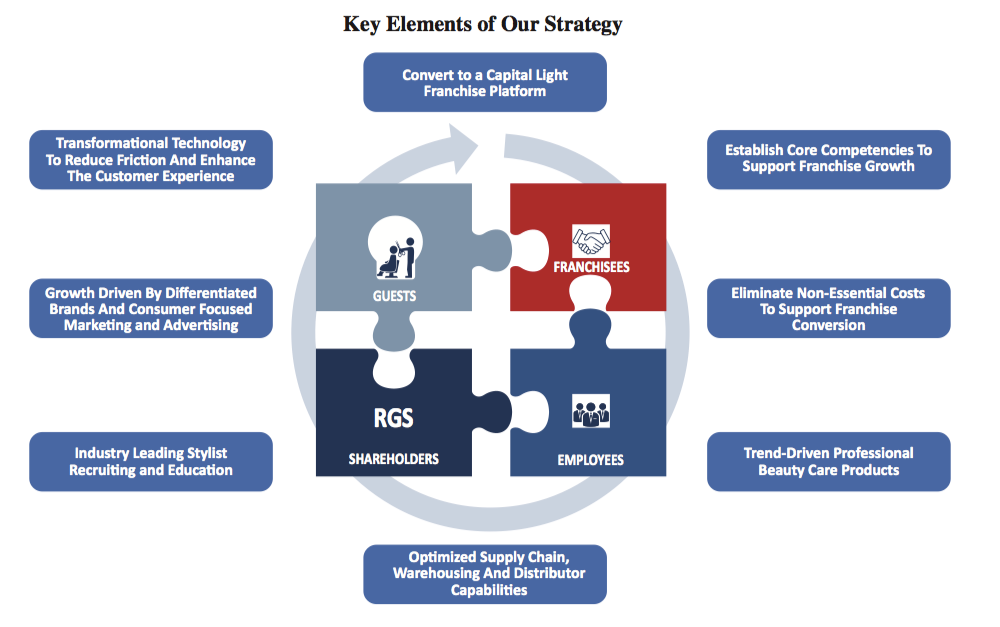

A full franchise strategy* makes a lot of sense as franchising frees up a lot of capital which is required by company owned salon.

By only choosing to support franchise business model, they would have eliminated administrative costs and personnel required to look after the company owned salon.

Months after Sawyer took over, Regis announced that they had sold substantially all of its mall-based salon business in North America, representing 858 salons, and all of its previous International segment, representing 250 salons in the U.K., to The Beautiful Group (TBG), an affiliate of Regent L.P., a private equity firm based in Los Angeles, California.

This all sound good until you realise that Sawyer had not effectively solve the problem. By selling to TBG, Regis had received cash and removed the headache of managing almost 1100 salons.

The salon franchise business is fundamentally not suitable for large franchisee or private equity operator. TBG managed to destroy their franchise business at the malls resulting in lower future royalties for Regis. Strategically, it would have been better if Regis had taken the step of going down the ground to offer the franchise opportunity to their small financially motivated owners.

To rub salt into their wound, in 2019, Regis entered into a settlement agreement with TBG in which Regis exchanged the franchise agreement for a license agreement. TBG then transferred 207 of its North American mall-based salons back to Regis as Regis was the guarantor of these lease obligation.

In fiscal years 2019 and 2020, the Company accelerated its sale of salons to franchisees by selling 767 and 1,475 salons, respectively, across all brands.

The plan is to become a fully-franchised asset-light company by the end of fiscal year 2021 by selling the approximately 800 - 1,000 salons to franchisees in the next twelve months and closing the remaining salons at their lease expiration.

But alas, Sawyer will not get to see his work complete as he would be replaced before the fiscal year 2021 is up.

Pandemic induced cuts:

With the pandemic and with almost 3 years of restructuring, Regis had the chance to reset its expenses. At the peak of the lockdown, RGS furloughed 85% of employees, reduced salaries on the remaining 15% of employees and significantly cut discretionary expenses.

In July 2020, Regis announced that the ongoing transformation to a franchise platform enabled it to eliminate administrative costs and personnel. In total Regis removed approximately $25 million of annualised general and administrative expense costs for FY2020.

New CEO, Same Strategy, Different Execution:

On October 2020, Felipe A. Athayde commenced his employment with and appointment as Regis' Chief Executive Officer and President. Athayde has spent nearly a decade at Popeyes' parent, Toronto-based Restaurant Brands International (RBI), and for about a year-and-a-half at Popeyes itself. Though in a different industry, RBI is also franchise-focused.

Athayde is the executive who led Popeye's 2019 rollout of a chicken sandwich menu offering that sparked a social-media-fueled frenzy — and a subsequent shortage of chicken in United States. Thou, we doubt any social media marketing would lead to a haircut frenzy….

Athayde told analysts on the company's earnings call that as a new CEO, his main priority is to complete the process of converting to an all-franchise model but that his obsession is the profitability of franchise owners.

"The brands which have grown the fastest are those that have been the most profitable. I consider this to be my most important learning from my 10 years in the restaurant industry, so Regis' obsession has to be and will be the profitability of our franchisees."

-Felipe A. Athayde

Finally, Regis have someone who is talking sense. The strategy is simple, convert all the operation to franchise, and make sure that they are profitable.

The first major strategic initiative by Felipe Athayde is to focus on the performance of its brands and the profitability of its franchisees.

Management Shuffle:

Supercuts and SmartStyle brands will each have a Brand President leading dedicated, brand-centric teams. A third business unit, Portfolio Brands (a collection of growth and innovation concepts), will be run by another Brand President and team. This presents a major departure from Regis' previous structure that distinguished between the franchise and company-owned businesses in a brand-agnostic way.

"Starting today, our primary responsibility is to lead, nurture, and grow our brands. And to do that, we need to focus our organization around those brands... It's a simple but fundamental change, which we believe will create tremendous value to our franchisees and shareholders, "

-Felipe A. Athayde

Shawn Thompson, a former restaurant executive, has joined Regis to become President of Supercuts. Thompson brings 8 years of franchising experience with Restaurant Brands International, having held a variety of roles including Global Head of Operations and President of Tim Hortons US.

Shawn Moren, formerly EVP, Regis Corporate Store Operations, Artistic Services and Human Resources of Regis, moves into the role of President for SmartStyle.

Jim Lain, formerly EVP and COO at Regis has rejoined the team to become President of Portfolio Brands. Prior to Regis, Lain was with Gap Inc. where he served as Vice President.

We like the idea on the focus on brand building and having Thompson joined Athayde at Regis meant that Athayde is bringing his own people into Regis. At the same time, the new management team is also balanced with people from Regis who knew the business well.

Zero-Based Budgeting:

Similar to RBI and any companies with 3G executive, zero-based budgeting will be instituted. As Regis transformed from a fully franchise operation, the corporate HQ costing would be reduced. By moving to zero-based budgeting, the management will have better visibility and control over their expenses.

The respective brand president will have increase accountability over budgets, and will be tasked to ensure expenses are aligned with our company's new business model and its respective priorities.

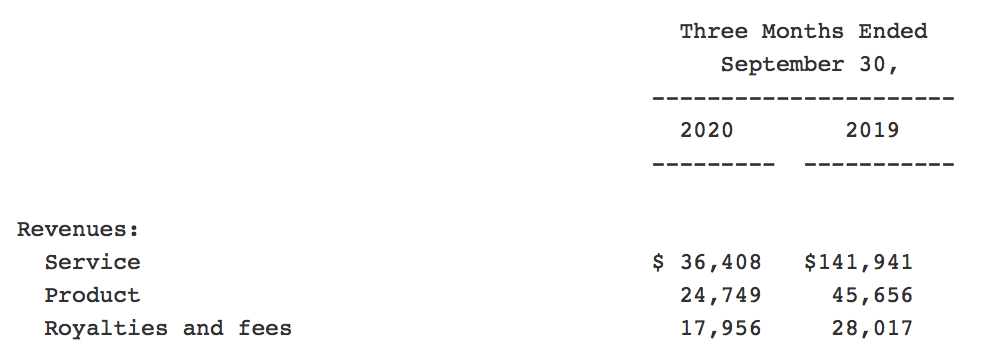

Looking at the statement below, we will expect the G&A to continue to decrease in 2021. With service revenues mostly gone by 2021, Regis will need to bring its general expenses down to 70 -80m before profitability to happen on a normalised year which we think is highly doable. Rental cost will be substantially down when the franchise model is 100% in place.

FY2021 1Q:

Regis had 80% of franchise store and is on track to be 100% franchise by end 2021. Service revenue is now on track to go to zero soon. With Royalties and fees, dropping just as fast, this year would be a terrible year for them.

With most expenses almost halving, we will expect FY 2021 to be a year where losses will amount to USD 100m.

With around USD 80m in cash, we expect Regis to just scrap past 2021. With the pandemic easing, we will assume that people in the United States will resume cutting hair at the salon instead of at home. Unlike other services, haircut cannot be digitised and the the pandemic is the wind behind Regis cost resetting transformation.

If the franchise strategy is well executed under a normalised environment, we are expecting a net margin of around 5 - 10% in a normalised trading environment bringing in around 8 - 15m in net profit and a ROE of 10 - 15%.

We have no plans to buy Regis at the moment, but this set of situation of a re-franchising opportunity, the increase in gross and net margin, incoming of a decent CEO, coupled with the pandemic to reset cost quickly looks like a good mix for a turnaround story which could be executed in the near term (2 - 3 years).

We will be dropping subscribers a note again if we initiate a position.

If you wish to receive more regular updates on what we are working on, do join our telegram channel.

If you have any comments, just hit the comment button below.

*Franchise: Each franchisee pays an initial fee for each store and ongoing royalties to the Company. In addition, the Company collects advertising funds from franchisees and administers the funds on behalf of the concepts. Franchisees are responsible for the costs of leasehold improvements, furniture, fixtures, equipment, supplies, inventory, payroll costs and certain other items, including initial working capital. The majority of franchise agreements provide the Company a right of first refusal if the store is to be sold and the franchisee must obtain the Company's approval in all instances where there is a sale of a franchise location.