As mentioned in the last article, we do put ourselves through a lot of newspapers as we grew up reading one every morning. Now we are covering more than one…

As full time investors, we take our newspaper reading seriously. We usually cover business news in Singapore, Malaysia, Indonesia, Philippines, Thailand, Korea, Hong Kong, Japan and China in the morning before moving to news in Europe and the Western Hemisphere in the afternoon and evening.

The only thing we are scanning for are recency bias and fundamental attribution error from the media. Sometimes, current news are so bad for a particular company that media would have nothing good to say and the already low price becomes lower and in turn become a good bet.

As the companies covered in the newspaper often involve larger firms which had fallen on it knees, when the narrative starts to shift the share price starts normalising. So what we are are actually doing is seeing what others are not seeing and recognising that optionality in that narrative shift.

Recency Bias had created a recent narrative which could be easily forgotten

Fundamental attribution error created a belief that the company is doing badly because of bad attributes (but it may be that the company is struggling due to certain external factors out of its control)

The firms are used to be leading firm within their respective industry, the pessimism is almost peaking

As prices are at some historic low, the various call options (read our article on imagination to understand our thinking on this) on these shares are so cheap that any positivity would result in a normalisation of valuation

Often we forget that a company is a living organism and the bad news of a living thing being under an existential threat is that they will react violently and fight back to survive.

We are covering two companies that is actually interesting to us due to media.

While we may not have triggered any purchase, we thought that these companies had been affected by recency bias and fundamental attribution errors due to the media and the investing industry.

“It may be at the wrong price if it’s in the press” #1

Our introduction to this company comes in the book below. This is one of our favourite business turnaround book and gives us inkling on how a huge corporation could be turnaround. This idea is also coupled with a special situation happening in end 2021 and we think that we may just be sold on the idea.

IBM had been struggling for a long time and their desperation become totally evident when they decide to pay US$34 billion for cloud company Red Hat?

On Oct 09 2020, International Business Machines Corp (IBM) had announced that it is splitting itself into two public companies. IBM will list its IT infrastructure services unit, which provides technical support for 4,600 clients in 115 countries and has a backlog of US$60 billion, as a separate company with a new name by the end of 2021.

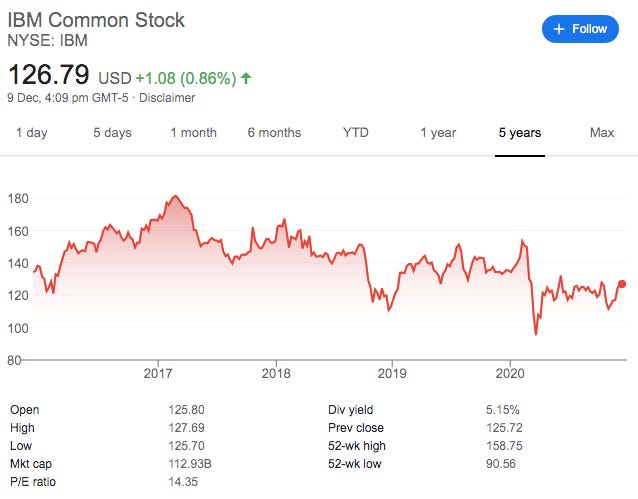

The main narrative shift is that the split would have created a company which is focus on recurring revenue (which is all the rage now). With current price stuck at 5 years low we think that market is not recognising the shift in narrative at all.

Caveat:

IBM may have overpaid for its US$34 billion acquisition of cloud company Red Hat

US$5 billion in expenses related to the separation and operational changes which may result in not a split…

SAAS type revenue may no longer be the best way to value a company at end 2021

Optionality:

Timeline is end 2021

Software and solutions portfolio would account for the majority of company revenue after the separation and could be valued on a growth basis

Software sales and seasonal demand for its mainframe servers which would be IT infrastructure unit could be valued on a yield basis

If the valuation metric is use, valuation will definitely be higher if the valuation metric changes

Price:

Long time director Sidney Taurel (former Eli Lilly CEO) did a USD 550,000 purchase of IBM shares paying an average of USD 110.75

Director Bill McNabb (former Vanguard Group CEO) did a USD 1m purchase of IBM shares paying an average of USD 108.01

The main thing is that the other IBM directors Joseph Swedish, David Farr and Federick H Waddell all bought various amount of IBM shares recently

The main thing is that the directors are all aligned with the shareholder at current price

“It may be at the wrong price if it’s in the press” #2

Our introduction of this company comes with another book and another legend - Andy Grove. While everyone talks about his classic book “Only the Paranoid Survive”, our favourite is “High Output Management”. This is the book that taught us on how to run a meeting effectively. We are forever grateful as we believe that the book make us a better manager of people.

In Nov 2020, three Apple Mac laptops will, for the first time, have Apple instead of Intel chips since 2006. The partnership between Apple and Intel started in 2005, when Steve Jobs move away from PowerPC processors towards Intel helping Apple to have the same power as some of the top Windows computers.

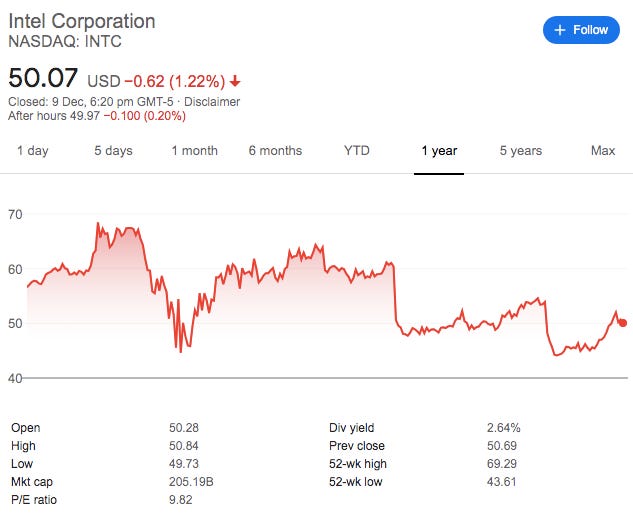

The narrative from the media is that Intel chip will no longer be competitive. Intel recent failure at moving towards smaller transistor manufacturing process from 10 nanometer (nm) to 7nm is in contrast to TSMC current capability to manufacture at 5nm.

The worst thing is that Intel supposed demise comes on the fact that previous CEO Paul Otellini momentous decision to not build chip for the iPhone. The volume of chip manufacturing went to manufacturers like TSMC providing the capital for research and development and capital investment that has propelled TSMC into the fabrication lead. TSMC is believed to be way ahead of Intel and the continued miniaturisation of chips makes Intel unable to compete technically.

Rival AMD is gaining market share at the expense of Intel, had a gain 80% in share price this year. But how many people remembered the same scenario in 2006 when AMD is at the top of its game with the K8 architecture and owns up to 25% of the market share before Intel step up the game and it Pentium range of chip starts chipping away at AMD lead. In 2012, AMD lost around USD 1b wiping out its profit in 2010 and 2011. The fabless strategy was conceptualised in 2008 with AMD selling most of its fab to Global Foundries. That one decision is the one important decision that had brought AMD back into a competitive position in recent years.

What we are trying to highlight here is that strategies takes years to play out and AMD/Intel tech lead over each other will continue to swap or get replaced?

On July 23 2020, Bob Swan - CEO of Intel said that he is considering the outsourcing of the manufacture of its most advanced chip. This strategy is 12 years late than AMD 2008 decision but Intel of today is unlike AMD of 2008.

Intel continues to make 80% of CPU in personal computers and 94% of CPU in servers. In addition, Intel 10nm chip is roughly the same as TSMC 7nm chip making Intel chip not that far technically from TSMC.

The main narrative shift would be that Intel is starting to make accelerated progress on its 7nm chip coupled with outsourcing gains. With current PE at below 10x and the rest of the chip maker price at 40x, either Intel trades up or Nvidia and AMD has to trade down. At 10x PE, we believe that Intel downside is limited.

Caveat:

Intel plan to move to 7nm in 2022 maybe a tad too little and too late as TSMC will be at 3nm by 2022

The outsourcing of manufacturing requires Intel to modularise their chip manufacturing process (building within industry constraints) which may not be completed in time

Merger among the Semi-conductor giants like AMD acquisition of Xilinx, Nvidia acquisition of ARM may have created a different playing field which may disadvantage Intel

Optionality:

Timeline is till end 2022

Pandemic had created a jump in demand for computers and chips which should give Intel money and time to catch up

Intel is already outsourcing around 20% of their manufacturing and their acquisition of NetSpeed System Inc and the arrival of Sundari Mitra in 2018 had already drive chip design standardisation and more outsourcing

Intel spends USD 13.4b on R&D and some of it is definitely building something of the future which include machine learning chip to rival Nvidia

Price:

At 10x PE with tons of optionality at today price from

Development of AI chip to rival Nvidia

More outsourcing of various modules to cut cost and speed up production

News of being able to manufacture 7nm before end of 2022

It is worth a bet.

Conclusion:

As mentioned in our concept of Special Situation investing is that there is a specific situation and timeline we are looking for. The variant perception must be clear. For both IBM and Intel who used to be the stalwart of the technology industry, the ability to buy them on a Special Situation thesis with a clear deadline on execution (2021 and 2022) is a scintillating proposal.

We will be measuring the investment thesis against their own deadline and target. We will expect IBM to have a small pop when more information on the split happens and Intel to have a re-rating as news of their transformation continue to come to the market.

The bet (take note that it is not a long term investment thesis) is that the media and the market is giving too much credence to recent news and attributing the company failure to its own rather than the environment. We believe that the narrative will change either for better or worst but at current prices, we are fine to bet with IBM’s directors and Intel dominance/profitability in the CPU market.

If you wish to receive more regular updates on what we are working on, do join our telegram channel.

If you have any comments, just hit the comment button below.