Position Update

Trading since 2013

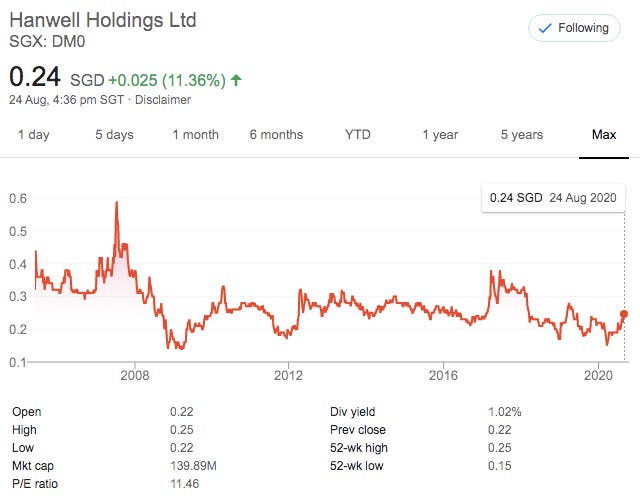

Note: This is the position update for Hanwell.

For those who had gotten in with us before the capital reduction exercise of SGD 0.03614 on 12th July 2019, please note that we are planning to trim our stake at prices around SGD 0.26 - SGD 0.29.

We are hopeful that the market will starts to recognise its good 2020 2Q result and its upcoming 2020 4Q result.

We have an oversize position in this constituting around 7% of our portfolio and we plan to bring it down closer to our ideal 1-2% (we have been too zealous in our purchases during the March 2020 period).

This position forms part of our Graham portfolio.

This is a company that we had been trading on and off for the longest time (since 2013).

The company share price had gone nowhere since then. In our trading log, we had bought it at SGD 0.17 - SGD 0.24 and we had sold it at SGD 0.22 - SGD 0.27. Overall, it had been profitable trade*.

The most important aspect of building a Graham Portfolio is to understand that this investment will not form part of the long term portfolio.

We must maintain strict discipline to

set a clear target price to buy when it is selling at a huge margin of safety

ignore the market perception as this is usually an unloved company

be comfortable to deal with illiquid shares and be able to opportunistically buy them on the market

size the positioning appropriately. For us, it is usually 1% of the portfolio. For you, please decide what is your comfortable risk profile.

sell when the market offer you fair value or beyond.

not understand why the market will offer us such opportunity to buy and sell and we are just there to take advantage of it.

understand that we are there to make a potential short term profit and not fool yourself into making it into a big or permanent position.

to maintain self discipline in not deviating from your target price.

Quick and Dirty Valuation:

Let see, the company is currently valued at SGD 139m. Using the company account, we know that the company account control SGD 71m in cash and SGD 39m in receivables against payable of SGD 12m. The base valuation on networking capital on the company basis is SGD 98m**.

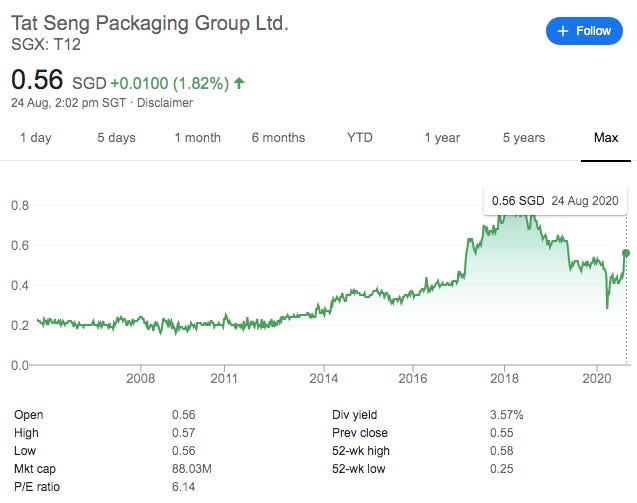

Hanwell owns 63.95% of Tat Seng. Using that we will get a valuation of SGD 56m for the stake in Tat Seng.

Hanwell has 554m shares outstanding.

Using the Net Working Capital valuation and Tat Seng valuation, we should have a rough valuation of 98m + 56m = 154m.

Applying a 30% discount***, we should be buying Hanwell at 107m which is around 19 cents.

So at what price will we sell it?

How about at conservative fair value? Our estimation is around SGD 0.27.

Catalyst:

With the pandemic and with more people cooking at home, Hanwell’s core grocery brands had staged a good recovery and should continue to do well.

Tat Seng should also benefit from the booming e-commerce demand.

Our repeated call to the management to do a demerger for Tat Seng had fallen on deaf ears. Other than a outright sale of Tat Seng, this could be the second best news from Hanwell to trigger a possible rerating.

We had laid out our plans on what we will be doing for the weeks/months ahead so decide on what is best for you.

* We do occasionally do get spooked by the market to buy on optimism and sell on pessimism…

** Take note that we are already placing a huge margin of safety here. The company equity is SGD 175m.

*** 30% because we think it will not deviate much from our conservative fair value. We apply different valuation discount for different companies.