Franchise Model

Why it is an enticing business model...

Before the SAAS business model, there is the Franchise business model.

What is similar is that there is a recurrent flow of business and revenue.

A SAAS business model include creating a best in line product and then putting out on the web and crossing your finger (nah. it is not all luck, there is lots of execution involved).

A Franchise model include creating a business concept which could be replicable by other entrepreneurs. In turn your draw a recurring royalty from them and through a commission on the sale of their product/services.

In term of business model, they are highly similar in which there is little capital outlay once the business is going and the business comes with a certain level of recurring revenue.

There are more moving parts within a franchise business (it is not so easy to handle a bunch of entrepreneurs), but the model is pretty risk free once replicated. A bunch of entrepreneurs is bound to give you more ideas than a bunch of employees. SAAS is harder to create and maintain, as integration effort is always ongoing and as much as it is easy for customers to sign on, there is always a chance that they may sign off as well (not so easy in reality, thou it still could be done).

On a financial perspective, they are the same to us. It cost quite a bit to create something in the front and then the business can reap rewards on a ongoing basis for a long time if the business continue to generate value to the customers. We believe it is easier to create a franchise business than a SAAS business.

Our article on Regis Corp which is on the verge of converting all their hair salon from owner operated to franchise is a typical type of business we are interested in.

If the business becomes a fully franchise business model (franchisor), the business has a low HQ cost and an ability to generate high margin coupled with a high Return on Equity. Coupled that with a minimal investment cost for new outlets and possibly supplier credit, a franchise business model grows more valuable as it grows bigger. If you run a partial owner operated/franchisor business, you would be saddled with almost twice the cost making the financial slightly uglier. Nevertheless a well run franchisor is highly valuable and we would argue that it is as valuable as a SAAS business.

McDonald had in recent years been going back to the franchise model and this is what it had done for the share price.

Over the long term, an international franchisor can be a really huge winner.

On the reverse, a franchisee model can be highly profitable too. Just imagine getting a McDonald franchise in the early days, it made millionaire out of a few in Asia. The main thing is to be able to spot a rapidly growing franchise and getting the master franchisor rights with a particular area.

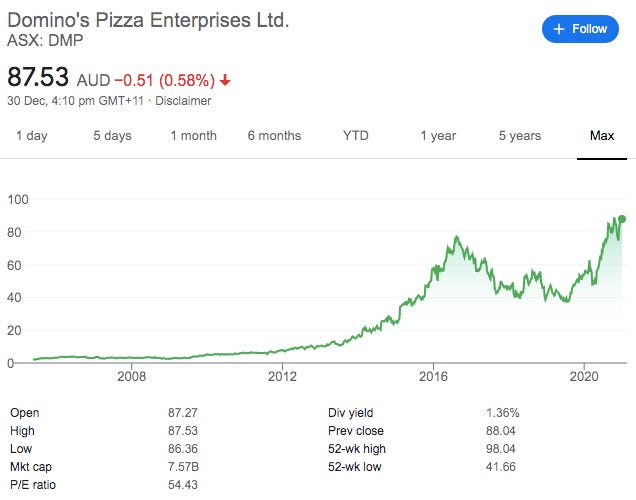

Domino's Pizza Enterprises Ltd is a good example of a good franchisee. Look at that return.

We are looking at a few franchise business now. This is an area we are familiar in and we should have a batting average higher than most.

On a side note, do you know that Dairy Farm is also one of the few major franchisee operator in Asia. Think Ikea and Starbucks… We are still bullish on Diary Farm despite our lousy timing.

If you wish to receive more regular updates on what we are working on, do join our telegram channel at https://t.me/weightedresearch.

Subscribe to our newsletter if you find this information useful.

If you have any comments, just hit the comment button below.