We still remember the dawn of 3G. The year was a lot earlier than many would have put to their memory. The year 2001 is when the promise of widespread possibility of new uses.

There is clear excitement in the investment community on the investment thesis of the telco. They were supposedly the growth stocks of the day. There is talks of higher data usage and higher average revenue per user (ARPU). Every analysts believe that telco will be churning out tons of cash as everyone used more of their services. Their huge operating leverage in a chummy 2 -3 competitors industry due to the barrier to entry limited spectrum and high cost.

The analyst were right on the industry, but they could never foresee the rise of mobile internet connectivity will spawn the smartphone and the apps that came along with it.

While it is true as consumer starts to consume more and more data, over the top apps chip away at telcos’ provision of ancillary services making call a redundant service and data a commodity product. The international direct dialings (IDD) used to be such a money spinner disappeared as everyone started to shift their call through data. Everyone except financial services had migrated out of short message service (SMS) and SMS revenue plummeted. Suddenly, the mobile phone number and the data that comes along with it is the only two things we are procuring from the telcos.

Mobile technology improved to such a point that telco business morph from a smart essential services to a dumb pipe. Soon consumers demand to have the highest data at the lowest price. Since call time is redundant, it became a service which is given away for “free” along with data service. Some telco also accelerated their demise by selling their network to mobile virtual network operator (MVNO), creating more competition as everyone competed on price and handset subsidy.

To summarise, a quite few things happened here.

large CAPEX to acquire required spectrum,

continued large CAPEX on equipment to expand their 3G/4G network,

services start to migrate from paid to free apps,

revenue of ancillary services (like IDD and SMS) disappeared,

homogenisation of services to a phone number and data service,

regulation and a search for additional revenue created the MVNOs,

resulting in higher level of competition within the basic services,

price became the marketing campaign for telco,

mobile subsidy become common to tie consumers down into their contract,

consumer become more price sensitive,

continued demand for high level of service despite lower ARPU.

So cost for acquisition and network expansion continued to spiral upwards, while the mobile penetration increase but the ARPU decrease as the service become commoditise. Telco business had become a boring and predictable business. While they had continued to remain profitable, the only way for them to maintain their ROE is to continue binging on debt.

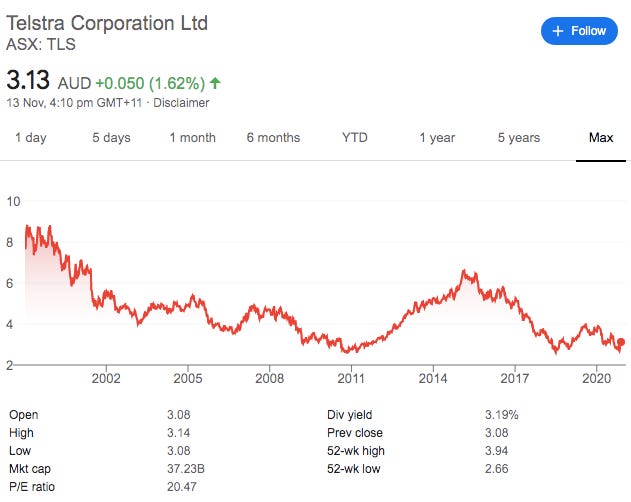

The past decade had been a horrendous for most Telco. PE had remained elevated due to decreased earnings. Share price had retracted for the past 5 years but with limited earning growth and continued high elevated level of CAPEX to move to 5G, the earning profile should continue to be depressed. Our belief continue that the de-rating will continue for a long while. We do not foresee any significant price increase for 5G, while the CAPEX continue to be elevated. Earning profile for telco, except for countries which has low mobile penetration will continue to be staid.

That said, the telco did acquire a huge amount of assets during their building phase. If the telco starts to split themselves up, we believe that the sum of the parts is much higher than the whole…

Let’s look at the share price of the telcos around Asia.

Axiata and Singtel can be seen as similar as they are dominant in their home market while holding on to various telco around Asia. Their valuation looks similar. If Axiata and Singtel continues to split themselves up, our gut feel is that the sum of parts may be bigger but looking at telcos across the region is too much work and we doubt Axiata and Singtel would split themselves up.

The company we are interested is actually Telstra.

Telstra had just released a set of new information on their strategic decision and we think that the sum of the part > whole can be realised soon.

Unlike Axiata and Singtel, Telstra is at its lowest point since 2001. Telstra is mainly focus on Australia which make analysis easier. There has been tremendous destruction of shareholder value in the past 5 years and share price is at the lowest range.

Unlike 4G, we believe that 5G will be a transformative for most telco.

Target addressable market will be expanded to various equipments needing more bandwidth on the go.

Price war should be more benign as the industry learn to differentiate on offerings

The increase sale to enterprise customers do not require subsidies

Enterprise customers will be more sticky than retail consumers.

While 5G will be likely economically better for telco, the impact on valuation would have been minimal if there is no corporate restructuring within. For Telstra, the plan had all been spelled out, the question is only timing.

We had been waiting since we read about the Telstra InfraCo plan in their 2019 Annual Report.

Now more information had been released. The thesis may take up to 2024 to play out thus this may be a long wait.

Let’s run through the history here.

Telstra InfraCo:

In early 2018, Telstra had highlighted that they had established a standalone infrastructure business unit to drive performance and set up optionality post the nbn* rollout.

On 1 July 2018, Telstra InfraCo was created to be a standalone infrastructure business unit within Telstra, to provide greater visibility to the market of the value of this business and create more optionality in the future. Telstra InfraCo will controls assets with a book value of around $11 billion and is responsible for network infrastructure assets such as data centres and exchange buildings, most of our fibre network, the copper and hybrid fibre coaxial (HFC) networks, international subsea cables, exchanges, poles, ducts and pipes.

In early 2019, they reported that Telstra InfraCo is now operating as a standalone infrastructure business unit. Telstra InfraCo’s asset will include mobile towers, all fibre, and network supporting infrastructure.

On 1 July 2020, Telstra InfraCo took accountability for the new asset. Telstra InfraCo is now accountable for around 250,000 kilometres of fibre optic cable, 360,000 kilometres of ducts, 8,000 mobile towers, masts and poles, 5,000 exchanges, two data centres, and access to 400,000 kilometres of subsea cables.

Things seems to be moving well.

Outcome:

The outcome will be not 2 but a few more possible units emerging out of this exercise.

The original Telstra which continues to have the most superior 5G network for consumer and enterprise

InfraCo will be further divided into

InfraCo Fixed - Run Telstra fixed line assets

InfraCo Tower - Run Telstra mobile towers

ServeCo

own the retail mobile business

back end technology and spectrum

Thesis:

The thesis will be that the valuation of Telstra will be backstop by

the valuation of Telstra 5G operation which should be valued on a EBIDTA multiple basis.

InfraCo Tower will be valued on a yield basis as the cashflow is predictable

InfraCo Fixed will be an optionality to merge with nbn which will be listed similar to Netlink Trust - SGX: CJLU. It will also be valued on a yield basis.

ServeCo retail mobile business will most likely be sold

Valuation:

InfraCo Tower is likely to be hive off at around AUD 4.5b according to Goldman Sach. Optus which is also looking at hiving off their towers are reportedly going for AUD 2b.

The valuation thrown around for the InfraCo as a whole is around AUD 34b.

With a market cap of 37b now, we think that despite the recent upswing, Telstra is still a buy. We will now just await for the sale of the tower assets which will likely to happen at the end of 2021.

While we had been following the corporate development for a while, we have yet pull the trigger.

Do hit the button to tell us your thoughts on the possible special situation idea and if this is worth following.

*NBN Co Limited, known as simply nbn, is a publicly-owned corporation of the Australian Government, tasked to design, build and operate Australia's National Broadband Network as the nation's wholesale broadband provider.