Company Update: First Service Holding

When the major shareholder is in trouble...

I first talked about First Service Holding (FSH) on the 27th July 2021 when a couple of subscribers emailed me about the idea. It is a statistical position in my personal portfolio.

On the 28th September when Evergrande blew up, I followed up with an article on not recognising the intelligence of the market and why valuation still matter.

The theory then was that FSH which is one of the smallest should be taken over when the dust settles… if it settles…

Then, on 7th October, there is major shareholding movement.

Most of the shareholders filed to sell their shares and there would be a takeover of the company by an external party.

The theory had been spot on but am I going to get my returns?

FSH shares were suspended on the 9th Oct 2021.

And then the wait began…

Days become weeks and then years???

When Modern China (China) terminated their consent solicitation for their senior note on the 20th October and then suspended their shares on 21st October, I know that that the inevitable is here.

Finally, I can pinpoint a reason for the long wait…

The next question is how badly would First Service Holding be affected if Modern Land went bankrupt?

Looking at their 20212Q numbers, the trade receivables due to related parties are RMB 147m which constitute around 28.9% on revenue of RMB 508m.

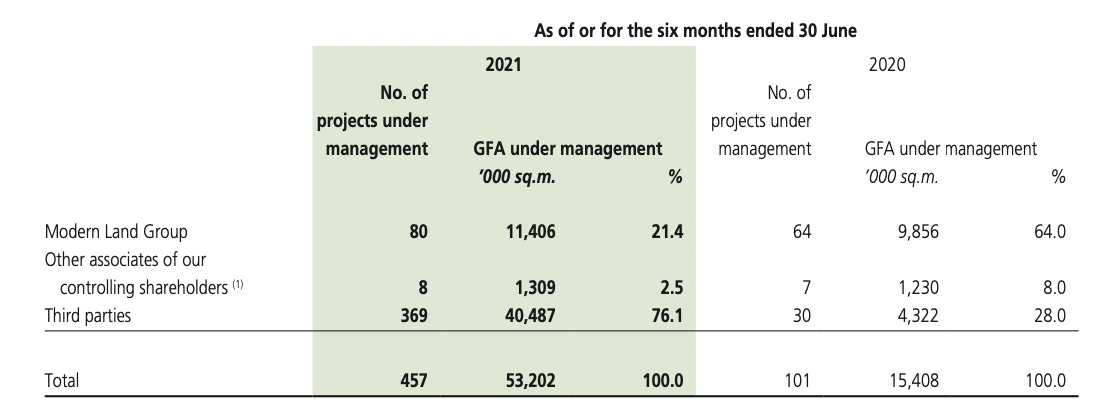

On a project basis, Modern Land constitute 21.4% of the whole portfolio.

On GFA basis, Modern Land constitute around 27% of the total contracted and undelivered GFA.

So on an overall basis, the expectation is that 30% of the company’s project will be affected.

Since the property crisis is in full blown, what would be the acquisition price for First Service Holdings?

There are a few things I am very sure on.

The majority shareholders like Glorious Group Holdings Limited, Zhang Lei, Zhang Peng, Liu Peiqing and Long Han would be keen to offload their shares to save their empire.

On the 7th October 2021, the acquisition price would most likely be between HKD 1.30 - HKD 1.60

On 20th October, the buyer would most likely be asking for a huge discount since they

have the cash

know that there is a full blown property crisis

know how desperate the sellers are

would have asked for at least a 50% discount?

or even try to get out of the deal.

Since the sellers would be unwilling to sell on the cheap, they

would want to force the buyer to buy at the previous agreed price?

would rather just wait for the crisis to blow over?

might tap on the other piggy banks they might have?

look for government help?

At this juncture, it seems that the chess game will be on a stalemate…

It is in this type of situation that I always remind myself that there is a difference between Betting, Trading and Investing.

Since this has always been a bet, the weight has been kept small.

It is also in this scenario that I am reminded on the reason why I use the name “Weighted Research”.

The name is meant to remind myself that the hardest thing in investment is to search for an optimal process to weigh the odds of each and every investment such that the weighted expected return of the portfolio will be largely positive.

I still think that there is a good chance that consolidation is about to happen in the property management space in China and FSH would be the first one to be taken out.

But with trading suspended and liquidity gone indefinitely, I would be writing down the price of FSH to zero in my portfolio.