Company Update: DXC Technology 2022 2Q

Forecasting into the future to FY24

After spending most of the decade investing in Asia, I finally moved into investing in the US market during the pandemic. I have continued to eschew the high profile names and chose to focus on the less prominent names which I can understand.

DXC is one of the first article on the site. I did another article on the halfway mark for last year and this is the follow up for this year halfway mark.

For readers who are new to the DXC, please read my initial article here and 20212Q update here.

The turnaround is happening and the share price is rising and there is nothing much to say.

Since wriggling up to a high at USD 44.18 it had started to decline and price is once again getting interesting here.

I had continued to hold on to DXC as it has started to shift from a trading to an investment position (Betting, Trading and Investment).

That means that I am less willing to trade and more willing to wait.

That also meant that I am more willing to glimpse a tad further into the future and make some projection on it. There are some predictability and sustainability in their business.

Furthering that point, it also meant that in the event that share price starts to retreat, I am willing to weigh my position higher.

This position forms part of our Special Situation portfolio.

DXC had just announced their 20222Q results and it looks like the turnaround continues.

The main theory on Sep 5th 2020 is that Mike Salvino (Mike) will be able to stop the rot and DXC could start growing again.

The stop of the rot started on two front

Fixing troubled account

Cost cutting

Fixing Troubled Account:

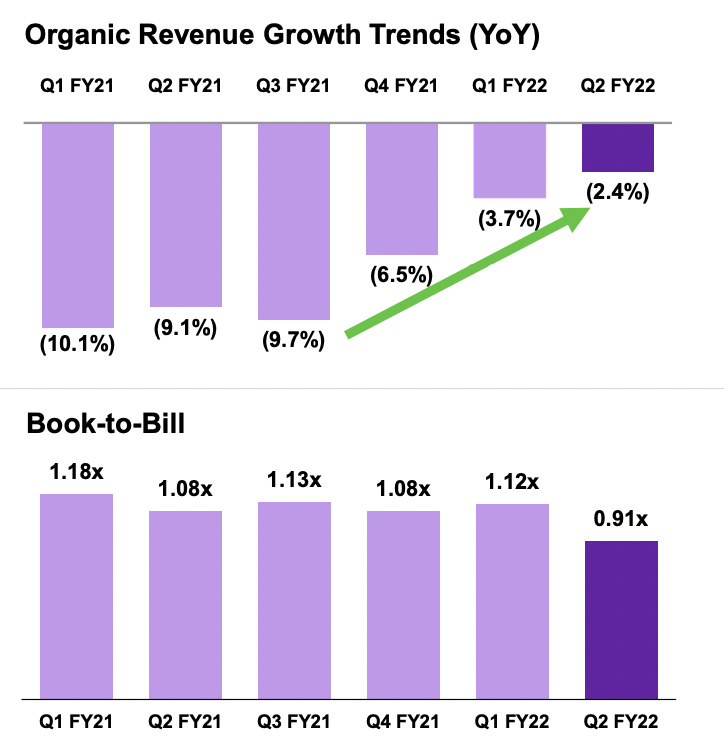

On the portion of the troubled accounts, there is a clear deceleration of negative organic revenue growth. Since organic revenue growth is a backward looking instrument, looking at book-to-bill would be a forward looking indicator.

But wait, isn’t that treading below 1.0 at Q2 FY22?

Management had also repeatedly asked analysts not to judge their book to bill on the quarter but on a whole year instead. If we had used the YTD data, things would have been a lot clearer.

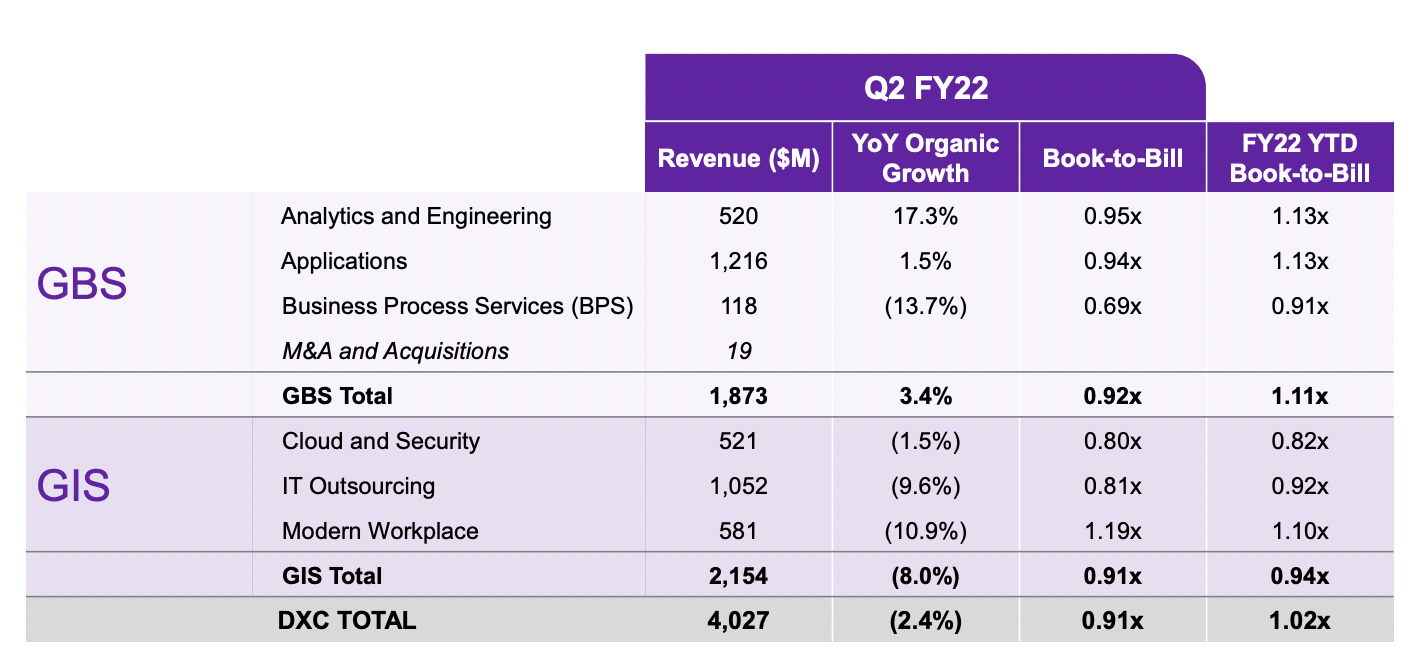

If we are to look at FY22 YTD Book-to-Bill column, the DXC total stands at 1.02. Management had indicated in the conference call that there has been a timing delay for closing of two GIS deal which had lead to the current shortfall.

Those deals had just closed and if they had included the two deals, GIS segment of 1. Cloud and Security and 2. IT Outsourcing would have stayed above 1.0x.

With future revenue solved, the next is that margin on their revenue and that is where cost cutting and spending on the right area matters.

Cost Cutting:

Instead of focusing on retrenchment and outsourcing, DXC as a service firm needs to recruit more people, increase their pay and retain them. The right people can service more clients and retain clients.

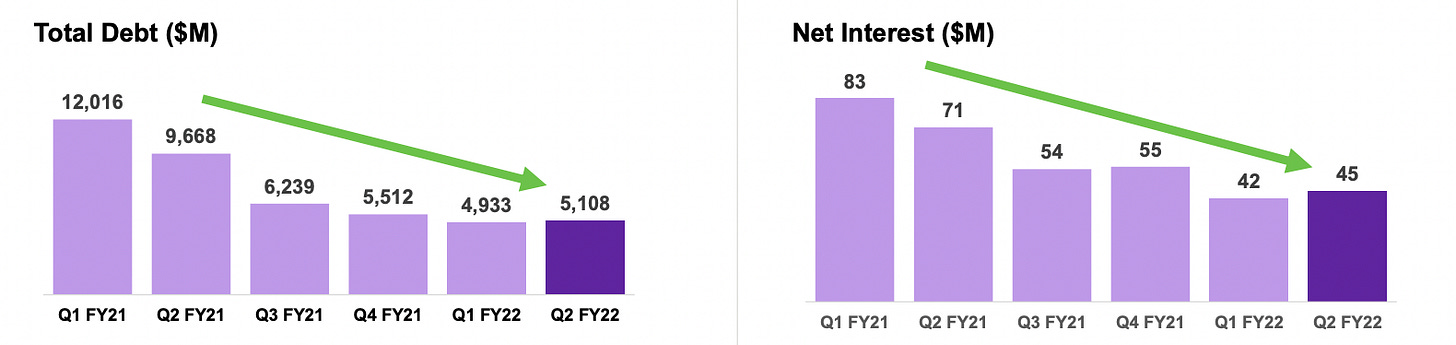

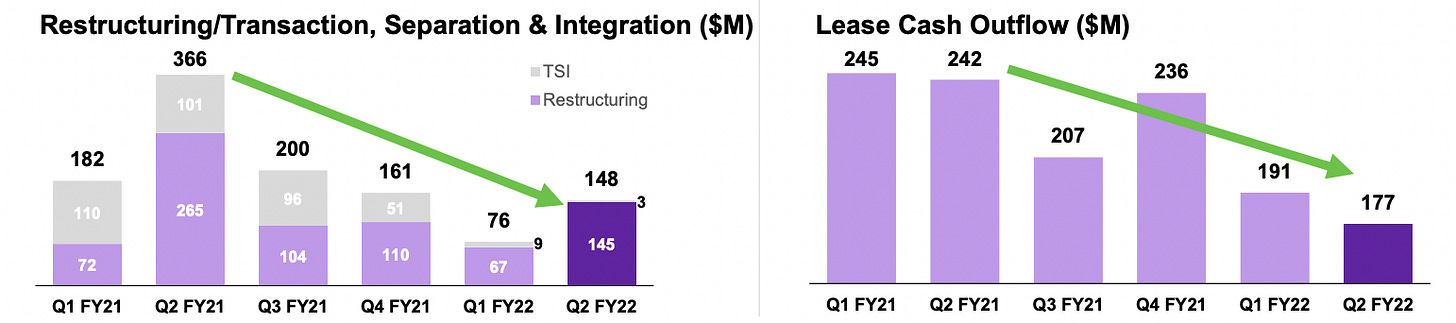

Cost cutting had come from other areas like the cost of their debt, restructuring expenses and leases.

Divisions that are non-core had been sold and management had guided that they are keen to offload more at the right price. Using the proceeds, the debt had been reduced to a more manageable level helping to reduce net interest.

Restructuring and leases cash outflow had gone down and will continue to tread lower.

So let’s look at the result.

Result:

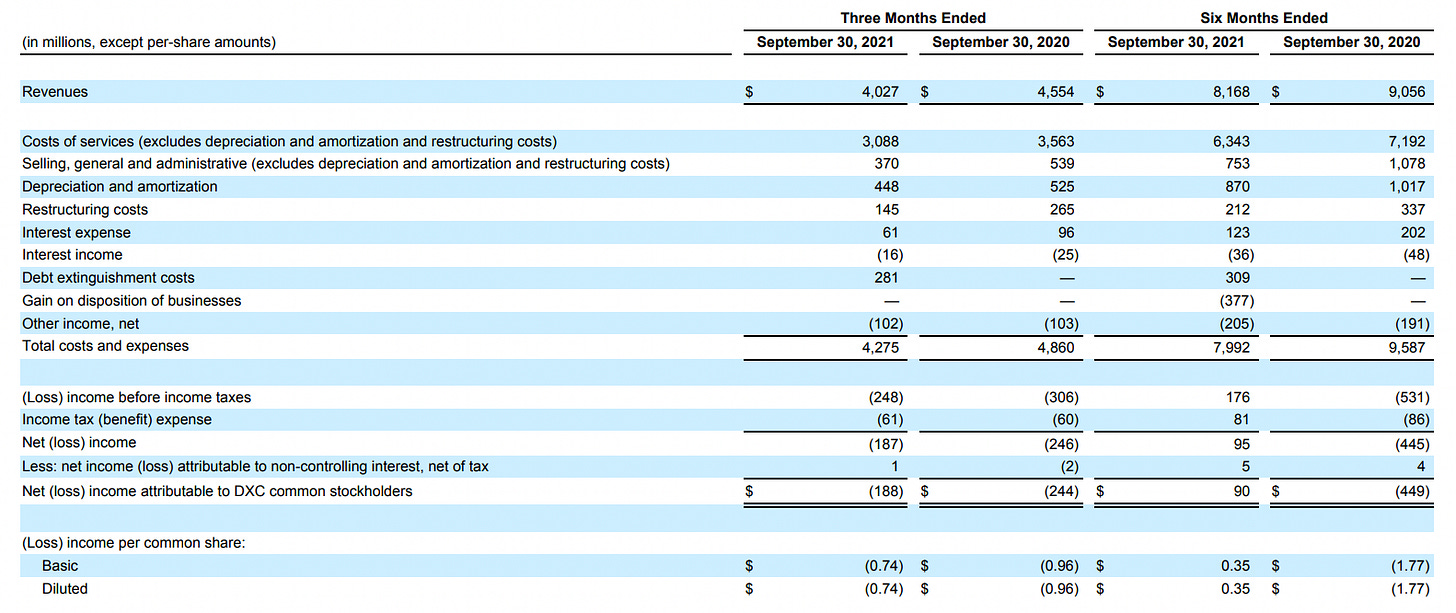

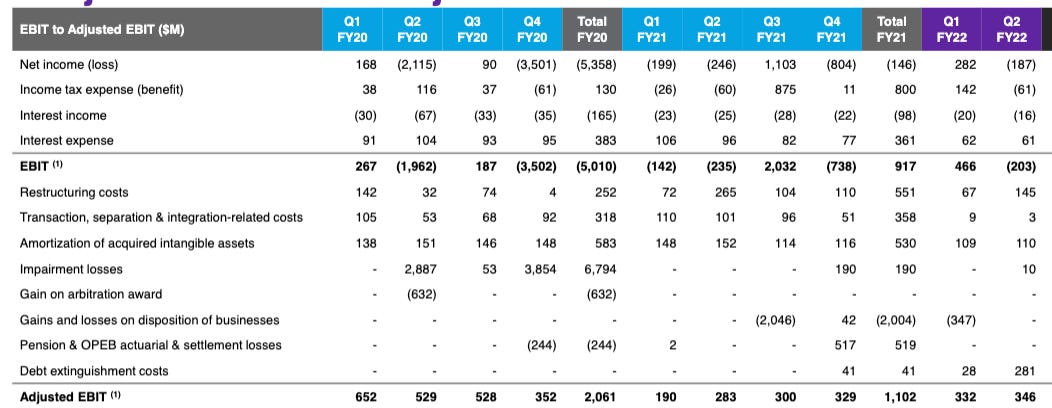

This is not the prettiest of numbers for 20222Q. There is a net income loss of USD188m for the latest quarter. But if there is some adjustment done for restructuring, debt extinguishment and some of the amortisation, then normalised profit is positive.

The good thing for us is that DXC management wanted us to recognise that and had provided the requisite work here.

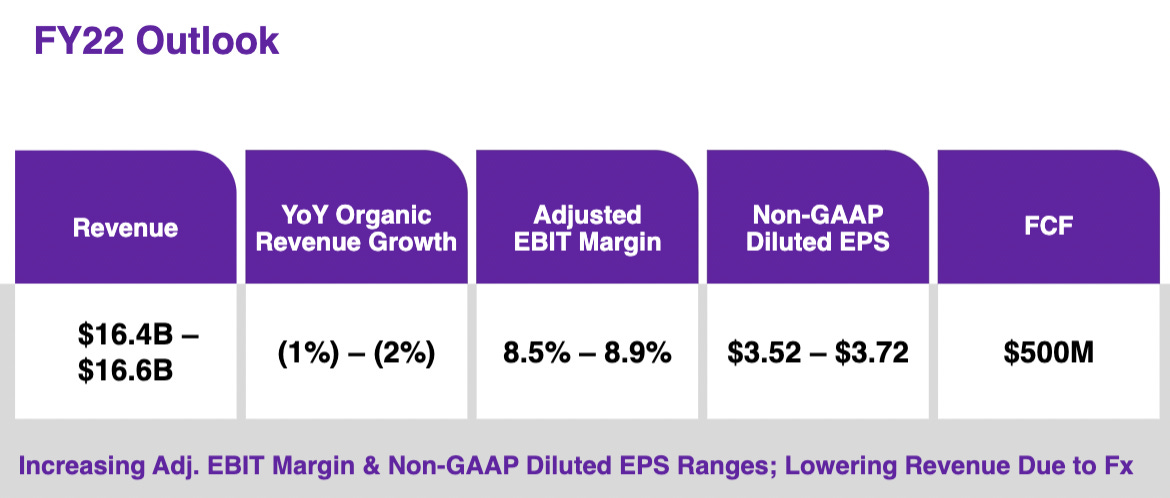

Adjusted EBIT would have amounted to around USD346m for FY22 Q2. DXC should comfortably be hitting EBIT of more than USD1,000m for FY22.

Unlike other companies, I am going to give the management guidance some credit. There is indeed a way to forecast the customer spending in their industry. The aim is to stay as close to the customers and they will tell you their plans and you can make the necessary adjustment.

The predictability of their business made it possible to value the business.

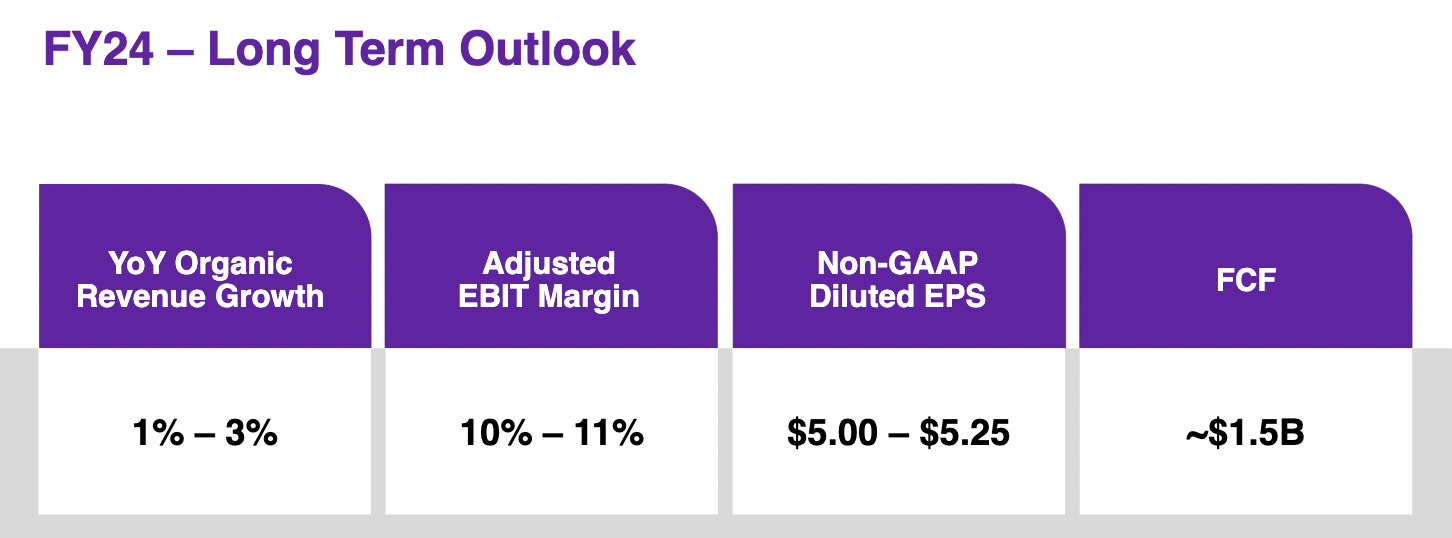

For FY24, the management had made the prediction as below.

There is nothing earth shattering on the above forecast. Instead, I think it is rather conservative.

If I am going to look beyond FY24, we would be looking at a company which has a ROE between 20% - 25%, minimal debt, cash of USD 2.5b on the balance sheet. If we can put ourselves in 2023 (FY24), I think that the current valuation looks reasonable.

At this current price, I am more keen to buy than sell.

If you are keen to know on real time on what I am doing, click the subscribe button below.