Company Update: Dairy Farm 20204Q

Some up, Some down, Overall flat...

This is the period when I really struggle. The reason is that I usually fall ill during this time period. My family doctor once showed me my medical records highlighting that I had been visiting him the same period every year for a couple of years! I took up regular exercise after that but the ability to fall ill at the same time every year never did go away.

Or it could be the annual result announcements that are causing my sleeplessness and feeling of illness… I am operating on Asia and US timing now, so hopefully I can squeeze in more updates on various businesses that we are interested in.

Our initial report on Dairy Farm published on 21st Aug 2020

Update on Dairy Farm 20204Q results:

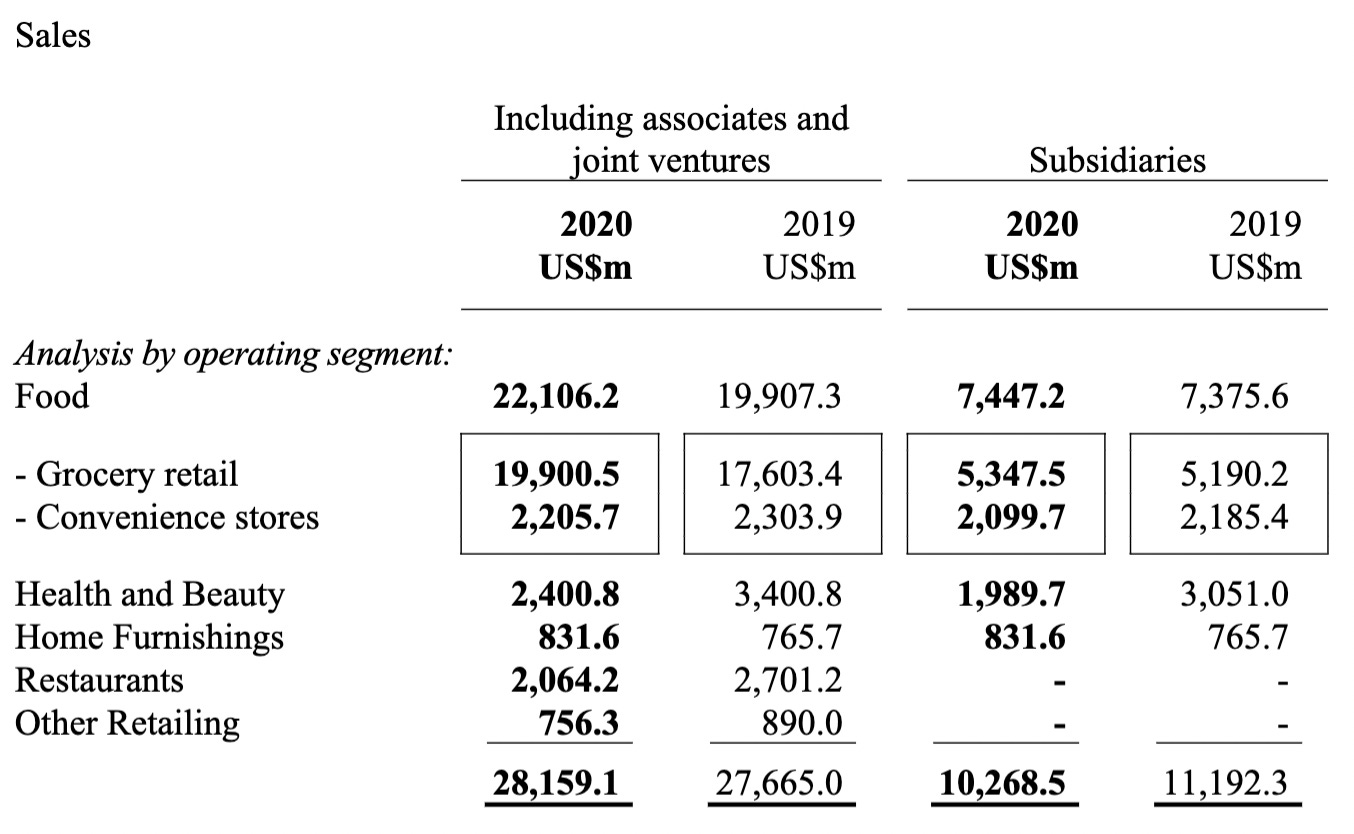

Subsidiaries:

The only significant letdown came from the Health and Beauty segment which fell from USD3,051m to USD1,987m.

7-Eleven South China opened over 200 new stores during the last FY! Talk about constant investment!

Wellcome Hong Kong also launched a lower price campaign which we thought was really clever. In a midst of a pandemic, they had choose to lower price and entrench their existing and new customers.

One more Ikea store opened in Macau and a larger replacement store been up in Taiwan. Two more stores will be opened in 2021 making it 15 at the end of 2021 compared to 10 in 2017.

Giant Singapore stores had been fully relaunched with everyday low prices with a focus on fresh food.

Guardian Singapore and Malaysia e-commerce sale had grown strongly as what the management had suggested? That must have came from a very low base… We are sure the sales at the physical stores had reduced significantly just by looking at the headline number.

Mannings China continue to register improving sales trends throughout 2020

Mannings Hong Kong will definitely be a shadow of its former self. The everyday low prices should help set a formula for Mannings China.

Meadow brand was launched across Hong Kong, Singapore and Malaysia with 600 SKUs. We are duly impressed by this progress.

Yuu Rewards reached 3 million people in Hong Kong and Hong Kong has 7.5 million people! Wow!

Meadows potato chips are the number one brand (SGD $1 per pack!)

Number one nuts in Hong Kong

Number one brand in Dairy Farm supermarkets

Associates and Joint Ventures:

Maxim’s reported sales of USD2.1b (24% reduction) with Dairy Farm share of profit at USD 36m. Normalised earning (minus growth) should be easily double of that.

Maxim’s is opening Shake Shack in China and Starbucks in South-East Asia. We are happier partaking in Shake Shack and Starbucks in growth in Asia than the US.

Yonghui continue to perform well on the topline basis most likely due to their focus on fresh food.

Robinson Retail is probably the best way to invest in retail in the Philippines. Now Robinson Retail had scale both in the supermarket segment as well as in the pharmacy segment.

Overall operationally, the associates and JV did better than their subsidiaries through the pandemic.

Other Income:

Without grants and rent concessions (USD 207.2m), it would have been a terrible year for their core operating profit.

If not for the grants and rent concession, the profitability would be way down at USD181m. Business and restructuring cost comes up to be USD90m. This drop in profit is worrying.

Valuation:

Grocery Retail: We do wonder our expectation of net margin of 4% is reasonable if they maintain everyday low prices. If we are to cut it to 2%, then the net profit should be around USD106m at 10x PE bringing a valuation of USD1,060m. E-commerce is also a menace here, we are not comfortable writing in growth for this business.

Convenience Store: As a group, they should continue to bring about a normalised profit of USD80m. We will assign some growth to that at 15x PE, bringing a valuation of USD1,200m.

Health and Beauty: This look like a goner. We think that e-commerce is killing this segment. It may or may not recover to its former glory. Mannings China gives us some hope. But overall we will assign a lower normalised earnings of USD50m at 7x PE bringing a valuation of USD 350m.

Home Furnishing: With a brand like Ikea, we can easily assign a lower normalised earning of USD50m at 12x PE bring a valuation of USD 600m.

Maxim continues to dominate franchising in all areas from Genki Sushi, Starbucks Coffee, Shake Shack and IPPUDO ramen. As they continue to throw money into growth, we will value them at 12x PE using normalised earning of 80m bring a valuation of USD 960m.

19.9% of Yonghui would be worth around USD1.84b and 20% stake of Robinson Retail will be worth around USD 338m.

Together, we will be getting around USD6.348b.

Suddenly, Dairy Farm looks fairly valued, due mainly to the deterioration of the Health and Beauty segment and the possibly net margin contraction from the grocery businesses. We are still unsure if the net margin contraction is positive or negative for the business but overall an everyday low price strategy is always powerful if any retail company can pull it off.

We had been pretty conservative in assigning multiples to the various businesses and the fair value are definitely much higher (which cannot be realised unless a split occurs). Our valuation range from USD 4.43 to USD 5.629. Overall, we still think the odds are in our favour, thou conviction level is much lower than during the time we first publish our article.

Subscribe to our newsletter if you wish to receive weekly information on our positions.

If you have any comments, just hit the comment button below.

If you would like to follow us on real time on what we are thinking of and news article we are reading on please join us @ telegram - https://t.me/weightedresearch.

If you would like to re-read some of our investment reflections, then do follow us on Facebook at https://www.facebook.com/weightedresearch.