British American Tobacco Malaysia hitting equilibrium point?

Will vaping be legalised?

British American Tobacco Malaysia Berhad (BATM) manufactures, imports, and sells cigarettes, pipe tobaccos, cigars, and other tobacco products primarily in Malaysia. It markets its products under the Dunhill, Peter Stuyvesant, Rothmans, KYO, Pall Mall, Kent, and Benson & Hedges brand names.

While the BATs ( around the world) battles with

falling volume,

increase in excise.

BATM needs to also battle with illegal smuggling of tobacco products from its neighbouring countries.

Illegal Tobacco:

the tobacco black market issue remains at a crisis point, with smugglers now being more creative in smuggling via small coastal jetties. The Group urges the Government to take effective enforcement actions to shut these channels down to further address illegal supplies of tobacco.

That increases the complexity in investing in BATM.

Would the Malaysian government be vested enough to crack down on illegal supplies of tobacco?

The Malaysian government is in catch22 scenario.

They want to increase excise to collect more taxes but that incentivise more smuggling. Since it is hard to stop the smugglers, they could not increase the excise tax without decreasing volume which reduces the overall tax collected.

To effectively address the tobacco black market, measures like enforcement actions to stop illegal supplies from being smuggled into the country must be complemented with measures that address the affordability pressures that consumers in Malaysia currently face. As such the Group is hopeful that there will be no excise increase in Budget 2023 as any increase would further drive more consumers to the tobacco black market.

Since it is a hard problem to solve and the Malaysian government is already pulling all the stops to stop smuggling, what more could be done?

Equilibrium?

As long as there is no excise increase and there is increased crackdown on smuggling, a steady equilibrium would be reach where legal tobacco starts to maintain market share against the illegal tobacco.

In the latest quarter, BATM reported an increase in revenue.

Is this the equilibrium point?

It would be interesting to continue to see if BATM’s revenue would be stable in the coming quarters.

Vaping:

Vaping is already widespread in Malaysia.

What if it is legalised?

We are encouraged by the Government’s commitment to regulate the vape industry in Malaysia. We strongly urge the Government to adopt policies that are evidence-based and data-driven, to ensure the over one million Malaysian vape users have access to reduced-risk products that are compliant with quality and safety standards. BAT Malaysia will strongly support any sensible, pragmatic regulations on vaping, in tandem with our purpose to build A Better Tomorrow™.

Valuation:

Pricing at 11x PE, with a dividend of 8.85%, the share price seems to be not priced for the possibility of an equilibrium point or a legalisation of vaping. Vaping should help to reduce the illegal tobacco in the market and possibly help the legal players consolidate market shares?

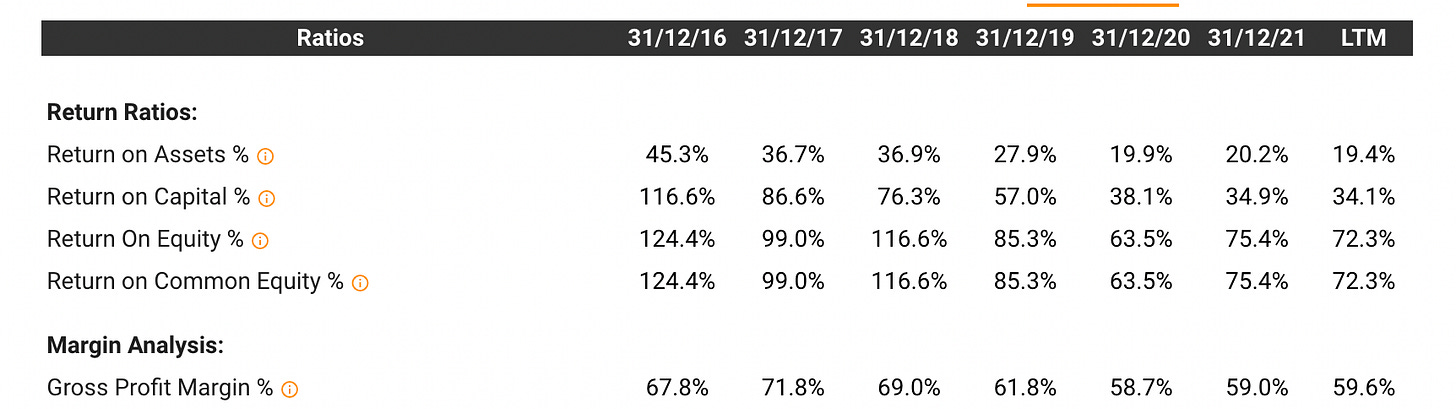

With a gross margin of >50% and a ROE of > 70%, it is not hard to see a serious re-rating if any of the above hypothesis come through.

Thou, the guillotine of increase in excise tax continue to hang over all the tobacco players around the world.