Are education businesses in China un-investable?

Not when they work with the government

We had been covering the Chinese education sector for a long time as we are interested and vested in NetDragon Websoft (ND).

To understand more about ND, please read our

initial investment thesis (18th October 2020),

the subsequent update on our thoughts on the online education industry - (16th November 2020 , 4th February 2021) and

our 20204Q report.

While the investing community is worried about online education in China, they will need to differentiate between the players who are in the B2C space and the B2G space.

We had highlighted the risk of private educator on the 31st March 2021.

Other than cracking down on Big Tech, the Chinese government is also trying to ease pressure on schoolchildren. Private education companies had been receiving end from the Chinese government.

What we are sure is that while the B2C space guys get decimated, the B2G guys will be increasingly call upon to help improve the education system.

Similarly to the central procurement in the pharmaceutical level in China which created tons of losers and a few winners, this “purge” of private tutoring will create big winners within the education space.

ND operates in the B2G space where they provide software to the ministry and the provincial level. With the impending "conversion into non-profit” of the private education sector, ND is bound to benefit.

In addition, ND EdTech arm is more of an international operation. They own brands like Edmodo and Promethean. They have upcoming contracts in emerging countries like Turkey and Malaysia.

With this industry development, we believe that ND EdTech arm had gotten more valuable. How many players in the EdTech industry is able to work on the B2G level?

One worry is that the B2G space would get more crowded and better products would be offered within that space. That is a possibility. The rules will come hard and fast but the government procurement process will be highly bureaucratic and slow.

We think that is ND’s moat. It is just too hard to sell on a government level. It takes trust, connections and lots of time.

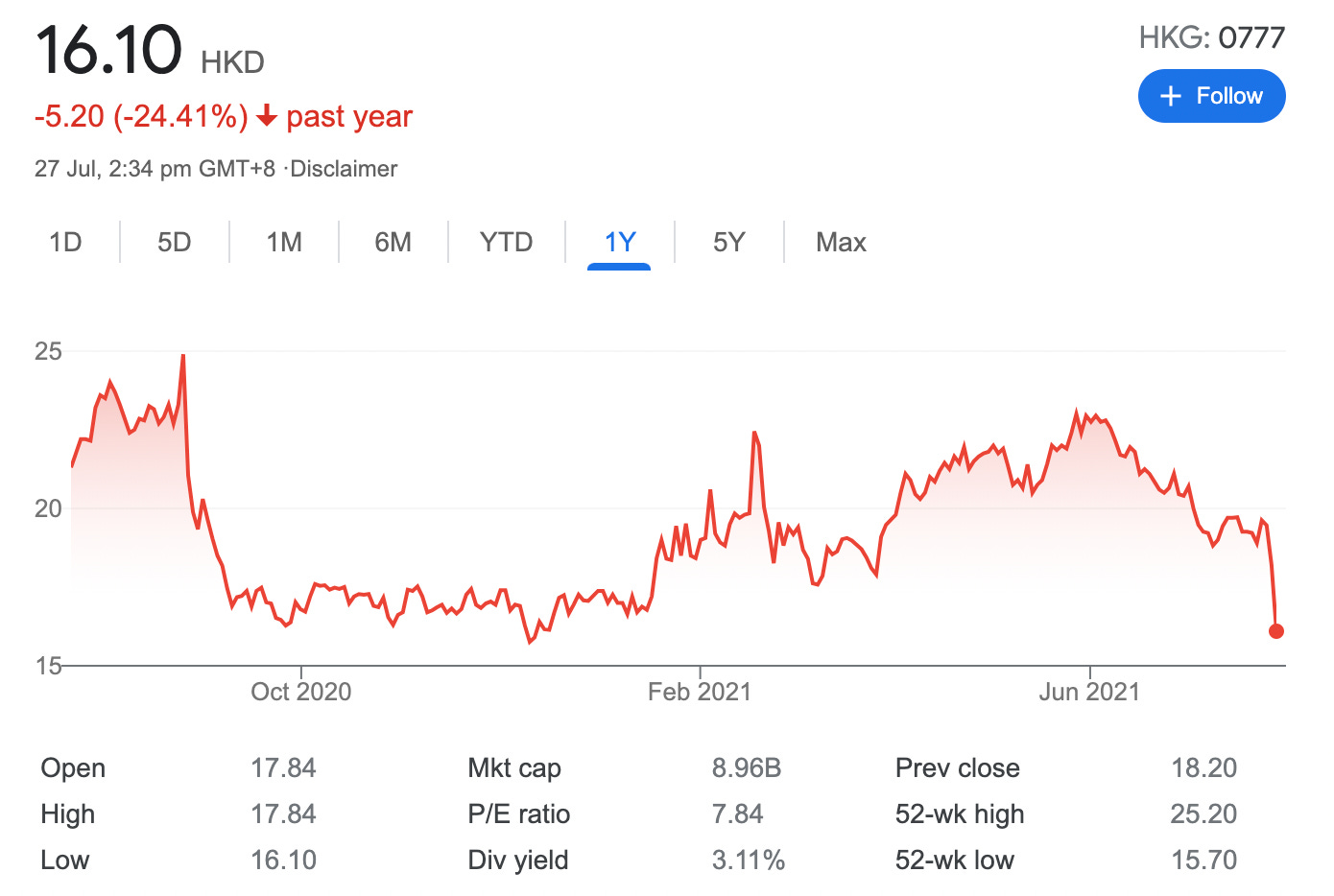

ND is moving below our average price and that means that we are back in the market to accumulate more shares.

Subscribe to our newsletter if you want to receive timely information on our positions.

If you have any comments, just hit the comment button below.