Written on 30th September 2024 - 1st October 2024

Nothing happened to my portfolio for 39 weeks and then 2 days of monetary stimulus announcement from the Chinese changed everything. Now, we await for the fiscal stimulus.

There is no reason to look for more misvalued companies on the HKEX when all of them have gone up >20% in price in the last few days so I have decided to start writing.

Writing stops my itchy finger from triggering any unnecessary buy or sell.

It is often good to ride the bull and wait for the pullback. I can already foresee an avalanche of buying then selling when the Chinese come back recharge from their week-long national holiday.

This week, I will be touching on some of my positions which requires more faith than the usual value play. Usually investors will want a simple story. But business gets bigger = complicated, or the beauty of the business depends on an alignment of interest = complicated capital structure.

These are the companies that are left out in this current HKEX rally and thats why I am talking about them.

Pentamaster International (Penta) - bigger complication

Let's go with the “not so good” news first.

Penta is not keen on doing any capital allocation exercise. That means that the dividend will remain low and share buybacks will be non-existent. Penta continues to believe that they are a growth company and they need all the cash to continue to build up their various businesses.

As for the low share price, they would rather have Pentamaster Corporation - Malaysian listed parent to come in to buy when the share price is low to act as a stabiliser.

As a shareholder, I would love to have a higher dividend but at the same time I am keen to see them reinvest the money to grow the company. The way to judge their policy of retained earnings and growth would be to look at their ROE.

Penta is still managing a ROE of 16% for this current FY.

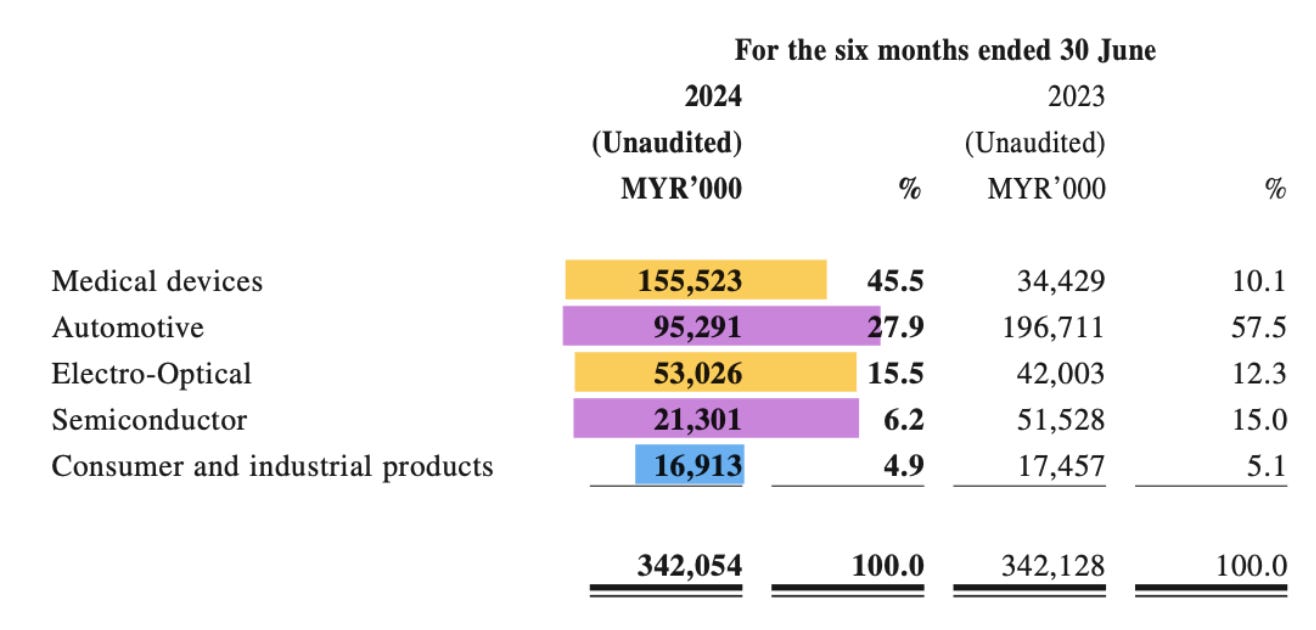

While this is not fantastic, this was achieved on a mid-cycle for their medical segment, a cyclical low for their automotive (Silicon Carbide) segment and an impending cyclical upturn for their Electro-Optical segment.

As Penta got into more business segments, it is getting increasingly difficult to forecast their business for the next year. The irony is that as the business grows more robust, growing from an electro-optical company to a multi-industry, multi-technology segment company, there is less chance for it to significantly outmanoeuvre and outperform the market.

Exceptional growth only when the company is tiny, focused on a particular segment or industry while being highly susceptible to death.

Excess shareholder return is bound to decrease as robustness increases.

It means that increasingly, I am betting on the management foresight to get into the right sector.

On to the good news.

“Penang attracted RM60.1 billion (USD 12.8 billion) in FDI in 2023, more than the total received from 2013 - 2020 combined.”

-Pangolin Investment Management

With a capable management team, a good set of technological know-how, I am sure that there are ample opportunities in Penang for Penta to tap into.

The medical segment (FAS) is set to continue to grow as more medical manufacturing facilities expand into Penang.

The move towards silicon carbide (ATE) seems inevitable for automotive, data centers and renewables. The introduction of gallium nitride as another material also opened up additional possibilities for Penta.

With MediQ (Medical Device Automated Assembly Solutions) set to go into production, it means that Penta will have another line of revenue soon.

Penta seems well positioned for future growth either on a locational basis or on a technological front.

If you happen to happen to be in Bayan Lepas Penang, do visit the first semi automated food hub there. The project is a collaboration between the Penang Development Corporation and Penta.

There are robots delivering food up and down the 2 levels. This is a testament on the ability for Penta to integrate various technologies to deliver something of use to the customers.

If I am a new investor today, I will definitely choose a simpler company to analyse. Penta is getting way too complicated…

With an average price is HKD 1.00 and I am down 30% on the position.

p.s. another lesson is that I should have learned earlier is to stick to companies who are listed in their home market (excluding those who are listed on the international exchange like NYSE, NASDAQ and LSE).

China Leon Inspection (Leon) - complicated way of aligning interest

One of the things I have learned from a fellow investor friend is to be wary of convertible bonds. This is a red flag which puts him off.

Another of my fellow investor friend hated minority interest as it is often hard to decipher the real financial situation.

So a combination of both seems like a really bad idea if I use their evaluation criteria.

While it is easier to click avoid, I do get attracted to some companies due to their industry like a fly attracted to a light source (to possible death).

China Leon Inspection provides services on inspection, testing, technical, and consulting services in Greater China, Singapore, and internationally. It offers coal inspection and data, mineral inspection, petrochemical product inspection, climate change and sustainable development, power and energy, and leak detection and repair services, as well as integrated services in the field of ecological environment.

-Tikr.com

The testing, inspection and certification (TIC) sector is a highly fragmented industry. It also means that hidden within this fragmented industry are often leaders within the various niches. Leon happens to be the leading private TIC firms in the coal space in China and one of the leading players for petrochemical products in Singapore.

This is an industry which usually grow at 2x multiple of the GDP growth. It means that revenue will grow as long as the industry the TIC is serving is somewhat growing.

While coal usage continues to shrink in China, there is increasing environmental need to TIC-ing the coal at its source, while transporting and using coal. TIC is just going to go up. China is not going to give up on its coal production as coal energy generation is of strategic importance to them. Cost of coal is going to get higher but that is not going to stop them from burning coal to generate energy.

TIC is an industry that relies on motivated professionals. It means that Leon relies on aligning their interest with the partners on the ground through minority interest.

Overall, I like the TIC industry, less so of its product - coal which is declining in usage in China. I would have love to get it cheaper but HKD 1.32 seems decent enough to start an initial position.

As for the convertible, Leon redeemed their old convertible bonds on the 11th June before proposing to issue convertible bonds on the 27th September. My guess is that an acquisition is coming. Looking at their past acquisition, I am hopeful that it will be a good one.

And of course, the acquisition will come with more minority interest which will further complicate analysis.

How can one have a good life analysis without some complication?

I am holding it for the long term. The winds finally seems to be blowing at the same direction for them so i expect results to be better in the coming years.

Hi Wee Hiang, thanks for the writeup. I too have been invested in this company for a couple of years now and am disappointed to read that the management doesn't intend to actively return capital or reduce the price to value gap in the share price, although I had sort of inferred as much over the past couple of years. Do you intend to hold for the long term?

I suppose that as long as the management is growing the business well, the value of the shares will remain intact and hopefully grow for investors of the shares. However, it could stay undervalued for a long time and when the share price will reflect the value of the business is anyone's guess.