2024 Week 27

Kweichou Moutai, Wuliangye Yibin, Shede Spirits, ZJLD Group Inc, Tsingtao Brewery, China Resources Beer, Diageo, Pernod Ricard, Thai Beverage

Sin stocks - Kweichou Moutai, Wuliangye Yibin, Shede Spirits, ZJLD Group, Tsingtao Brewery, China Resources Beer, Diageo, Pernod Ricard, Thai Beverage

During my last visit to Shenzhen, a company treated us to dinner. How could a Chinese dinner go without some tipple? We ended up downing a couple of bottle of Californian red wine and Chinese liquor (baijiu).

Instead of the regular revenge toasting and drinking of the past, drinking China has become more moderate. Similar to the west premiumisation move, the Chinese are drinking lesser but better and drinking the more expensive stuffs.

So what does it mean for the Chinese liquor companies if the Chinese are going to drink better? Does it mean that the top end liquor companies like Kweichou Moutai (Moutai), Wuliangye Yibin (Wuliangye) will have a bigger share of the wallet?

If your idea is to use the economist as a contrarian indicator, the recent article would have bolstered your confidence.

But maybe there is a good reason for that article since I ate Moutai ice cream and drank Moutai latte from Luckin instead of drinking Moutai in China.

Moutai has been transferring much of their distributor profit to themselves by increasing the ex-factory sale prices. In recent months, wholesale prices has also fallen (thou at the time of writing this article it has risen slightly) which meant that wholesalers are lowering prices to move their goods.

For more in depth thoughts on Moutai, you should read the writing from @moatlesscapital.

My thinking is that the taste profile for Moutai should not travel well. It is an acquired taste and will be a drink for the Chinese and curiosities for any unsuspecting foreigners who waddle into a business drinking meeting.

The only way for Moutai to continue growing is to go the Hermes way.

Like Hermes, it needs to take back all the distribution points and start to control the growth of its supply and ultimately control its demand. Unlike Hermes, it will most likely never be an international product.

With a 50% net margin, Moutai has ample profit and time to figure out its next profitable-loss making move.

If your idea is to look for value stock within the alcoholic space, maybe Shede Spirits or ZJLD Group would fit the bill. They are selling close to 52 weeks low, sport a > 20% ROE and has a PE <= 10x. They are supposedly state owned and should pay a good portion of their profit back to their shareholders.

They may taste like Moutai or Wulianye but unfortunately do not have the pedigree like Moutai or Wuliangye.

Then we have the beer companies like Tsingtao Brewery (Tsingtao), China Resources Beer (CR) which sells Snow beer. They have also gone on a premiumisation drive.

Unlike Moutai which needs to be aged for 15-year, 30-year, 50-year, and 80-year, beer premiumisation can be more easily executed through the act of increasing the range of beers and then trying to upsell the consumer on their regular tipple.

During the Reporting Period, the Company achieved sale of a total of 4.56 million kiloliters of Tsingtao Beer, up 2.7% year-on-year. In particular, the sales volume of products above mid-to-high-end reached 3.24 million kiloliters, up 10.5% year-on-year, and the Company’s revenue per kiloliter increased by 6.4% year-on-year.

-FY2023 commentary Tsingtao

Looking at the ytd stock chart, both Tsingtao and CR are trading closer to their 52 weeks low. With revenue increasing due to premiumisation, a stable gross margin coupled with restraint in SG&A and an increasing ROE, better margin and capital allocation has being awarded with lower stock prices.

The market seems to have been throughly sold on the premiumisation strategy, but would the investing community be willing to rerate it from it current PE of 15x to its historic PE of 20-25x?

While the Chinese liquor companies suffers from the PE derating, the world behemoth of liquor like Diageo and Pernod Ricard suffers earnings fall from lower post pandemic demand around the world.

Similarly, their share price are all at 52 weeks low.

Unlike the Chinese liquor firms, their business is bound to grow much bigger due to the entry of a new class of connoisseur from India who is bound to enjoy the finer taste of alcohol from Europe.

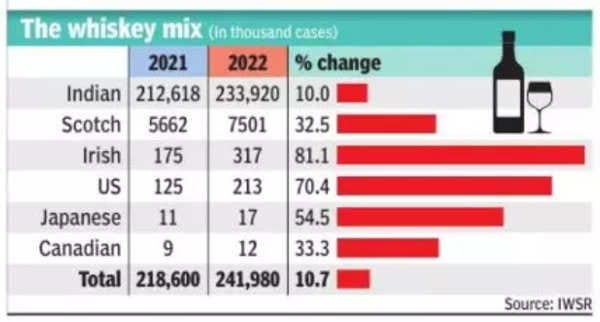

Fun fact: The amount of whiskey India consumes is more than half of the world's entire production!

Global agency IWSR in 2022 wrote that nearly two-thirds of the spirit sales are dominated by whiskey. Within that, 85% of the market is controlled by 10 home-grown brands. Imported whiskey is estimated to be at 3.3% of the total pie.

The premiumisation strategy India is already working and should continue for a very long time.

In addition, both Diageo and Pernod has a significant Indian whiskey portfolio. Between Diageo and Pernod, Pernod being family owned is more conservatively managed and should weather the downturn better than Diageo.

Finally, if you are still looking for a sin stock priced at the value range with a special situation in sight. You can look at ThaiBev which is listed on the SGX.

It seems that the long awaited (like forever) BeerCo IPO is still on track for mid 2025. There are ample levers to pull for ThaiBev. They own Fraser and Neave (F&N) and Fraser property within their portfolio. While “strategic”, I am sure they are up for sale at a right price.

Recently, UOB Kayhian and DBS Group Research just issued a buy call for ThaiBev at 57 cents and 69 cents respectively.

It seems that every “sin” investor has lost hope and is heading somewhere to drown their sorrow. Maybe this is the time to pin on some hope that the only sin to commit is to buy some sin stocks now.