2024 Week 20

Dividend yield, TK Group, China Merchants China Direct Investment, Consun Pharma, AEM, Mermaid Maritime

Dividend yield - when 10 minus 1 equals 9.5?

When things are going well, when the momentum is going strong, some typical rules just no longer applies.

Usually when a company commits a 10% dividend, the share price will drop by that equivalent amount or more when it goes ex-dividend (XD).

I have noticed that some of the Hong Kong companies has gone XD and the price did not fall by that equivalent amount.

Instead of a 10% drop, they had a 5% drop instead.

The reason could be that the stocks are so dirt cheap that it still make sense to buy for those who are late to the game.

The capital inflow is so strong that dividend no longer matters for now.

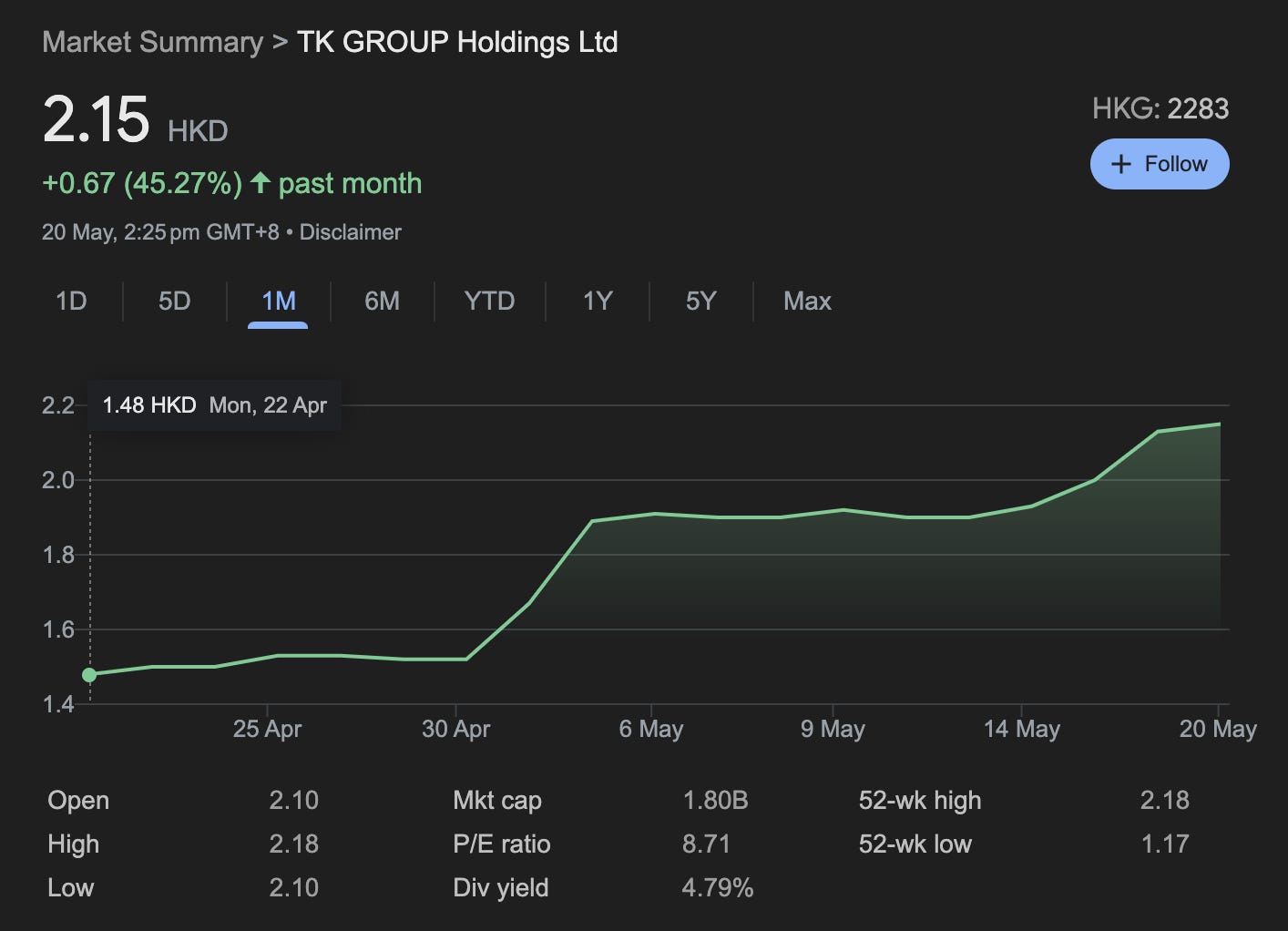

TK Group which I had flag on week 15 has risen from HKD 1.49 to HKD 2.15 for a quick 45% gain.

I have a feeling that it is definitely not going to drop by 5% when it goes XD.

It seems that it is possible to have the cake and eat it too in this current bull market.

China Merchants China Direct Investment (CMCDI) - firework close for a close end fund?:

Going back to the strong bull market. Every bull market comes with some pullback and it is often wise to imbue your portfolio with some “Special Situation”.

A few of my friends and I just had a call with Brian from Argyle Street Management (ASM).

They have laid out a almost water tight case here.

The red box is where ASM started their public campaign.

ASM is dealing with with a SOE which has been underperforming for years!

If we are judging the success of this activist campaign on its share price so far, it should be seen as a great success.

But I do not think that ASM is done here.

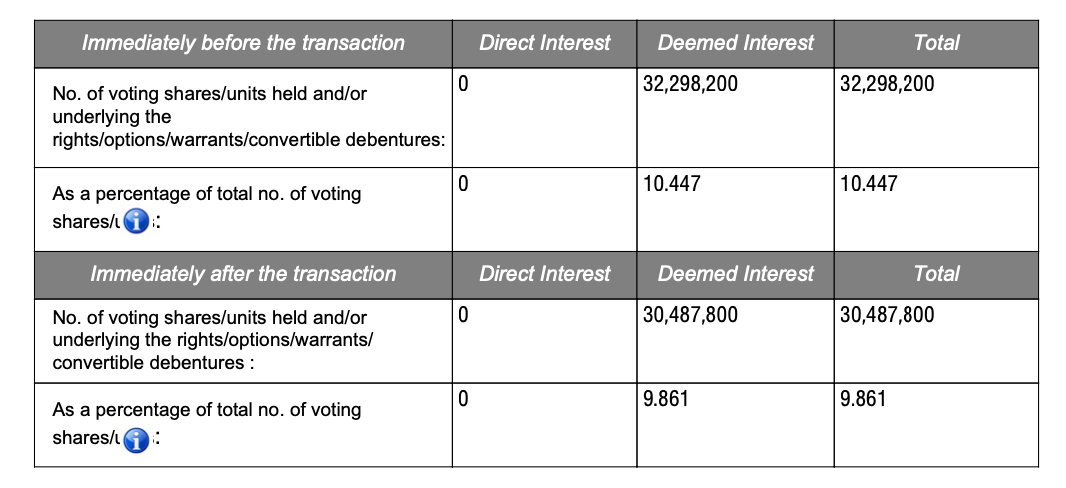

As of 13th May 2024, ASM holds a 8% stake in CMCDI. They are majority shareholders now and it will be hard for them to exit unless some corporate action happens.

That means that CMCDI needs to

sell some public investment

do some repurchase of their stock,

even considering a delisting

before ASM can exit in an orderly manner.

As for us, we can just ride the coattail of ASM and should probably exit before ASM does?

*The flea is just going on a ride on the back of the big black bear*

This is one of the few cases that the risk decreases as the stock price rises.

ASM is showing CMCDI that the activist campaign is working (elevating the share price).

CMCDI has no reason to fight so hard and may want to go with the flow. (they are a SOE afterall)

Expect some form of struggle from the CMCDI’s management but I think the war is over.

If you pull out the frame further out into max, then the last peak for CMCDI is HKD 20.55 on the 8th May 2015.

Personally, I will not be looking at HKD 20.55 to get out.

On average, close end funds operates at a 30% discount.

On a side note, for those who holds on to CMCDI, it is time to drop them an email at info@cmcdi.com.hk to tell them why they should work cordially with ASM for the greater good of the motherland.

Consun Pharma - filtering the bad stuffs like the kidney:

I have been following Consun Pharma since 2021

The initial issues I have with Consun is that there is a lack of clarity on the central procurement for traditional chinese medicine (TCM). I know that there are multiple changes to the centralized procurement process but I just do not know how to handicap the odds on how centralized procurement will affect Proprietary Traditional Chinese Medicine players.

Since that has become clear now (the largest provinces in China are all done with centralized procurement), the focus goes back to the internal working of the company.

It is hard to pigeon hole Consun as they do have a concentrated drug portfolio of kidney medicine (67%) coupled with gynaecology and paediatrics medicines (11.3%), contrast medium (6%), orthopedics medicines (5.9%), dermatologic medicines (5%), hepatobiliary medicines (3.1%) and others.

In the kidney medicine segment, most of their revenue comes from a single TCM drug known as Uremic Clearance Granules《尿毒清顆粒治療腎臟病臨床應用指南》which is used in response to late stage chronic kidney disease (CKD).

Consun continue to work on drugs relating to CKD which ensures that they are able to maintain and consolidate their hold on that segment.

The problem with the company has always been that it has a mix bag of up and coming product range which is too small to make a difference but has high enough growth rate to not bat an eyelid on.

The way forward for them to be a significant player (with at least 2 medical indications?) is to acquire a company which to bring about scale in any of the other segments mentioned above. That means that they need to be clear on their M&A plans going forward.

The worst possible scenario is that they are going to acquire in a cost competitive space and need to write off the investment. Unless that M&A plan becomes clear, Consun may not get the PE revaluation that it sorely deserves.

AEM - when the supply keeps coming:

Here I talk about AEM again.

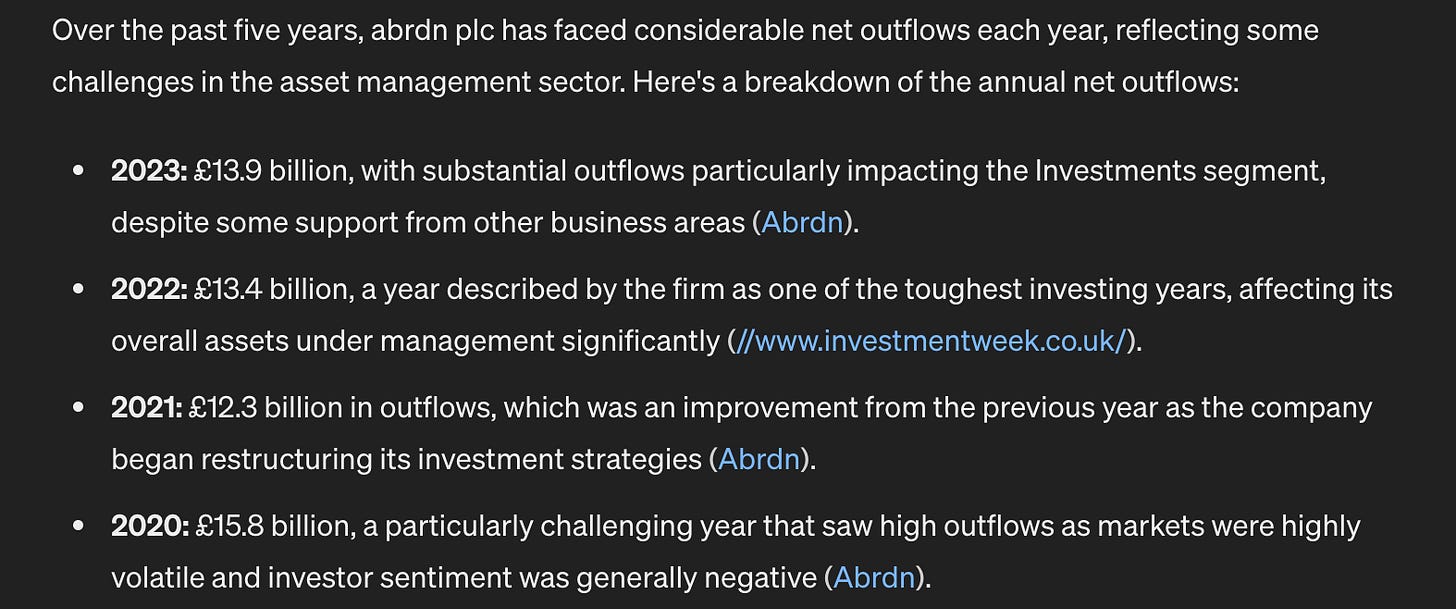

The majority shareholder abrdn plc continues to sell..

Is this “endless” supply of AEM going to continue?

Lets see what ChatGPT gotta say,

When a fund manager starts losing AUM, expect more leakage to follow (investors usually like shining new ship and will abandon big, old and wobbly ones?).

abrdn still has USD 500b in AUM so there is much room to shrink further.

AEM looks like it is low on abrdn plc totem pole.

Expect abrdn plc to continue selling AEM when there is substantial redemption in SGD?

Mermaid Maritime - decommissioning their margins:

On week 15, I wrote

“It seems that news of Mermaid’s “good fortune” is trickling down into the investor community and investors are finally taking notice.

At current price, Mermaid is definitely closer to being fully valued than undervalued.

A lot of the current valuation would depend on the progress of the new segment - decommissioning of rigs.

Decommissioning as a business is bound to have lower gross margin than their regular business. I would expect decommissioning gross margin to tread closer to 15% which means that the profit growth may not be as spectacular as expected by the market.

Expect some pullback in share price if the gross margin and net profit turns out to be worse than expected.”

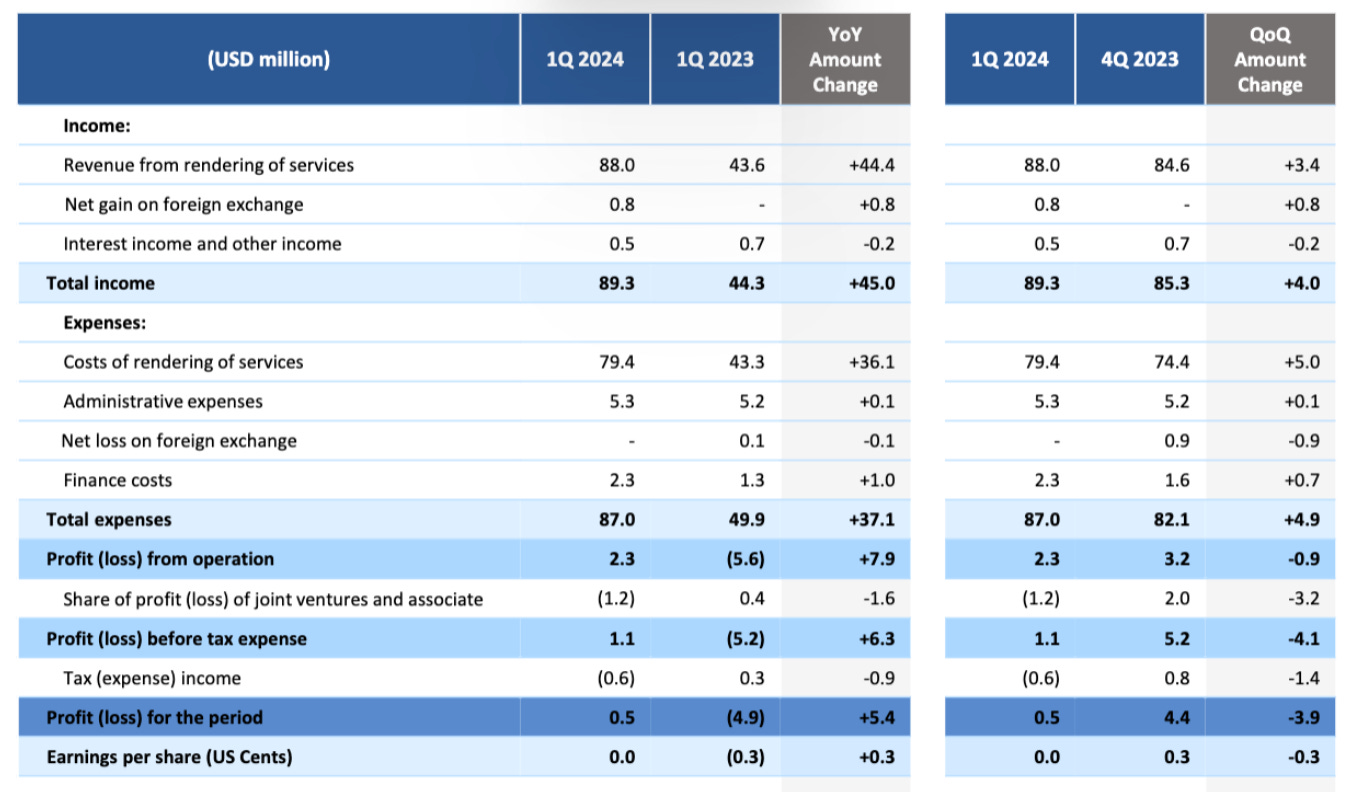

2024 1Q came out and that is the market’s reaction.

2024 1Q margins are weaker than 2023 4Q.

The 1Q is usually the weakest. A doubling of revenue just shows the type of market Mermaid is in (demand is high). I think point 10 is a good reflection of what happened in FY2024 1Q. Decommissioning in Thailand and its neighbouring water is going to be strong, but margin is going to be something they need to work on

The momentum for the sub-sea sector in the Middle-east and Africa will remain strong for Mermaid. Europe and the UK (north sea) could bring about some positive surprise too.

Time to put on your thinking hat to decide on the risk and reward for the next quarter, the full year and the multi-years boom ahead.

Interesting, especially Consun Pharma. Do the Uremic Clearance Granules carry any patents? There is no mention in their AR, other than UCG is the only "strongly recommended" medicine. My first instinct is there would be lot of competition if they were to expire soon, with gross margins at 75%. What is your take on management, 1-10? Thanks for the write-up!