2024 Week 19:

AEM Holdings Ltd, Pentamaster International, Lion Rock Group, Left Field Publishing

AEM Holdings Ltd - the burning house?:

AEM reported their 2024 1Q and it is as expected, an ugly one. Revenue and net margin all contracted. This is economies of scale in reverse.

As usual for any press release, they tried to blunt the bad news with some good news.

“The Group’s continuous investments in R&D has yielded positive outcomes, with two significant high volume production wins for its test solutions in the high performance compute (HPC) / artificial intelligence (AI) space.”

-AEM 2024 1Q

I guess the PR firm is hoping that the association with AI will help to blunt the ugly financials…

The positive spin has not been able to hold off a 22.55% drop in share price.

If I am the younger me,I would be like a degenerate or contrarian as some would like to call themselves, be dashing into this house on fire.

The older me now, will just be writing about it.

“Given that the visibility into the second half of the year remains limited, we expect any uptick in growth to occur only in 2025.”

-AEM 2024 1Q

I will be looking for some upturn before jumping on the bandwagon of AEM.

Pentamaster International - the magician:

Talking about semiconductors, the other stock I own is Pentamaster International.

While AEM “specialises” in ATE for System Level Test (SLT), Pentamaster builds ATE for wafer, die level tests and burn in test.

Anyone who wants to know a primer on ATE, should just look at the video below.

I am still positive on the Automated Testing Equipment (ATE) space. This is an industry that is just going to continue to evolve and grow.

More tests from wafer, die level probe, burn in, final test, SLT will be needed as chips are just getting so much more expensive. They need to “catch” the defect as early as possible (from wafer and die level probe) and as late as possible (SLT) so as not to ship anything defective to that customer.

There is still much room to grow for AEM and Pentamaster International.

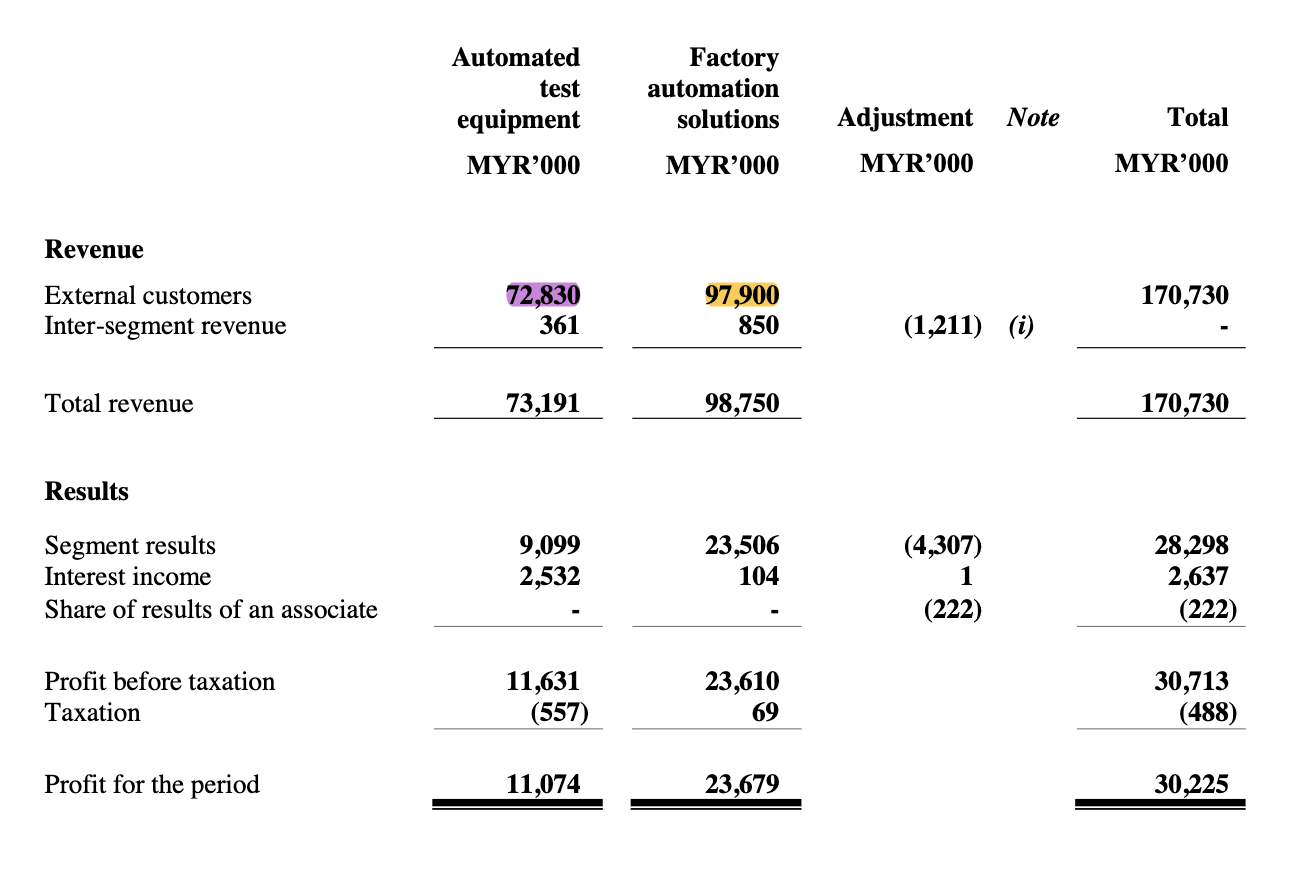

Going back to Pentamaster International, while the ATE segment dropped off in revenue from MYR111m to MYR72m, the Factory automation solutions segment focusing on the medical industry grew from MYR 54m to MYR97m.

I do not know how Pentamaster International continues to pull rabbits out of their hat.

They are just such good operators in a highly cyclical industry. Pentamaster are now a highly diversified, multi-industries, multi-segments company. They have been a joy to watch as they execute year by year.

But at the same time, I do seriously wonder if I should be vested in this company. While the management has been excellent, their industry required tons of hard work, tons of luck and a really good set of people at the very top. Any slip will cost them and me dearly.

In addition, I always wonder why would they bother doing quarterly earnings calls since it is almost impossible to garner any sufficient insight to predict this highly volatile industry.

I am contemplating on going up to visit them in Penang in July. If you are keen to grab some impressive tasting Penang char kway teow and have a chat with Pentamaster management, do drop me a note.

Lion Rock Group, Left Field Publishing - The last of the Mohicans:

I am still working through my last HK research trip and the next one is coming soon. I often wonder how anyone could meet like 1000 companies a year and stay on top of everything.

I feel so inadequate on my intellectual bandwidth…

My fling with CK Lau, the founder of Lion Rock and Left Field publishing started when it was still known as Cinderella Media (subsequently 1010 printing then Lion Rock).

I “cleverly” sold off Cinderella Media in 2012 when CK cleverly sold away their declining airline magazine publishing business (anyone remember the days when there is a nice magazine on every flight?) and chose to focus on their Asia-based printing operations, consisting of China-based book printer “1010 Printing.

If I had held on, my HKD 0.35 would have become HKD 1.46. If I have included all the dividends, I may have been better off financially just by holding on from CinMedia to Lion Rock?

Lion Rock owns 1010 printing, Malaysia-based book printer “Papercraft” and their separately listed subsidiary Left Field Printing Group. Left Field owns OPUS Group which owns the printing plant Griffin which controls 80-90% of the printing market in Australia.

While controlling a pseudo-monopoly sounds like a great idea, I do continue to wonder if Left Field could really flex their monopoly power. They could definitely earn better than risk adjusted return but anything more will create a backlash and tons of unhappiness.

CK Lau thinks that both Lion Rock and Left Field are undervalued.

Gross margin and operating margin has been trending up for Lion Rock since 2016. That seems to corroborate with what CK mentioned in the meeting “that it may be the golden years for the printing business”.

ah thanks for reading my verbal diarrhoea. we should be hosting a singapore investor catch up in the coming months.

Great to hear your thoughts on these stocks!