2022 Statistical #4: Capricorn Energy Plc

Continue to drill on the stock market?

If you are planning to mine/drill on the stock market, people been saying that there are still tons of opportunity around.

Between Oil and Coal, I still prefer oil, thou you would have been rewarded equally with choosing either of them at the start of 2021.

Capricorn Energy Plc (CNE) is one of the few energy firms where the rapid increase in price of oil has yet to reward the shareholders.

I am unsure why it is so unloved but the business seems to be protected on the downside.

This following company is place in the Statistical Strategy.

Arbitrage:

Valuation

Sentiment

Weighting:

Betting - Testing

Possible Catalyst:

Share Buyback

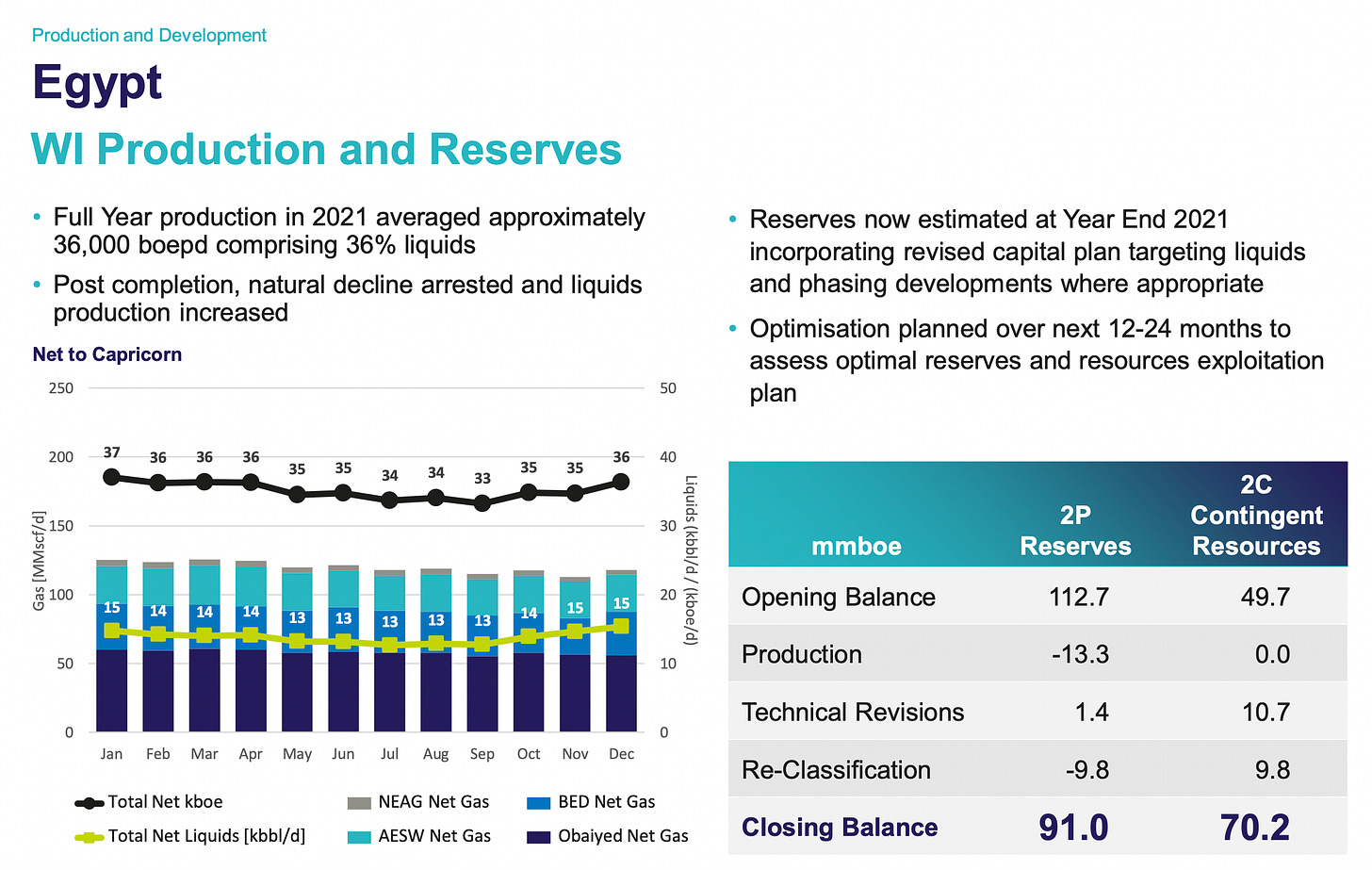

Faster progress in the Exploration or Development project in Egypt

Potential Risk:

Political upheaval in Egypt

Holding Period:

<1 year for share buyback to finish

2-3 years for Egypt production to show improvement

If you look at the 5 year chart, the company has disappointed their investors.

Thou, the share price has doubled from the pandemic low of GBP 83.91.

This is not the best chart to see as the volatility seems to be missing in this company despite being in the resource sector.

I think going forward, there is a better chance that the share price follows the price of oil than the previous years?

So what is so interesting about CNE?

CNE

is currently flushed with cash from the India tax dispute resolution (USD 1.06b)

has a future earn-out if oil price > USD 52/bbl from the sale of the UK assets, Catcher and Kraken which could be around USD 197mm

has a further payout of consideration of USD100mm from the sale of their Senegal assets to Woodside

has minimal debt at USD 166mm

has just completed a capital return of USD 500mm in 2Q2022 through a tender offer which has just completed at GBP 2.23/share with a 34.52% of their shares

has a USD 200mm share repurchase program running NOW

has a production forecast of USD4.5 - 5.5 boe with a production averaging 37,000 - 43,000 boepd (35%-40% to be oil)

a CAPEX of USD 120mm - 145mm to increase and sustain the resource base

a cap on their CAPEX for UK and Mexico assets at USD 40mm and USD 35mm respectively, with no more commitment beyond 2022

moving away from frontier-focused to infrastructure-led exploration

All of these sum up nicely in their investor presentation slide given on the 8th March 2022.

So what is the catch?

CNE’s

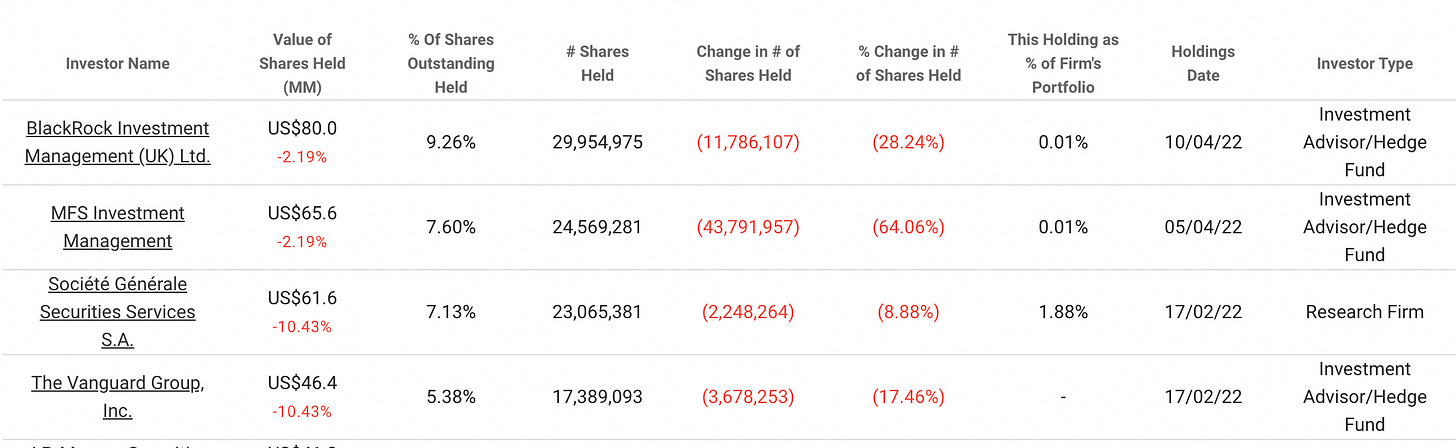

tons of investors are trying to get out

new asset is in Egypt which is in a volatile region

natural gas produce is sold at a fixed rate to a government entity (Egyptian General Petroleum Corporation - EGPC)

which meant that you need to discount the 60% - 65% of boepd.

In addition, EGPC has the preferential right to purchase CNE’s oil…

management in 2021 is the same guys in 2017…

So instead of gushing out cash from operations, CNE is instead going through an asset transformation with various uncertainty in a country within a volatile region, led by the same management who has yet to deliver significant shareholder return since 5 years ago.

On the other hand, CNE current financials is definitely in its best shape in the last 5 years.

At current price, it seems that downside is definitely limited thou I do wonder if there is any upside avaliable.