2021 Super #6 - Omni Bridgeway

When the world is your oyster...

We are going to dwell into a niche area of finance which most of you may not have heard of. The addressable market is huge and untapped. The opportunity set is global, while most of the largest firms are still local.

This is the company which had created a whole new industry and is definitely the world leader in the field now.

If you have bought this company in 2001 when it is still largely local and nano-cap and held it for 20 years, this would have been a 20 bagger! The best thing of all, after working on the same industry for the last 20 years, they are just starting to expand their work into Europe, the United States and Emerging Asia!

Their competitors are all local players with little oversea capability who will need to work on finding investment and talent. Since this is such a niche area of finance, we expect the company to be mopping up all the money and talent leaving little for their competitors.

In addition, the law makers are making new rules for the industry which will increase the bar for entering the industry. The higher barrier to entry the lesser the upstart trying to break in.

With a huge target addressable market, with the Asia and Europe hugely untapped, the growth potential is enormous.

Why is there such an opportunity?

First, the company finance is really hard to understand. Despite delivering value for 20 years, the investing community is still do not understand how to value its assets and income!

Second, the company will be removing US retail shareholders from their shareholder registry (sorry US investors!) by 8th March 2021. Share price may be weak due to this factor.

Third, the company could be reporting a sustainable 200m return in 2025 onwards. Currently, the company is valued at less than 1b. Paying 5x earnings for a world leader could be amazing value!

Fourth, the pandemic may bring about their highest volume of business in the next 6-12 months.

Some companies should be bought when valuation are low, but if the potential growth is huge (like global) and there is a good chance that they could dominate the segment, the purchase should be like NOW?

Litigation Finance:

For people who have not heard of the industry, litigation finance is a strategy that generally involves providing cash to litigants or attorneys to fund their cases in exchange for a portion of any awarded damages if the case is won.

Litigation finance firms have attorneys (expensive personnel) who can assess the merits of a case and its chance of success and investment professionals (expensive as well) who can handle the finance side of things.

Commercial cases are the bulk of the cases. That could include providing cash to a company suing another business for, say, patent infringement or breach of contract.

Litigation financing can also go towards the plaintiff that’s dealing with the cost of litigation.

In other time, the money could also go to law firms directly, which spread the funding among several cases. Sometimes these firms are working on a partial contingency basis where they charge the client a reduced rate and then take a percentage of any awarded financial damages.

If the cases pan out, it is a huge payday for everyone. If the cases do not pan out, the litigation lose your entire investment.

It is either a home run or a total loss…

Industry Landscape:

There are a 3 public companies that do litigation finance and the rest are privately held. There is a good reason to be privately held as the industry is highly profitable. Unless there is a good reason, all highly profitable firms should remain private…

Westfleet research shows that there are roughly 40 entities involved in U.S. commercial litigation financing, with assets under management of $9.5 billion.

Let’s give you a quote from JayGreenberg, cofounder and CEO of LexShares - a private firm. LexShares runs an online marketplace for investors — both accredited and institutional — to pick and choose which cases to invest in.

Since its 2014 inception, LexShares has invested in 103 cases, according to the firm. Of those, 43 have been resolved with a 70% win rate and 60 remain outstanding. The median annualized return for resolved investments after fees and expenses is 52%.

By comparison, the S&P 500 has returned an annualised 8.7% since January 2014.

52% after expenses! They will double their money every 1.5 years!

But we will need to invest in every cases for a high double digit return or if it is one investment it may turn out to be a zero!

On an expected value, it is really not that ideal.

One way we could invest in the litigation finance arena is to invest in funds which specialise in litigation finance. But you need to be an accredited investor (net worth of USD1m) or an institutional investors before you can invest in this opportunity set.

But why do we want to do that if we could be invested in the fund manager who is also invested in their own funds? Why be illiquid when you can be otherwise.

In addition, private players such as Legalist and Lexshares are tiny compared to our listed litigation finance firm while the listed litigation finance firm are tiny compared to the other asset management firms of the world.

The 3 listed player all have some origin from Australia or is listed on the London Stock Exchange.

They are

Burford Capital (Listed on LSE)

Litigation Capital Management (Originated from Australia, listed in LSE)

Omni Bridgeway (Listed on ASX)

Toward the 1990s, the Australia’s Parliament passed legislation that allowed insolvency practitioners to enter into contracts to finance litigation characterised as company property.

“That meant that if you had a company that was going bankrupt, the company was allowed to enter into a litigation funding contract to finance the pursuit of the company’s preexisting legitimate claims, which the company could not afford to finance itself due to the expense of insolvency proceedings. This is how it really began. The largest and oldest litigation funder in Australia is now known simply as IMF Bentham (due to a merger), but its original name was Insolvency Management Fund Limited.”

-Victoria Shannon Sahani

Professor of law at the Arizona State University Sandra Day O’Connor College of Law

So the largest and oldest litigation funder is IMF Bentham and that is the prior name of one of our 3 listed firms above - Omni Bridgeway.

We will ignore

Litigation Capital Management - too small market cap and fund under management

Burford Capital - due to Muddy Water report and their accounting methods

Potential problem for the Industry:

When the industry started, everyone funded the capital required for their cases using their own capital. After a while, the capital ran low and industry players started to clamour for outside investors.

In 2000, the way to attract additional capital is through an IPO listing. IMF Bentham was listed in 2001 and Burford Capital was listed in 2009.

The problem in the industry has always been capital on their balance sheet (the amount of capital determines the number of cases you can fund) until some bright fellow combined litigation finance with asset management. Suddenly, investment started to flow in and competition had intensified.

This influx of capital do not seem to have affected the returns within the industry but it will definitely bound to happen. For that we will be keeping a close look out for the possibly continued unbated influx of capital and possibly a deterioration of returns if underwriting quality drops.

The number of startups who are entering the space like Legalist and Lexshares are worrying as well. But we can easily see Omni Bridgeway buying one of them if their technology or platform is really viable or Omni Bridgeway will just creating their own technology or platform.

Potential misunderstanding on the legal reforms:

On 14th May 2020 in Australia, Hon. Christian Porter MP, Attorney General and Minister for Industrial Relations and Leader of the House had a media release dated 13 May 2020 titled “ Improving justice outcomes for class action members.”

Subsequently a parliamentary Joint Committee on Corporations and Financial Services (Committee) was set up to inquire into class actions and litigation funding.

On 22nd May 2020, all litigation funders operating in Australia to hold an Australian Financial Services Licence and to conduct class actions in compliance with the managed investment scheme regime.

Barriers to entry which is perceived to be low in this business will increase substantially. No longer could someone with some cash and a law degree have a crack at the industry.

We will expect that such standards would be roll out to the rest of the world and while that create certain uncertainty for the industry, any regulation could only benefit the largest player such as Omni Bridgeway.

To manage the various stakeholders, the twelve leading litigation finance firms have set up the International Legal Finance Association (ILFA), which aims to represent litigation funders in their dealings with governments, regulators, international associations, as well as professional legal bodies.

Of the twelve members, six – Burford Capital, Harbour Litigation Funding, Longford Capital Management, Omni Bridgeway, Therium Capital Management and Woodsford Litigation Funding – are founder members.

The creation of ILFA will help to further the forge understanding between the industry and the legislator helping to lower the industry risk.

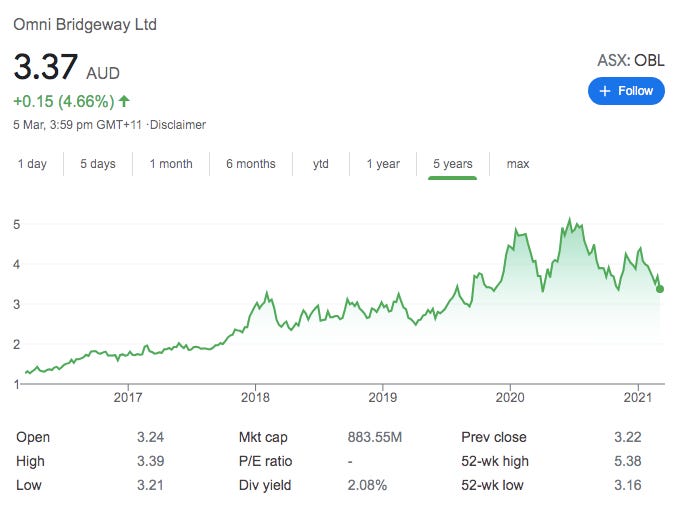

So lets dwell into our target Omni Bridgeway. On a 1 year chart, it is trading at the lower range.

For an industry leader, they had been recognised as such since 2015. But being priced “reasonably”, we think there is more to go!

This following company is place in the Unrecognised Growth Portfolio.

Catalyst: Recognition of earnings in 2 years (2022 - 2023)

Holding Period: Up to 5 years (2026)

Comments: Since we started buying the shares had gone down. We had not had that feeling for a long time. We hold a small position and intend to average up or down as we understand the company more.

From IMF Bentham to Omni Bridgeway:

Andrew Saker joined IMF Bentham in 2015 and transformed the business model. By leveraging its phenomenal track record, it set about launching a number of new investment vehicles, taking outside money for the first time.

With an outsized returns on offer, the demand for this new asset class skyrocketed. from 2016 - 2020, it launched 5 funds with over AUD2b deployed into cases from all around the world.

In November 2019 IMF Bentham and Omni Bridgeway merged to form the largest dispute funding team in the world and subsequently adopted the global name Omni Bridgeway (OBL) - acronym OBL will be used for the merged entity.

OBL includes the leading funders formerly known as IMF Bentham Limited, Bentham IMF and ROLAND ProzessFinanz as well as a joint venture with IFC (part of the World Bank Group). It is also the global leader in dispute resolution finance, with expertise in civil and common law legal and recovery systems, and operations spanning Asia, Australia, Canada, Europe, the Middle East, the UK and the US.

With IMF Bentham listing on the Australian Stock exchange in 2001, and Omni Bridgeway commencing operations in Europe in 1986, our merged business has an established track record of funding disputes and enforcement proceedings around the world.

-2020 Annual Report

Geographical Growth:

OBL is currently moving into new markets like New Zealand, Latin America, Asia (South Korea, Japan and India) and Africa. Existing market expansion includes Canada and US.

Geographical coverage

United States is relatively late to the game, but off to a fastest start. In North America, OBL is expanding their Canadian operation to Calgary and Vancouver and in the US to new offices in Miami, Chicago and Washington.

Europe is largely untouched despite UK having a head start. They are just embarking on new offices in Paris, Rome and Madrid.

Hong Kong and Singapore just started around 7 years ago, still providing a huge runway.

In the Asia Pacific, they had seen opportunities in New Zealand, Tokyo, Seoul and New Delhi. They had committed to an investment in Japan and manpower in New Zealand.

Product Growth:

The acquisition of Omni Bridgeway by IMF Bentham brought new capability within the new entity. In a typical litigation funding situation, the investment opportunity is limited by the cost of the litigation, but with their new active approach they could take on “larger deal size” through methods like claims monetisation.

So instead of being on the side of the plaintiff, they will be on the defence side helping to minimise losses.

The move should expand the addressable market, help OBL expand their ticket size according to their risk appetite and strategy.

In addition to the changes by the Victorian government to establish Group Cost Order or contingency fees, OBL is in the midst of looking at acquiring or setting up their own law firm.

The ability to grow their business to the defence side of the court case allow them to continue to deploy more capital to qualified investment, increasing their fund under management.

Fund under Management Growth:

In their 2015 plan, they had moved away from balance sheet financing to external fund financing which helped to grow the company.

For 2020, the OBL will be planning to increase the fund under management to 5b with around 1b of funds committed annually.

Investment Return vs Accounting vs Valuation:

Between 2001 and 2019, Omni Bridgeway completed 192 cases, 171 of which were successful. The average case took 2.6 years to complete with the initial outlays having an average return of investment (before overhead) of 130%.

The high demand allows Omni to charge management fees of 1.83% coupled with performance fees of up to 30% of any profits.

Accounting:

The problem with OBL is that the earnings are lumpy.

For Fund 1,2,3, they basically promise their investors that they will only withdraw returns after thee investors get theirs. That means that revenue recognition would only happen upon distribution of the funds.

Unlike Burford Capital which part of its revenue comes from writing up the value of disputed court cases that haven’t yet concluded, OBL carries its claims at cost throughout and does not record any unrealised gains.

2023 Forecast: Assuming it has 2b fund under management

Using a historical rate on a doubling of the investment over a 3 years period, and a 30% profit fee, the annualised return across 3 funds Fund 1,2 and 3 would be around AUD360m in 2022. With a 30% profit fee that should be AUD120m of revenue,

The annual 1% fee on a AUD2b fund would be around AUD20m. Operating and interest expense should amount to 100m in 2022 bringing a net profit of around 40m every year.

Using 2022 as a target, we should be looking at 25x PE ratio on today market valuation which is not exactly cheap…

2025 Forecast: Assuming it has 5b fund under management

Using a historical rate on a doubling of the investment over a 3 years period, and a 30% profit fee, the annualised return of a AUD1b fund annually would be AUD300m per year.

The annual 1% fee on a AUD5b fund would be around 50m. Operating and interest expense should amount to AUD150m in 2025 bringing a net profit of around AUD200m from 2025.

2025 Forecast: Using Estimated Portfolio Values (EPV) Forecast:

Using the company EPV to make an estimation of the valuation of the company assuming that the funds would be all utilised by 2025.

The last EPV amount for October 2020 comes up to AUD16.9b.

Assuming that 50% return a profit, the profitability will amount to around AUD8.45b. That will bring about AUD6.45b of profit after netting out the AUD2b of investment. At 30% profit fee, the company is poised to earn AUD1.9b over 5 years making around AUD380m per year of investment return. With a 1% management fee that will bring revenue up to AUD430m.

Operating and interest expense should amount to AUD150m in 2025 bringing a net profit of around AUD280m from 2025.

If we are to assume a 10x earnings between AUD200m - 280m, we will reach a value of AUD2 - 2.8b. This is a doubling of price in 5 years time if the market takes that long to recognise its value.

We had conveniently left out OBL investment through its own balance sheet which amount to AUD321m which will be growing to AUD642m if it perform to historical expectation.

Treat that as your margin of safety.

The thesis rest very much on OBL continuing to attract capital.

If you are willing to project out to 2026 like us, then this investment could be for you.

We had taken a small position and will be upping our position as OBL execute on its plan for the next 5 years.

As usual, we will be treading in slowly as we understand more but we are excited with the global growth opportunities from Asia, Middle East, Europe and United States.

We are in the midst of reaching out to OBL current and ex-employee and talking to their clients. If you have anyone whom we can talk to, please do connect us.

If you would like to follow us on real time on what we are thinking of and news article we are reading on.please join us at our telegram channel - https://t.me/weightedresearch.

If you would like to re-read some of our investment reflections, then do follow us on Facebook at https://www.facebook.com/weightedresearch.

If you have any comments, just hit the comment button below.