2021 Statistical #4 - Huanxi Media

Content or Platform or maybe Both?

Chinese New Year is around the corner and we thought we should tell you a company closely related to this festival. Chinese family usually come together to have dinner during Chinese New Year (CNY) before retreating to the cinema to watch the CNY movie release. Since the cinema are close now, we thought this is an opportunity to tell you how the pandemic had shifted habits.

This is another industry that we are not familiar with as media industry is something that had been a hit and miss for us. We had previously invested in outdoor advertising, and magazines operating in niche areas. We are pushing out of our boundaries of our circle of competence here.

The growth of Netflix dominated the news a few weeks ago. 200m subscribers! Like what John Malone said, Netflix is going to be the first media company which is global in nature. We should qualify that sentence. Netflix will be the first global streaming media company (excluding China). There would be someone else streaming Netflix shows in China.

This will form part of our leisure thesis under the statistical portfolio.

It took us a long time to write this to distil down our thesis. As we put this out to our newsletter subscribers, the share price had moved slightly higher. Higher than what we had paid for (average price of HKD 1.42) and what we are willing to pay (anything less than HKD 1.48).

On a five year chart, Huanxi (HX) is still trading at its low. But the movie production industry is hard to predict and harder even to value. So this take a leap of faith.

China media industry is different. The distribution is different from the rest of the world. Their movie industry do not have the following like Hollywood and the industry is working on its own path. Most of the profit are made in the Cinema (pre-COVID). The online streaming market is not expected to make money due to the low ARPU and the high cost of production.

The top streaming companies are.

iQiyi (owned by B____)

Youku (subsidiary of A______)

Tencent Video (owned by T______)

Streaming has been a hit and a miss in China.

The hit and the miss of Streaming:

Hit: The low monthly streaming (monthly subscription fee is around RMB 19/month) means that unlike Netflix which relies fully on subscription fee, the Chinese platforms monetise using a variety of methods like

charging more for popular shows which sits outside the streaming charges

advertisement

online store

even a e-book segment and mobile gaming

,which are still insufficient to cover for production cost of the content.

Miss: The way the streaming platform had been going about this loss has been to justify it in its own way.

Youku which is own by Alibaba clearly sees entertainment as a loss leader that benefits and enhances its mainstay e-commerce businesses similar to Amazon and Amazon Prime Video. As long as Alibaba continue to lower the losses in their entertainment segment, they should be satisfied. Similar to Amazon, we do not think that they are in the running for domination in the streaming war in China.

The battle for user matter most to iQiyi who is owned by Baidu. Unlike Tencent Video, their parent is a tad “weak”. In order to drive down acquisition cost, iQiyi and Tencent Video had been streaming their rival shows each other platform just to share the cost of the production. They even got down to ensuring that they are pricing it similarly across platform.

Miss: Coupled with a myriad of other players like Bilibili, Bytedance and Kuaishou all circling around to look for potential entry into the long form streaming space, it looks like a possibility that streaming in China will never be able to turn profitable in the short term. We wonder which competitor will blink first.

Miss: At late last year, there is talks that Alibaba, Tencent are in talks to acquire stake in iQIYI before valuation and anti-trust concern thwarted the potential deal. Losing the chance to consolidate the industry, coupled with a few players who are still eyeing how to crack the online streaming market could only work very well for the content producer and that is where we are starting now.

Overall: Unprofitable industry dynamics!

If you have giants fighting with each other with “unlimited” budget like the streaming war in China, you would make money by remaining small and nimble, continue to feed off the giants and also making yourself indispensable to them, while remaining independent of them.

HX is focus on investment and production of films, drama series, and operation of a subscription based OTT platform. The company was founded by Mr. Dong Ping , Ning Hao , Xu Zheng and Steven Xiang in 2015, and listed on Hong Kong Stock Exchange (HKSE: 1003).

The problem with a production house is that there is bound to be many hit and misses in all areas and the question is how do you assess the probability that is an unknown? We believe that the way to understand HX is to understand the alignment of interest and that is where is will start.

Hit: Production

First thing we need to understand is that unlike Disney which owns the IP of their Marvel characters (which happen to always sell in the box office), any production house will never know if a movie will do well or not. Sometimes, even we throw in international stars staring in a predominantly Chinese led movie, it may still look like a B-grade movie.

What had been proven to work constantly is the directors.

HX has the exclusive rights to invest and produce films by China’s most prominent directors for multiple years period.

The right directors are important as their work could pull in the right stars which also help to drive attendance at the movie theatre. The chances of scoring a hit becomes higher when the ingredient is all in place.

In addition they have a pool of up and coming directors who are working towards being in the exclusive director shareholder club of HX.

Some directors are able to constantly churn out hits, but the production budget could really get awry once an artist/director goes to work. But what if the director is an investor in his own film? Would that align the director artistic inclination and the movie budget?

Coupled with the fact that the directors like to create sequel of their hits, it makes the risk - reward ratio for the production from HX a tad more predictable.

Hit: Co-investment

Instead of seeing HX as a production house, it would be alright to see it as a co-investment company as well. The company promise to invest in the films of these directors and at the same time, the directors are shareholders of the company.

Ownership interests of a number of top Chinese movie directors in the company, closely aligns interests of the company with those of China’s top movie directors, which allows HUANXI to have the right to produce high-quality movies and drama series for internet media platforms.

Looking at the list of their shareholder directors include the who who of the Chinese movie industry like Ning Hao, Xu Zheng, Peter Chan, Wong Kar Wai, Zhang Yibai, Gu Changwei and Zhang Yimou.

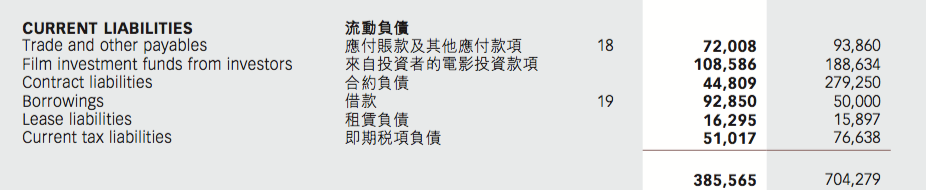

In addition, the director gets to invest in their own films to partake in the upside. The good thing is that HX gets to defray some cost and risk and also align the directors artistic and business incentive. Looking at 20202Q statement, you would have notice that investors had helped fund HKD 108m of their assets.

Hit: Building Huanxi.com app

With the large boys swinging at each other trying to dominate the streaming war in China, they are also spending good money to acquire content.

Instead of sticking to the production house, HX had decided that they will need to own the monetisation of their shows. This strategic decision had benefitted them.

They had created the a streaming app huanxi.com which at the last count in January 2021 has 5m fee paying subscriber and 27m downloads. This allow HX to capture the full value of their movie category. Instead of fighting a direct war, the small and nimble HX is fighting a guerrilla war with the major player with their knowledge and blessing.

Hit: Selling 囧妈 to Bytedance

During the Chinese New Year (CNY) last year, with all the cinema closed, HX did the unthinkable by terminating the distribution agreement with Hengdian Entertainment, where the latter guaranteed a box office of RMB 2.4 billion and sold their CNY movie Jiongma - 囧妈 to Bytedance (owner of popular apps including TikTok and Toutiao) for RMB 630m. The movie took RMB 217m to make.

Other than just showing the movie for free from the first day of the Chinese New Year on Douyin, HX get to broadcast on their own streaming site as well allowing them to draw in customers to their Huanxi.com app.

HX now can avoid sharing the full proceeds with its distribution channel and gets the chance to test its own streaming platform.

Hit: Getting exclusive foreign shows on Huanxi.com

HX has a limited category of films as they only produce movies. HX has gradually moved into short series production with their various Chinese directors. In addition, they also license various shows such as World of Fire from BBC.

Hit: On-boarding Various Platform

HX had also teamed up with the various “flies” of streaming to chip away at the giant stranglehold on customers.

HX had

entered into a strategic cooperation agreement with Huawei and a cooperation agreement with Xiaomi respectively to set up a designated zone for “huanxi.com” in Huawei TVs, Huawei smartphones and Mi TVs, Xiaomi smartphones.

cooperated with state TV - Hunantv.com to set up a zone in the mobile application of Mango TV and all the terminals of the internet TV business.

entered into cooperation agreements with the TV manufacturers like Juhaokan Technology (聚好看科技) of Hisense TV, Coocaa (酷開網絡) of Skyworth TV, Falcon Technology (雷鳥科技) of TCL TV and Xgimi Technology (極米科技) to set up designated zones for “huanxi.com” on each of the above TV terminals and platforms.

Effectively, anyone with a phone or a TV in China could be accessing HX shows. The second step of building distribution for Huanxi.com app is complete.

Misses: Sale of share to Bilibili

Bilibili will subscribe for 346,626,954 newly issued ordinary shares of HX at the subscription price of HK$1.48 per Subscription Shares for an aggregate consideration of approximately HK$513,007,892 which is approximately 9.90% of the total enlarged share capital of HX.

In return for the investment, Bilibili will gain exclusive online broadcasting rights other than HX's own online platform to existing and upcoming releases of HX Media-owned films and TV drama series. Bilibili will also be granted first right of refusal to any new films and TV drama series developed under HX's expansive portfolio of broadcasting contracts with a number of China's leading directors.

We thought that is just too much concession given for an investment and it seems that they are tying their fortune to the Bilibili platform.

Hit: Earnings

After the working on their business model for a couple of years, their model finally hit pay dirt by getting their movie hits in 2019. We expect that the revenue numbers of 2022 to mirror that of 2019 than 2020.

Growth Valuation: Hit or Miss?

Since the pandemic, HX had managed to widen their distributions, find more alternative sources of revenue. Coupled with box office income normalising, the revenue could only be higher and the profit margin can only be better.

Their lifespan of their movies had also lengthen, while their streaming app Huanxi.com will be available to another 50m? Chinese at the end of the Chinese New Year period due to the tie-up with various platforms.

With a high chance of producing another hit from their shareholder director, the business could be generating between HKD 50 - 400m worth of net profit each year. (we know it is too big a range to do any forecasting…)

We are unable to ascertain the real profitability nor are we able to do a discounted cashflow, but the ability to partake in the monetisation of a film by the great director of China for this period seems like an option which is worth the price.

2022 will most likely be the time when the China box office recovers and we shall see how HX recovers.

As long as we are getting the company below the cost of what Bilibili paid for, we think are getting a good deal owning a movie production company who also happen to control their own digital distribution channel.

Plus would Bilibili make an acquisition on HX?

That should make the shareholders, shareholder directors and us very happy.

If you would like to follow us on real time on what we are thinking of and news article we are reading on.please join us @ telegram - https://t.me/weightedresearch.

If you would like to re-read some of our investment reflections, then do follow us on Facebook at https://www.facebook.com/weightedresearch.

Subscribe to our newsletter if you want to receive timely information on our positions.

If you have any comments, just hit the comment button below.