2021 Review: Commodities

special x commodities x stats = returns?

The journey started exactly 2 years ago. I left my full time job on 1st Nov 2019 and plunged full time into investing. The first industry I took a stab at is the commodities industry and damn it is a tough industry to understand.

The initial motivation to look at commodities is to use it as an hedge against expected inflation.

First, I am a tad too early.

Second, with almost zero experience in the industry, the journey of investing in the commodities sector is more akin to the act of crossing the river by touching the stones.

After researching, dabbling and feeling the stones, I think I am closer to the middle of the river than the other side of the river bank.

I am just hoping that I do not get swept away down into the ocean.

This is the result of investing in 4 commodities-companies.

If I had equal weighted all the shares, then my return will be 26.61%. Since I had weighted heavily on Uranium and Crude, my return on the commodities sector is around 61.57%.

The newsletter has been named as weighted for this reason but that is another story for another day.

“It's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong.”

-George Soros

Now I will give a report card on my 2 years of work.

Uranium:

I started the commodities investing journey with much analysis and paralysis (for almost a year) before settling on the Uranium by investing in Uranium Participation Corp (now known as Sprott Physical Uranium Trust) on 23rd October 2020.

The reason is simple, the demand and supply situation can be analysed. There is adequate data on the number of nuclear plants and mines in operation. The only downside about Uranium is that Uranium is traded on private agreement and the prices are largely an estimate.

The Uranium market continues to be tight with miners deciding to curtail their production, owners deciding to invest in Uranium physical assets and keeping it in a warehouse.

More traditional nuclear plant is being build in China but technology improvement is against uranium prices as

uranium is abundant in nature but harvesting it economically is tough.

the spend fuel could be further utilised in new technology

The new technology is still years away and thus I am hopeful on the prices.

I have continue to add shares in Sprott Physical Uranium Trust at progressively higher prices as I await the day of reckoning of maybe not…

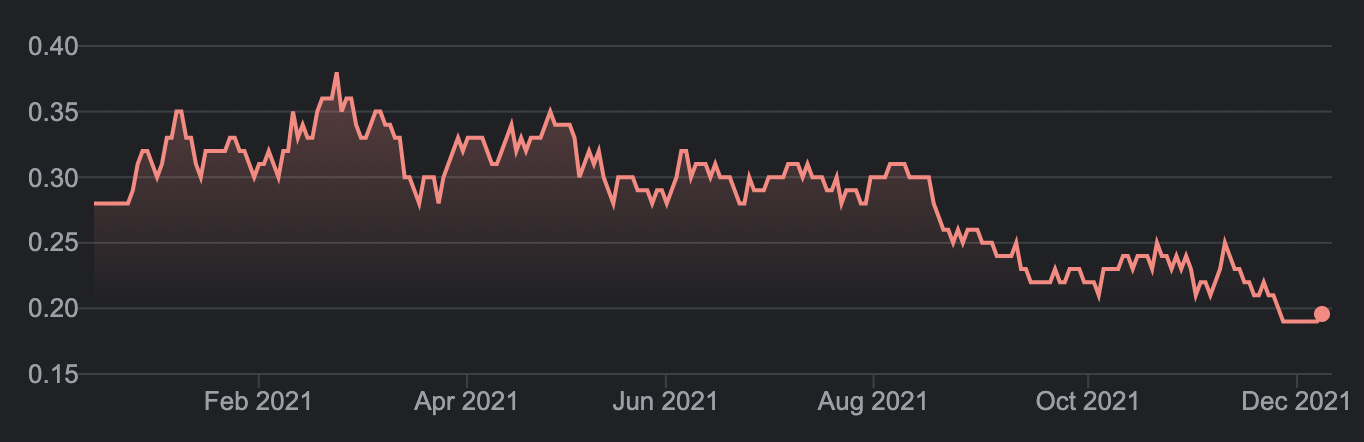

Manganese:

As for the rest of the commodities, I held back. The supply situation is just too tough for me to analyse. The “breakthrough” came when I decide to invest in Jupiter Mines (JM) on 29th October 2020.

The reason that I am able to pull the trigger is that there are multiple catalyst in place

a spinoff in the works (additional cash)

one of the lowest cost miner for Manganese (attractive asset)

an activist within the board (possible corporate activism in place)

management who are buying shares (possible boardroom tussle?)

high dividends (friendly capital allocation)

touted as one of the possible metal to be use in electric vehicle (optionalities)

But alas, JM went through all the identified catalysts and the share price turned out for the worst.

Spinoff was delayed and subsequently completed resulting in a change in shareholding on a bloc of shares

The asset is indeed attractive as the activist tried to oust the management

The activist won!

and the share price gotten lower through the process…

While JM grappled with logistics issue and with the price of Manganese dropping to a new low, JM’s high dividend is now in doubt since the activist would be more interested in growth than receiving dividend.

Manganese is one of the most volatile commodity as it is very dependant on the manufacturing of steel. Looking back, that should have been a big red flag on not investing but the catalysts pointing to a positive outcome are hard to ignore.

This is my worst performing position since I started this portfolio and I have continued to wonder if there is indeed still a story to continue holding on to JM.

The good news is that the position is a small part of my portfolio.

Crude:

Rex International (Rex) came into the picture due to a recommendation from a friend. After hearing the recommendation, it took me another couple of weeks before I could understand and value the business. I had made plenty of errors during the valuation process and I am just lucky to be able to buy Rex before the run up in oil prices on 24th June 2021.

The market capitalisation have always traded at around 10% discount to the oil price vs valuation provided in the article.

At current price, there are options which have not been price in but when oil is price at USD 80, there is higher probability that it will drop than rise and vice versa.

Copper:

Cornerstone Capital Resources (CCR) ticks most of my boxes of a good investment. I have found ways to value the company. There is multiple possible catalysts in place. By running on a business model on licensing their mining rights to junior miners, CCR has manage to kept burn to a minimum. The report came out on 23rd July 2021.

The decreasing yield and investment in high quality copper mining has been happening for a very long time. Copper seems to be the clearest beneficiary of the electric vehicle revolution and the lack of investment in copper mining of the past resulting in big supply and demand shock. There is only a few high quality mines around and they should all be valued higher in the years ahead.

The share price of copper companies are still low and the setup looks all good until you consider the political environment where these copper mines are. Like any good mining stories, they are only as good at the political environment there.

Maybe Freeport would have been an easier buy…

Overall, it has been a very educating experience. I have moved into a sector which I am very unwilling to touch in the past. On a risk reward basis, I think I would have been better avoiding the sector than investing in it.

If anyone of you had been dabbling in the commodities sector like I do, do give me your thoughts and comments.