2021 Quicktake #5: Cornerstone Capital Resources

When we get the option of owning copper without the operating risk

One common theme that had been recurrent on our hunt for natural resources is that copper demand is going to boom with growth in supply limited.

Our initial reaction is to buy Freeport but we went into analysis paralysis when we go near a company that we can hardly get near to understanding.

Another way is to buy copper future but as mentioned in our last article - Natural Resource Investing we do not like to speculate on prices increasing.

The thesis stays a thesis until we are able to find an investment structure or company to express it.

So let’s go into the thesis and then we will touch on our idea of the week.

Demand:

The ability to forecast demand for any commodity is a fruitless exercise. It is like an impossible task. While we are unable to forecast demand, we can forecast its usage intensity.

You may ask, what is the difference?

The difference is small but important.

If usage intensity is going to go higher, we can expect more usage of that commodity within that product.

Copper is going to be more intensively used in the world of electrification.

In the case for cars, electric vehicles (EV) will use 4x more copper than conventional internal combustion engine (ICE). For every ICE car replaced by EV, an additional 60kg of copper must be found.

EV charging unit consume 2.5 kg of copper. There is a need to populate the world with charging unit which became a new user of copper.

In addition, the move towards renewable all requires more copper. Onshore wind consumes more than 2.3x more copper than traditional thermal generating unit while offshore wind consumes up to 6.3x more!

We could go on to solar, energy storage and…

You should get the point that the new economy will require higher copper intensity. While we do not know if copper demand would definitely rise (the shift to EV may be slower), the intensity is definitely increasing through time. That is as far as we can go for demand.

Supply:

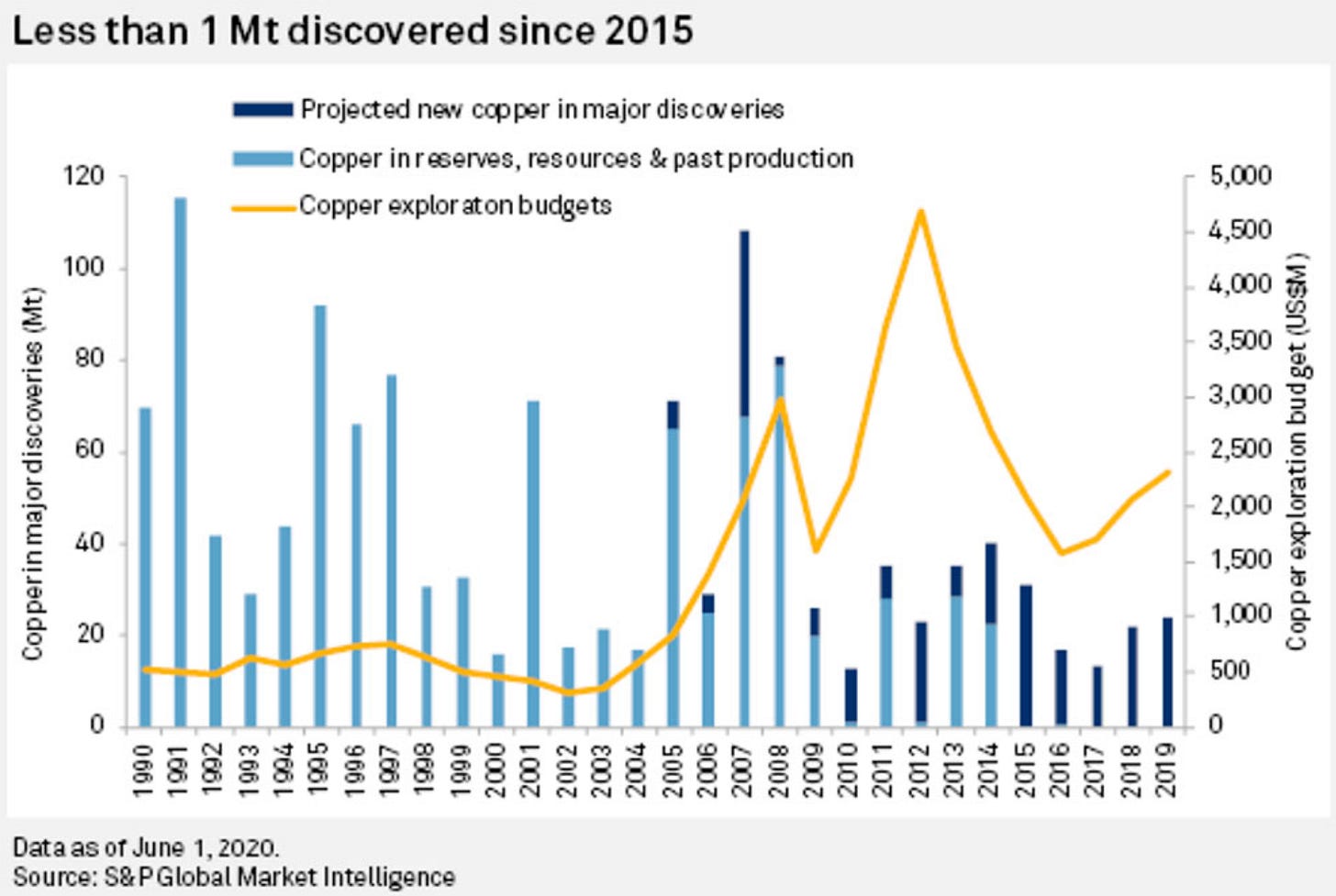

Of the 224 significant copper deposits discovered globally over the past 30 years, only 16 have been found in the past decade — and just one since 2015.

Those 16 deposits contain just 8 per cent, or 81.3 million tonnes, of all copper contained in discoveries since 1990

From 2021 - 2026, only seven of the undeveloped discoveries are expected to begin production.

“While there is still an abundance of undeveloped discoveries, most are smaller or low grade, with relatively few high-quality assets available for development,”

S&P Global - Kevin Murphy

Latin America remains the most prolific region for copper discoveries and the region hosts many of the world’s largest copper mines and accounted for almost half of the world's copper mines.

So that is where we go searching for Copper on the stock market.

SolGold:

SolGold is an emerging copper-gold major focussed on the discovery, definition and development of its copper-gold deposits in Ecuador. There is really nothing interesting about Solgold except that they are operating on one of the 16 significant copper deposit found in the past decade.

SolGold owns the Cascabel project in Ecuador, the only available Tier 1 copper-gold asset in the world not owned by a global, multi-national mining company.

The Cascabel resource has been endorsed by BHP, the largest mining company in the world and owner of 13.6% of SolGold, and Newcrest mining, the largest gold producer in Australia with a 13.5% share of SolGold and by Franco Nevada, the royalty company that provided SolGold with US$100 million in feasibility study funding in return for a 1% net smelter returns royalty on SolGold’s 85% share of the project.

All these sounds good, but SolGold is operating the mines and with everything related to mining, things may get complicated…

The best thing of all is that we are able to invest in Cascabel asset without the usual risk in mining. That will be the 15% of the project which is own by Cornerstone Capital Resources.

Cornerstone Capital Resources (CCR):

CCR owns a 15% direct interest in Cascabel as well as owning 6.9% of SolGold. This places CCR’s ownership at 21% of the resource. The 15% carried interest is extremely valuable as SolGold is funding all expenditures until completion of a bankable feasibility study. Their portion of the costs incurred are only repayable when the mine is in production from their share of cash flows.

CCR has basically function as a prospect generator followed with a joint-venture model with SolGold. That allow the company to minimise cash outflow while maintaining a significant upside in the projects they are working on.

Other than Cascabel, CCR has a joint venture model, with Newcrest funding Caña Brava project in Ecuador and Miocene project in Chile. CCR also has a 12.5% interest in the Bramaderos project in Ecuador fully funded by Sunstone Metals (similar to the SolGold agreement).

Valuation and Catalyst:

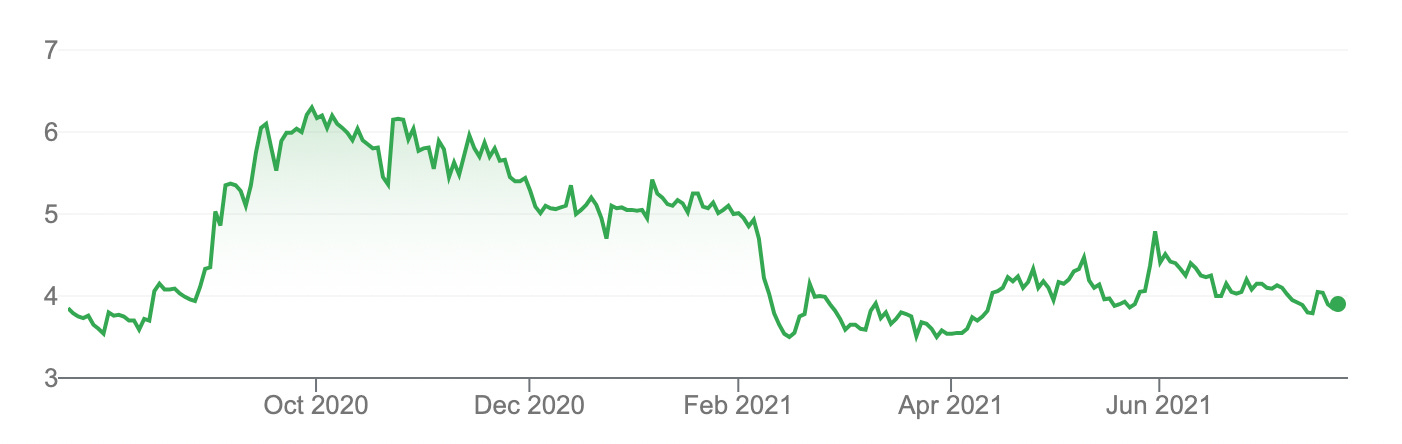

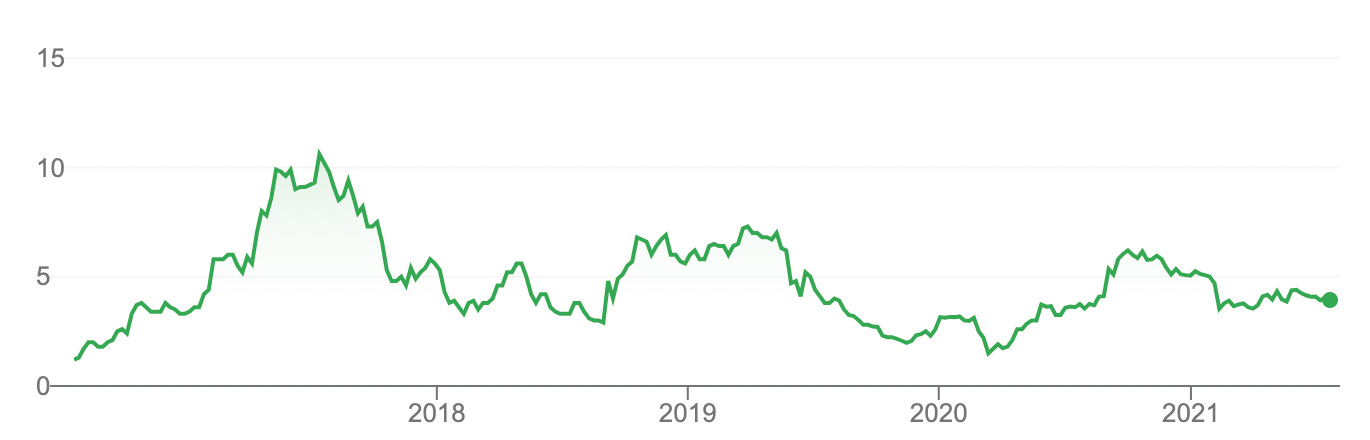

CCR is currently trading close to the lower end of its one year, five years and all time chart.

Previous Acquisition: SolGold had previously tried to acquire CCR using SolGold stock at a 22% premium to CAD 3.25 which equate to about CAD 3.965.

Possible Sale: Management had indicated that they are looking for a sale and they will sell!

Alignment of Interest: Chairman - Greg Chamandy owns 9.9% of CCR

Capability: Greg Chamandy is an entrepreneur and investot. He has the experience of in investing and selling Richmont Mines

Fundraising: Cornerstone’s top 3 shareholders acquired their shares at CAD 8.60 per share. In the fund raising done in June 2020, investors paid CAD 5.00 per share.

Valuation: If the precedent transactions average of US$0.07/lb Cu Eq. is used, the valuation points to a CAD 18.00 per share on Alpala project.

Strategic Value: Potential acquirer such as a royalty company gets to secure a strategic position superior to any other SolGold shareholder in a world class asset.

Cooperation: After years of bickering, SolGold and CCR have finally decided to work cooperatively to advance the Cascabel Project.

With this layer of conviction build in, coupled with some private valuation in place and the possibility that demand will outstrip supply in the long run, we think this is an option is worth buying.

If you would like to follow us on real time on what we are thinking of and news article we are reading on.please join us at our telegram channel - https://t.me/weightedresearch

or follow me on Twitter - https://twitter.com/OngWeeHiang

If you have any comments, just hit the comment button below.