2021 Statistical: #1 Snack Empire

Comfort food. Yum!

Our investment journey started with nanocap as that is what we can afford 20+ years ago. We continue to think that it is a good way to learn companies which is simple enough to be evaluated easily through reading the most current annual report and a simple balance sheet and income statement analysis.

The problem with nanocap is the low liquidity. Since they offer very little liquidity, we do try to be patient and size them appropriately (often very small sizing). The ability to pick up some of these nano-small company continues to excite us and thus we continue to get involve despite having very little absolute return out of our whole portfolio. It is just fun to read and understand smaller companies and the industries which will only take a few hours instead of weeks and months…

If you are a professional investor, you can skip the companies below.

This is the bonus issue for the retail investors who had signed up recently.

So enjoy…

This following company is place in the Statistical Portfolio/Special Situation.

As per our article on documentation, we do just read everything that we can get our hands on. Sometimes, it is these nanocap that drops into our lap and we could not resist taking a bite at it.

If liquidity for small cap is bad, just imagine how bad it could be for nanocap. Sometime, it is almost impossible to buy a stake in these company (sometimes we wonder if we are the only external shareholder who is accumulating other than the management).

The reason you invest in such a company is because you can see a

very cheap valuation

aligned management

growing company

shrinking share base

If all of the factors are available, then it is fine to enter into a nanocap company.

The issue of liquidity comes in two fold, since illiquidity keep potential shareholders out, it also helps to give the share price a boost when there is liquidity coming in. Most of the time, investors in such companies are really doing analytical arbitrage, betting that their view is sufficiently correct than the market price.

The companies we are covering here do have some liquidity (if you are patient) and we thought we should cover them now. As our membership grows, we believe that covering these nanocap ideas would no longer be viable.

If it is late at night in Asia and you feel like snacking, like most Asian you would head down to the local market to buy some comfort food. They are tasty and cheap. When we talk about comfort food, nothing can beat the idea of a fried chicken with a couple of beers.

Maybe KFC comes to your mind here, but we have better fried chicken in Asia than KFC or anything in US. There may be some debate on that point… even McDonald McSpicy is known to be the best in the world (at least to this American born Chinese).

The creation of snacks are usually perfected at the night market operators and then propagated by an enterprising young entrepreneur through the glamorisation of the concept.

While it is common to grow a snacking chain to 20 - 30 stalls, it is pretty rare to find one which had multiplied to hundreds through ownership and franchise. The issue is with control. The larger the span of operation, the harder it is to manage.

The outlier are the dining businesses from US and China. Due to the depth of their home market they are able to build economies of scale at home before starting growing through the world. Chain that propagate out from anywhere else is pretty rare. Name me any successful European food chain…

Well recognised fast food joint like Chipotle and Shake Shack in the United States are well known and highly valued.

We are definitely not buying Chipotle at current price. The alternative is to get your Chipotle exposure from Pershing Square like we do.

If you are interested in buying Shack Shack, do you know that you could get a tiny exposure through Dairy Farm as they hold the franchise right in China?

The nanocap company we are talking about here is Snack Empire.

Snack Empire is the owner and operator of Shihlin Outlets and Restaurants under the Shihlin Taiwan Street Snacks® brand adopting two basic models, namely (i) Self-operated model; and (ii) franchise and licence model.

Their core menu comprised eight Snacks Products and four Beverages; XXL Crispy Chicken, Handmade Oyster Mee Sua, Sweet Plum Potato Fries, Seafood Tempura, Happy! Ricebox, Crispy Floss Egg Crepe, Sausage Cheese Egg Crepe, Mushroom Cheese Egg Crepe; while our Beverages Products included Winter Melon Tea, Smoked Plum Juice, Honey Lemon Cooler, Lemon Ai-Yu Jelly (with Honey) and their own range of bottled drinking water

It is listed on the HKEX in 2019 with the history of the company being traced back to 2003 when the founders founded STSS Company with a vision to introduce authentic Taiwanese cuisine to the fast food industry in Singapore.

Operation Model:

The beauty of analysing small companies is that it could be done quickly. The company runs two model

Self-operated Outlets and Restaurants**

Non-self-operated Outlets and Restaurants (Franchise and licence model***)

The self operated outlets are in Singapore and West Malaysia. Non-self operated Outlets and Restaurants are mostly located in Indonesia,Malaysia and the United States.

In Indonesia, the outlets are operated by a Master Licensee which account for more than 50% of the total number of restaurants while only generating around 15% of revenue. The reason is that

the Master Licensee does not procure chicken, being the main food ingredient, and packaging materials from the company

the unit prices of products sold to the Master Licensee are generally lower than to other Franchisees.

(We’ve) been focused on doing what it does best, gunning for process efficiency, and making clever use of capital to expand in an efficient and risk-controlled manner.

-Daniel Tay and Melvyn Wong, Snack Empire co-founders

Financial and Valuation:

In the latest financial, sales was affected by Covid-19.

The total sales of goods generated by the Singapore Self Operated outlet continue to grow due to the take away nature of its Singapore Self-operated Outlets which sits well with the shift in consumer behaviour.

With the lockdown in Indonesia and Malaysia, the sale of goods for both their outlet sales and franchisees should have decreased. As the restriction starts to relax in Indonesia and Malaysia, we would expect a gradual improvement in sales of goods under the franchise division and a recovery of franchise fee and royalty.

Out of the SGD13 m raised, there is still SGD12.35 remaining as Covid had thrown a spanner into their expansion and refurbishment plan.

Covid allowed the company to reassess possible growth possibilities. The general allotment of money into the working capital also indicate to us that Snack Empire has more than enough cash to further lower their cost of materials.

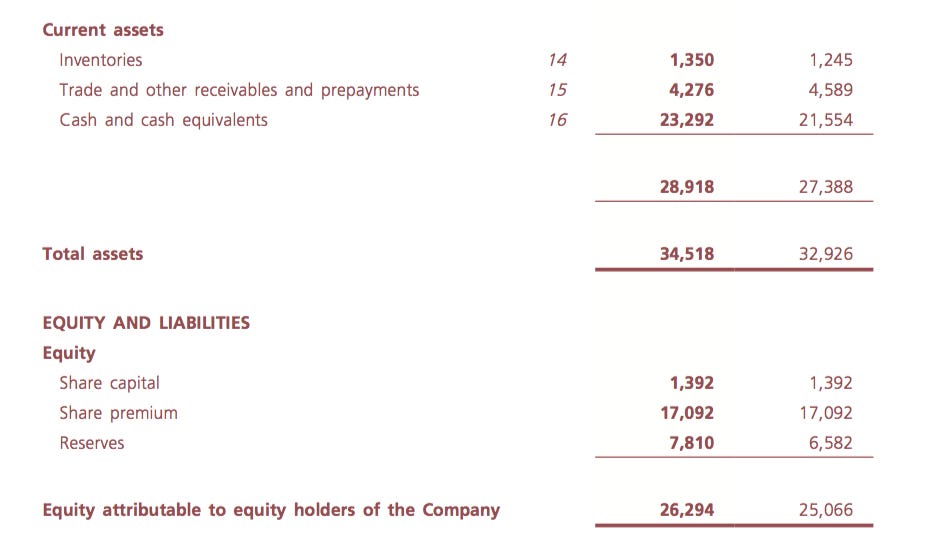

With a networking capital of 28m, Snack Empire is well capitalised to sustain another year of Covid.

Coupled with minimal debt and a possibility of improving their networking capital position, we could easily value the company using their 20202Q networking capital, with no growth factored into the share price.

Covid and Thesis:

The thesis is really simple. The operating outlets in Singapore should continue to be profitable even as Indonesia and Malaysia economy exit from the lockdown. While the economic impact from Covid is real, the fact is that the franchisee operations are bound to improve as lockdown ease.

What the company are missing are the revenue from the franchisee and once that recover (which require no injection of capital from Snack Empire), we could expect Snack Empire to be price above equity value.

The company looks cheap on factors we had stated at the start of the article.

cheap valuation

Current valuation of Snack Empire stands at HKD155m. Using their past years earnings, they earn around SGD 2.2m - 3.5m. Using normalised SGD3m = HKD 17m which is around 9x PE with a ROE of 10%. Networking capital valuation is around SGD 26m = HKD 155m which is the current market valuation of Snack Empire. Earnings should continue to grow from this year onwards and PE will continue to go down.

aligned management

growing company (due to the growth/recovery of their franchisee operation)

shrinking share base (X)

Now we will just need to convince the management that maybe some part of their cashflow could be used to buyback some shares.

Disclosure: At the time of publishing Wee Hiang has a position in the above company. Holdings are subject to change at any time. This report, and disclosure, should not be considered to be a recommendation.

If you wish to receive more regular updates on what we are working on, do join our telegram channel.

Subscribe to our newsletter if you find this information useful.

If you have any comments, just hit the comment button below.

*For us, Nanocap refers to company with valuation of lesser than USD 50m.

**Outlet refers to a take-out outlet, which is typically a concessionary counter consisting primarily of a front counter and kitchen without seating area whereas Restaurant refers to a self-service restaurant with seating area.

**Non-self-operated Outlets and Restaurants are owned, managed and operated by Independent Third Parties under the franchise or licence arrangements, with technical and operational support from our Group, including training, operations manuals, access to our supply and distribution network and advertising and promotion assistance. Our Franchisees and Licensee are solely responsible for all capital expenditures and ongoing operating expenses in connection with the Non-self-operated Outlets and Restaurants.